Turn up the pay on payday.

The first automated savings solution that rewards your employees for achieving their financial goals.*

The first automated savings solution that rewards your employees for achieving their financial goals.*

Money is the #1 source of stress for Americans.

Financial wellness programs are the #1 requested workplace benefit.

75% of workers say financial stress impacts their productivity.

The first automated savings solution that rewards your employees for achieving their financial goals.

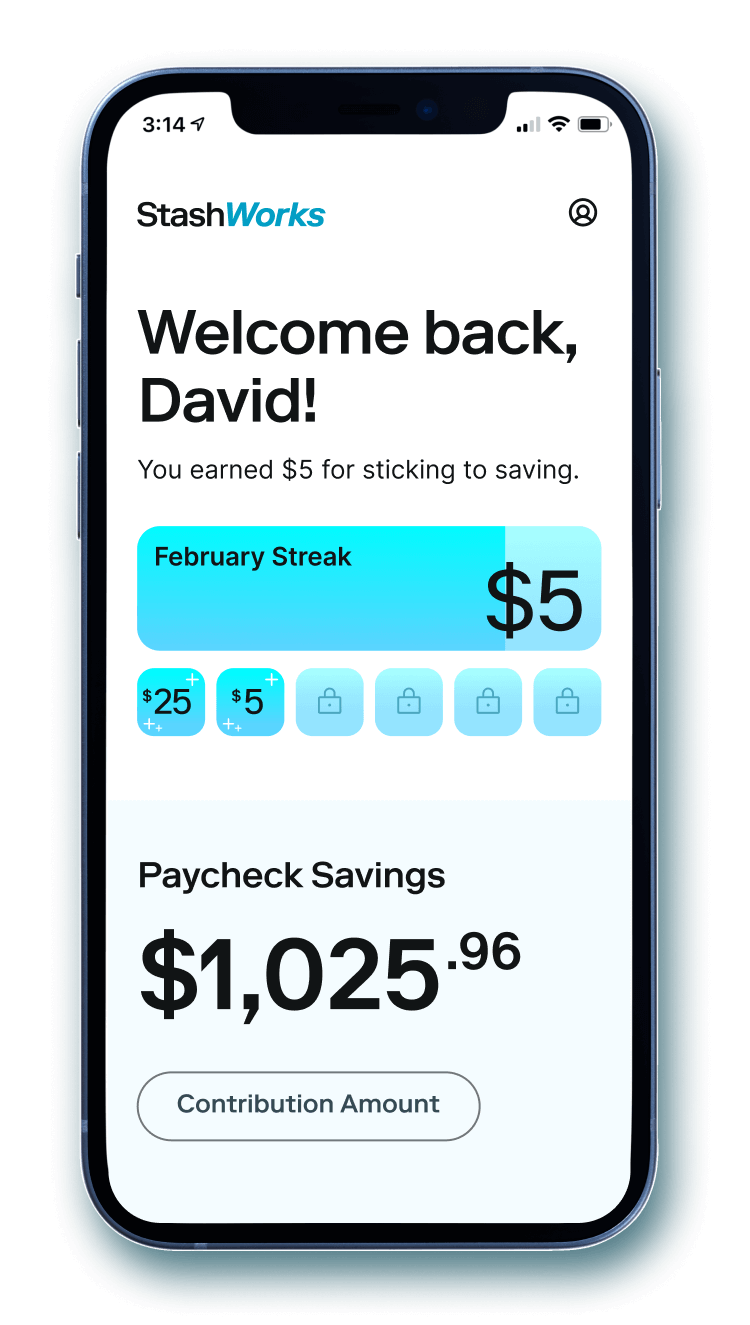

Employees earn cash in a Stash Smart Portfolio as a reward for achieving saving streaks.7

Automated payroll deductions help employees build their savings consistently.

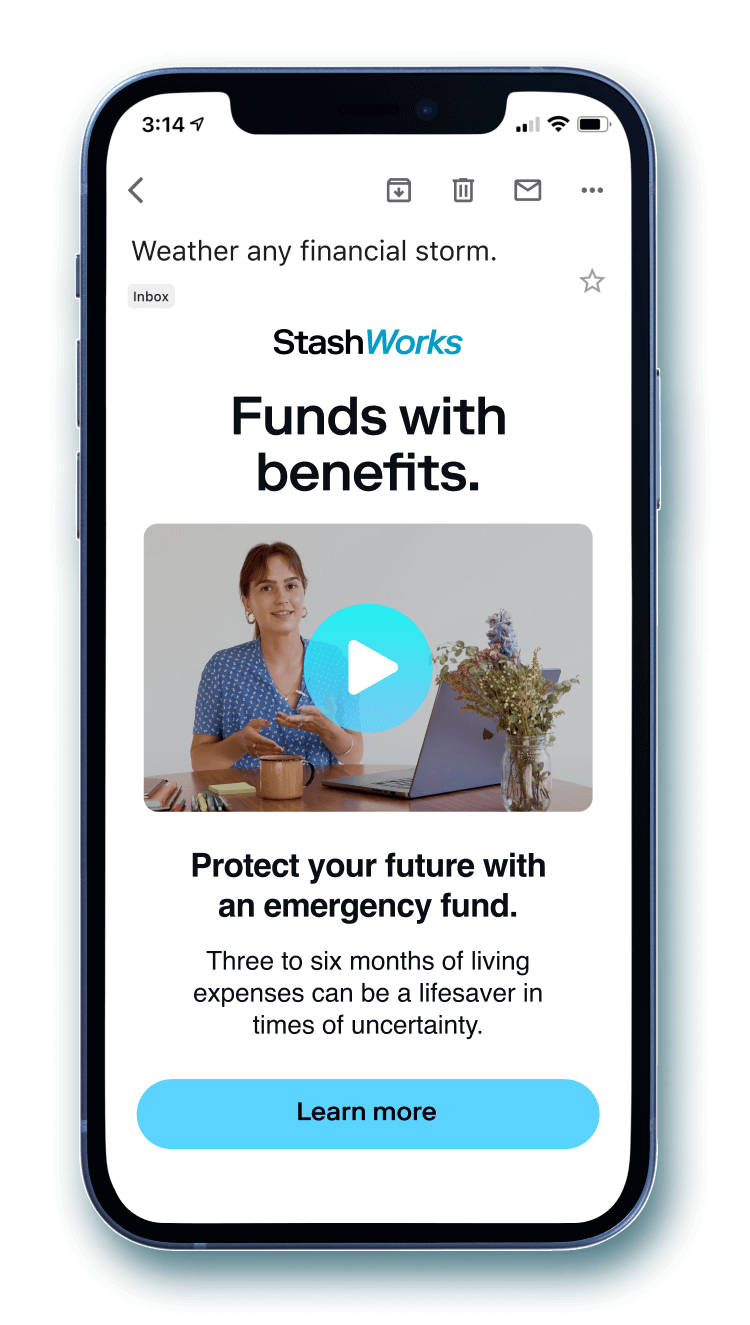

Employees gain confidence and financial knowledge with engaging content and expert guidance.

Connect with the StashWorks team today to learn more about our automated financial solutions.

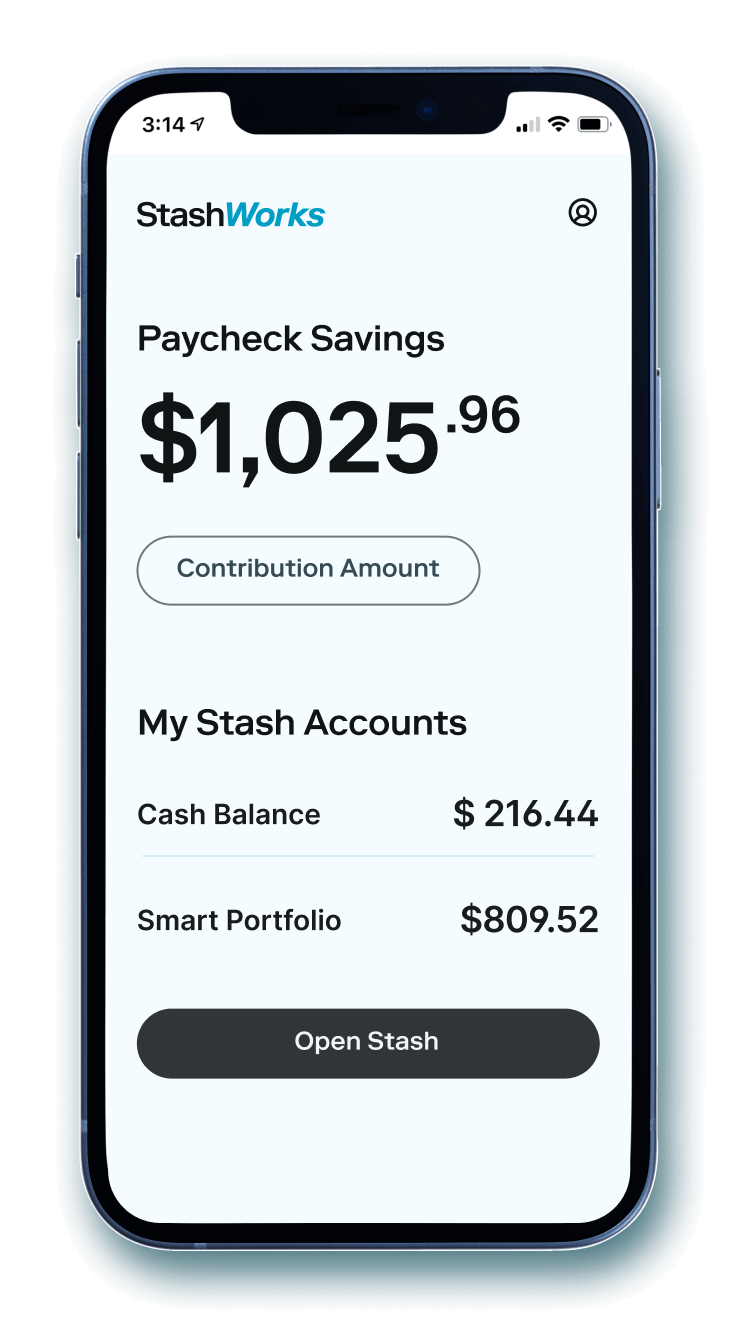

Get in TouchStashWorks is a workplace benefits program powered by Stash. We securely connect with your HRIS system, so that employees can allocate money from their paycheck into a StashWorks account. They’ll earn automatic stock rewards in a Stash Investment Portfolio as they continue to save money for the future. We offer a suite of financial tools and education to support their financial growth. Employees don’t pay any subscription fees and there are no account minimums. They can adjust their paycheck contribution amount in their StashWorks Dashboard, where they’ll also have access to their full Stash banking and investing account.

A cash reward is deposited into an employee’s banking account when they complete a “savings streak.” These funds are blocked for withdrawal from Stash for 90 days to deter fraud. The employee can invest or spend the cash, using their Stock-Back® Debit Card, at any time and without limitations, encouraging them to save and invest for their future.

Yes, every employer can contribute cash to their employees’ Stash rewards. We are developing the functionality to support employer-sponsored stock rewards in the near future, addressing the unique legal and compliance obligations for each business.

Yes. We encourage employees to reach out to us directly for all StashWorks-related questions. Our customer service team is available via email or phone from 8:30 a.m.-8:00 p.m. ET Monday-Friday and 10:00 a.m.-6:30 p.m. ET Saturday and Sunday. In addition, employers and employees are provided with training guides and sessions, including FAQs and our online customer service portal.

As a registered investment advisor, Stash provides personalized investing guidance and financial education based on each users’ goals and risk level. StashWorks does not, however, provide live, one-on-one access to financial advisors, planners, or wealth managers.

Stash is not currently authorized to serve customers residing outside of the U.S. Only employees with a SSN can enroll in StashWorks.

If an employee is a StashWorks account holder and leaves the employer or is terminated, they have a 90 day grace period to (1) convert their account to a Stash Growth plan for $3/mo or (2) cancel and withdraw funds. They continue to have uninterrupted, unchanged access to their account during the grace period, but do not receive streak rewards.