Jan 16, 2020

Giving Credit Where Credit Is Due

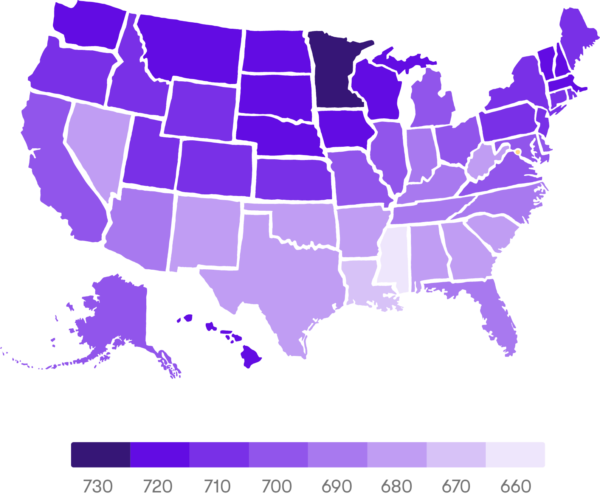

These states had the highest (and lowest) credit scores in 2019.

If you’re from Minnesota, you may have a new reason to be proud of your home state. The average credit score there is 733, the highest in the U.S. If you’re from Mississippi, you may have some work to do—the average score there is 667.

That’s according to credit-reporting company Experian, which released its latest annual Consumer Credit Review, a survey that ranks each state by credit score. In 2019, the average credit score in the U.S. was 703, increasing two points compared to 2018. Additionally, 59% of Americans have a credit score that falls above 700, the survey found, which is generally considered a good score.

States with the highest and lowest credit scores

Minnesota has topped the list of highest credit scores for the past eight years, according to Experian. The winner is followed closely by South Dakota, North Dakota, Vermont, and Wisconsin on the list of highest credit scores. The states with the lowest credit scores are South Carolina, Texas, Alabama, Louisiana, and Mississippi.

Wisconsin had the biggest jump of any state this year, seeing an increase of seven points. Here’s how the top five states scored:

*Source: Experian

Here is how the bottom five states scored:

*Source: Experian

In 2019, 42 states saw increases in their average credit scores compared to 2018, while nine states saw no change. Thirty-four states reported an average credit score of 700 or higher. If you don’t see your state in the top five, you can find where your it falls on the map below.

*Source: Experian

What does a “good” credit score mean?

A credit score is a point-based score developed by a company called Fair, Isaac Co. It’s sometimes referred to as a FICO score. It uses credit history data compiled by credit bureaus Experian, Transunion, and Equifax. Your credit usage information is regularly transmitted to these three agencies.

A credit score can range from 300 to 850. The better your credit, the higher your score. Perfect credit is 850.

Banks and lenders use your credit score to assess how responsible you are with loans and debt over time. Your credit score is determined by a variety of factors including your credit history, which is based on how many credit cards and loans you have, how large a portion of your available credit you use, how timely you are with your payments, and more. In theory, this helps future lenders assess the risk you pose to them.

Credit scores are considered within these general guidelines, according to Experian:

| Your credit score is: | Within this range: |

|---|---|

| Very Poor | 300-579 |

| Fair | 580-669 |

| Good | 670-739 |

| Very Good | 740-799 |

| Excellent | 800-850 |

If you’re on top of paying your bills, your credit score is more likely to fall into the good to excellent range. You can work to improve it if your credit score doesn’t fall within that range.

Increasing debt in the U.S.

While personal loan debt is the fastest-growing debt in the United States, average credit card debt grew second fastest, increasing nearly 3% to $6,194 from 2018 to 2019, according to Experian.

Personal loan debt is different from credit card debt. Consumers usually apply for a personal loan from a financial institution, and they often use it to consolidate credit card debt and other loans. It often carries a lower interest rate, according to Experian.

How to Catch Up

Raising your credit score is probably easier than you’d think. But it’ll require organization and a disciplined approach. If you have bad credit, here’s how to start improving your score:

- Make all of your payments on time—setting up payment reminders can be helpful.

- Try to keep your balances low.

- Keep an eye on your credit reports.

- Try using a free credit score app on your phone to stay on top of your score.

- Only apply for more credit if you need it; Opening too many accounts in short order can hurt your score.