Aug 15, 2022

How To Raise Your Credit Score: 11 Steps To Do It Fast

A low credit score can have serious implications for your financial life—from securing a car loan to being approved for a mortgage. Luckily, credit scores aren’t set in stone—you have plenty of options if yours is in need of a boost. Depending on what’s hurting your score, it’s possible to see improvements in as little as 30 days.

While it’s worth noting that not every method will yield immediate changes, there are steps you can take to give your credit score a lift quickly. The effort you put in now will work in your favor in the long run, and create a more solid foundation for your credit and financial wellness going forward.

If you’re wondering how to raise your credit score, start with these steps:

3. Lower your credit utilization

5. Avoid too many hard credit inquiries

6. Be judicious when closing old accounts

7. Resolve collection accounts

9. Consider consolidating debts

11. Use a credit monitoring service

Read along to learn how to raise your credit score.

1. Review your credit reports

Time commitment: One afternoon

Improving your credit score starts with knowing where your credit currently stands. Head to the official AnnualCreditReport.com website to pull a copy from each of the three main credit bureaus: Equifax, Experian, and TransUnion. You’re entitled to one free credit report per year from each.

When reviewing your reports, be on the lookout for any inaccurate information like unauthorized purchases or misreported late payments. If there are any, reach out to your lender to correct and remove them.

And in case you’re unfamiliar with the concept of credit scores, here’s your refresher: Credit scores are calculated by scoring models based on your credit report from any of the three major credit bureaus. There are a variety of scoring models that weigh certain factors differently, but the two used most often by lenders are FICO and VantageScore.

So, what is a good credit score? Both FICO and VantageScore models score credit on a scale of 300–850:

| Credit Rating | FICO Score Range | VantageScore Range |

|---|---|---|

| Excellent | 800–850 | 781–850 |

| Very good | 740–799 | 661–780 |

| Good | 670–739 | 601–660 |

| Fair | 580–669 | 500–600 |

| Poor | 300–579 | 300–499 |

While credit scores vary slightly depending on the model, all credit scores are calculated using the same information. Here are the five factors that affect your credit score:

- Payment history (35%)

- Credit utilization (30%)

- Age of credit accounts (15%)

- Credit mix (10%)

- New credit inquiries (10%)

Understanding these factors is the first step to learning how to raise your credit score.

2. Pay your bills on time

Time commitment: Ongoing

Your payment history has the largest impact on your credit score, accounting for 35% of your overall score. If you want to raise your credit score quickly, prioritizing on-time bill payments is one of the easiest ways to do it.

| Tip: Set up automatic payments to ensure you never miss a payment. |

An account is reported as delinquent when the minimum payment isn’t made within at least 30 days and can stay on your credit report for up to seven years. If you’re past due on any payments, call your creditor to remedy the situation as soon as possible—the longer you wait, the more severely your credit score can be negatively impacted.

While settling late payments won’t remove them from your credit report, paying all future bills on time can set you up to improve your credit score going forward.

3. Lower your credit utilization

Time commitment: Ongoing

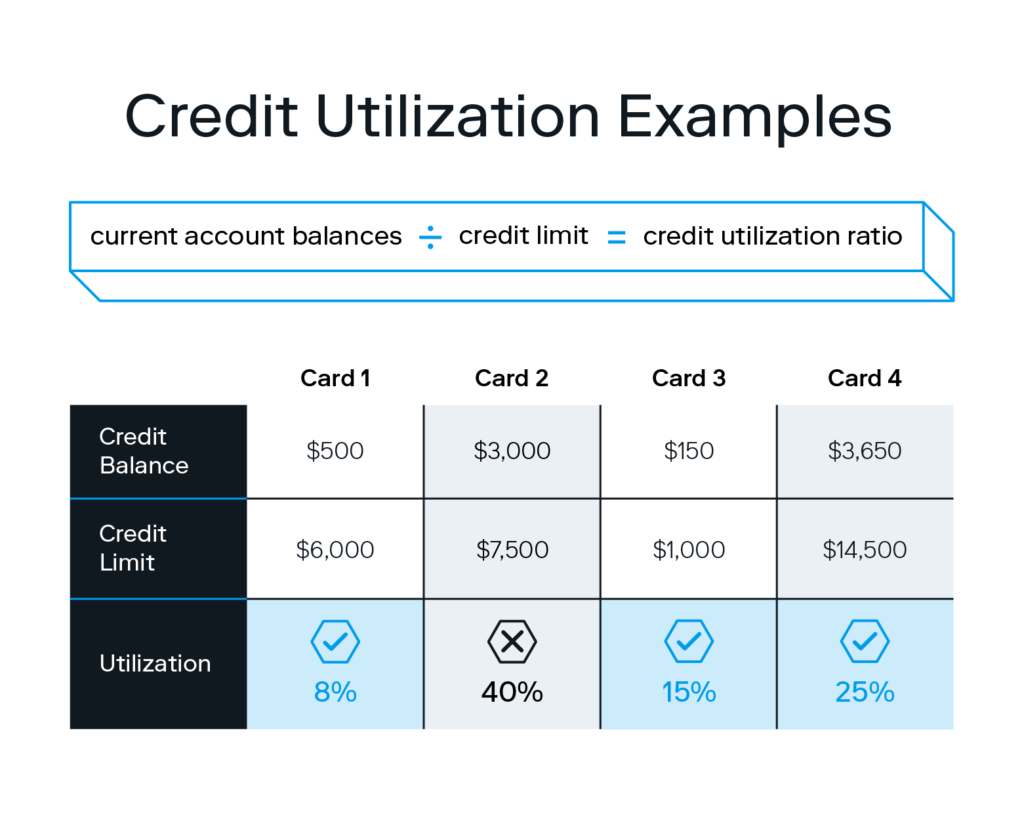

Wondering how to increase your credit score quickly? Paying attention to your credit utilization is another good place to start. Not to mention, it has the second highest impact on your credit score, accounting for 30% overall.

Credit utilization is a ratio of your credit balance (how much credit you’re using at any given time) and your total available credit. For example, if your credit balance is $500 and your total credit limit is $2,000, your credit utilization at that time is 25%.

Generally, most lenders like to see a utilization of 30% or less. Paying your credit card balances in full every month is an easy way to keep your utilization low. But if you’re trying to improve a low score, you’ll want to aim for 10% or less to have a greater impact on raising a less-than-ideal score.

| Tip: If you have multiple account balances, pay down the highest balance credit cards first to achieve a lower credit utilization. |

Asking for a credit limit increase is another strategy to lower your credit utilization, as long as your balance stays the same. This can be done online, but keep in mind you’ll likely need to have a recent increase in income to be approved.

4. Expand thin credit files

Time commitment: One hour

If you’re new to credit or haven’t used your credit accounts in a while, you may have a thin credit file. This means you have little to no credit accounts, making it difficult to generate your credit score. If creditors can’t reference your credit score and history, you might be rejected for new credit requests. Or if you are approved, it might be at the expense of a higher interest rate.

Luckily, there are a few ways to expand a thin credit file if you’re building or rebuilding your credit. One method is Experian Boost*, a program that collects payment data that wouldn’t normally appear on your credit report (like utility payments or phone bills). Boost scans your bank accounts for such payments and then uses them to calculate your Experian FICO score.

Another option is to utilize rent reporting services. If you pay monthly rent, these services allow your on-time rent payments to appear on your credit reports. Not every credit scoring model factors rent payments into your score, so this method may only impact VantageScore credit scores (not your FICO score).

5. Avoid too many hard credit inquiries

Time commitment: Ongoing

There are two types of credit history inquiries: soft and hard inquiries. A soft inquiry refers to instances like a credit check by a potential employer, credit checks from banks or lenders you have an existing account with, or checking your credit yourself. Soft inquiries don’t affect your credit score.

Alternatively, hard inquiries mainly refer to new credit applications, such as for a credit card, a mortgage, or a car loan, and these can negatively impact your score.

While a single hard inquiry is unlikely to significantly hurt your score, having many in a short span of time can. Lenders might see this as an indication that you’re hurting financially and deem you as a high-risk borrower. For that reason, it’s best to avoid hard inquiries if you’re trying to boost your credit score.

6. Be judicious when closing old accounts

Time commitment: None

Your credit age (or how long your credit accounts have been open) accounts for 15% of your credit score, and a longer credit history benefits your score. For this reason, keep old accounts open—even if they’ve been paid off—to maintain the length of your credit history and positively impact your score.

Aside from maintaining your credit age, keeping old accounts open can also benefit your credit utilization ratio. Closing an account while you still have balances on other cards would lower your total available credit, and in turn, increase your credit utilization—potentially lowering your score by a few points.

Exceptions to this guidance would include any cards or accounts that come with an annual fee (you shouldn’t be paying for an account you’re not using), or if you’re having a hard time keeping track of your open accounts. Older, dormant accounts can be easy to lose track of and be vulnerable for fraud, so you may decide to keep tabs on your oldest account and close others if you’ve accumulated many.

7. Resolve collection accounts

Time commitment: One to two hours

If your goal is to raise your credit score, you should resolve any collection accounts immediately. A creditor turns an account over to a collections agency when a payment is late by several months, and your original account may appear as a charge-off on your credit report as a result. This means the creditor has given up attempting to collect the debt, and this can stay on your credit report for up to seven years.

Take action to pay off any collection accounts as soon as possible—this ensures you won’t be sued over the debt. Paying off collection accounts won’t remove them from your credit report; your account will simply be labeled as “paid” or “unpaid.” Still, a paid collection account is more favorable in the eyes of a creditor than an unpaid account.

Resolving collection accounts will impact your credit score differently based on the score model—VantageScore, for example, doesn’t assign a negative impact to paid collection accounts, while the FICO 8 model still considers them when calculating your score.

8. Open a secured credit card

Time commitment: 30 minutes

A secured credit card is another option to build or rebuild your credit. These cards give you the chance to build up a history of on-time payments and other good credit habits that can be reflected in your credit reports.

To open a secured credit card, you’ll have to pay a cash deposit, which is usually equal to the credit limit you’ll receive. The deposit serves as collateral to the lender. Once approved, use the card as you would with any other credit card, keeping in mind that the goal is to create a more positive credit history. That means paying on time each month and maintaining a low balance if you want this method to help boost your score.

9. Consider consolidating debts

Time commitment: Two hours

If you’re dealing with debts across several different loans, debt consolidation allows you to combine them into a single loan with one monthly payment. On the surface, managing a single loan payment instead of juggling multiple at once sounds like a smart move—but it’s critical that you fully understand the terms of any potential debt consolidation loan. If you don’t, you could end up with a higher interest rate and a longer loan term than what you started with.

Here’s what you want to avoid with any debt consolidation loan:

- A high consolidation fee

- A variable interest rate (instead of a fixed interest rate)

- A higher interest rate than what you’re currently paying

- A longer repayment period than what you currently have

It’s not uncommon for debt consolidation loans to come with hidden terms, like an increased interest rate over time, an extended repayment period that keeps you in debt longer, or a hefty up-front fee. Not only that, but your new interest rate is based on your past credit score and payment history—meaning if you’re already struggling with a low credit score, you’re less likely to secure a better rate.

That said, if you’re able to secure a lower interest rate than what you’re currently paying and the rest of the terms are favorable, a debt consolidation loan might be worth considering. Ideally, it can help you pay down your debt faster while making your monthly payments easier to manage.

10. Diversify your credit mix

Time commitment: One hour

Your credit mix refers to the different types of credit accounts you have, such as credit cards, loans, and mortgages. Accounting for 10% of your overall credit score, your credit mix is used to gauge how responsibly you’ve managed different types of credit accounts. Someone who’s successfully managing two credit cards, a mortgage, and a car loan is likely to have a higher score than someone with just a single credit card.

Diversify your credit mix by adding a new credit account or taking out a credit-builder loan. Whatever account you choose to add, what matters most is that you can manage it responsibly. Adding to your credit mix with a new account only to suffer the consequences of missed payments will do more harm than good to your score.

11. Use a credit monitoring service

Time commitment: Ongoing

If you want some support on your quest to learn how to improve your credit score, consider using a credit monitoring service. Primarily used to prevent identity theft and fraud, it’s also a handy way to keep track of your credit report and scores.

These services alert you to any account changes, such as:

- When a large purchase has been made

- When a new account is opened

- When an account has been paid off

A credit monitoring service is a great way to stay informed of any fraudulent account activity that could be hurting your score. This is helpful in the event that, say, you’re alerted to a new credit card that’s been added to your file that you don’t recall opening. You’d be able to contact your creditor immediately to report fraud and have it removed from your account before it can damage your score.

While you can (and should) still contact a creditor at any time to discuss fraudulent activity or suspected errors on your account, a credit monitoring service allows you to nip the issue in the bud before someone has the chance to max out your credit card or sign up for a loan in your name.

The best way to build credit will depend on your unique financial situation and credit history, but the steps above are a great place to start. Whatever your current credit score is, remember that improving your credit takes time—implement these steps sooner rather than later to see your score improve quickly. And if you could use some extra support in reaching your long-term financial goals, Stash makes it easy to save, plan, and invest on the regular.

FAQs about how to raise your credit score

Still have questions about how to raise your credit score? We have answers.

Why does a good credit score matter?

A good credit score indicates that you’re a low-risk borrower, leading to major savings over the long term—it allows you to score better rates on car loans, mortgages, credit cards, and anything else that requires financing. Those with a poor credit score are considered high-risk borrowers and are ultimately subject to higher interest rates and fees for any new account. Additionally, a good credit score is necessary to be approved for things like rental housing, car rentals, or a mortgage.

Once you’ve reviewed your credit reports and determined exactly what’s hurting your score, you’ll have a better idea of how to increase your credit score.

How can I raise my credit score in 30 days?

Since your payment history and credit utilization have the largest impact on your credit score, prioritizing on-time bill payments and paying down your account balances in full each month will make the biggest difference in your credit score upfront.

Will paying the minimum on my cards improve my credit score?

No, paying the minimum on your credit cards will not improve your credit score. While you should be paying the minimum payment every month to ensure a history of on-time payments, paying your credit card balances in full and as quickly as possible is what will actually improve your score.

Does getting a new credit card hurt your credit?

It depends. Opening a new credit card will add to your credit mix and lower your credit utilization ratio (which is good), but it also adds a hard inquiry to your account, which could lower your score. If you’ve made several hard inquiries in a short period of time, opening a new credit card is more likely to hurt your score.

How long does it take to see changes in your credit score?

It depends on the specifics of why your score is low in the first place. If your score dropped after a single missed payment, you can likely boost your score in as little as 30 days once you’ve made the payment. If your credit is low due to multiple missed payments or collection accounts, it will take a few months of positive credit habits to move the needle on your score. The answer to how to raise your credit score, along with how long it will take, will always vary depending on your unique circumstance.

*By mentioning this independent third-party, Stash is not suggesting any endorsement, relationship, or affiliation with any such third-party.

Related Articles

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

Budgeting for Young Adults: 19 Money Saving Tips for 2024

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning