Mar 28, 2023

What Is a Good P/E Ratio? A Beginner’s Guide

What does a good P/E ratio mean? In simple terms, a good P/E ratio is lower than the average P/E ratio, which is between 20–25. When looking at the P/E ratio alone, the lower it is, the better.

For new investors, “P/E” might as well mean “physical education.”

Good news, though, as there’s nothing extracurricular about “P/E”—it’s one of the most widely used stock market terms and tools in the investment playbook.

A P/E ratio, also known as a price-to-earnings ratio, is the ratio between a company’s stock price and its earnings per share (EPS).

The P/E ratio helps you answer a simple, fundamental question when trying to decide if you should buy a stock: Are you paying too much?

So what is a good P/E ratio for stocks, and how can you calculate a P/E ratio yourself? Follow this beginner’s guide to learn more about P/E ratios, what they can tell you about a stock, and some of the ratio’s shortcomings.

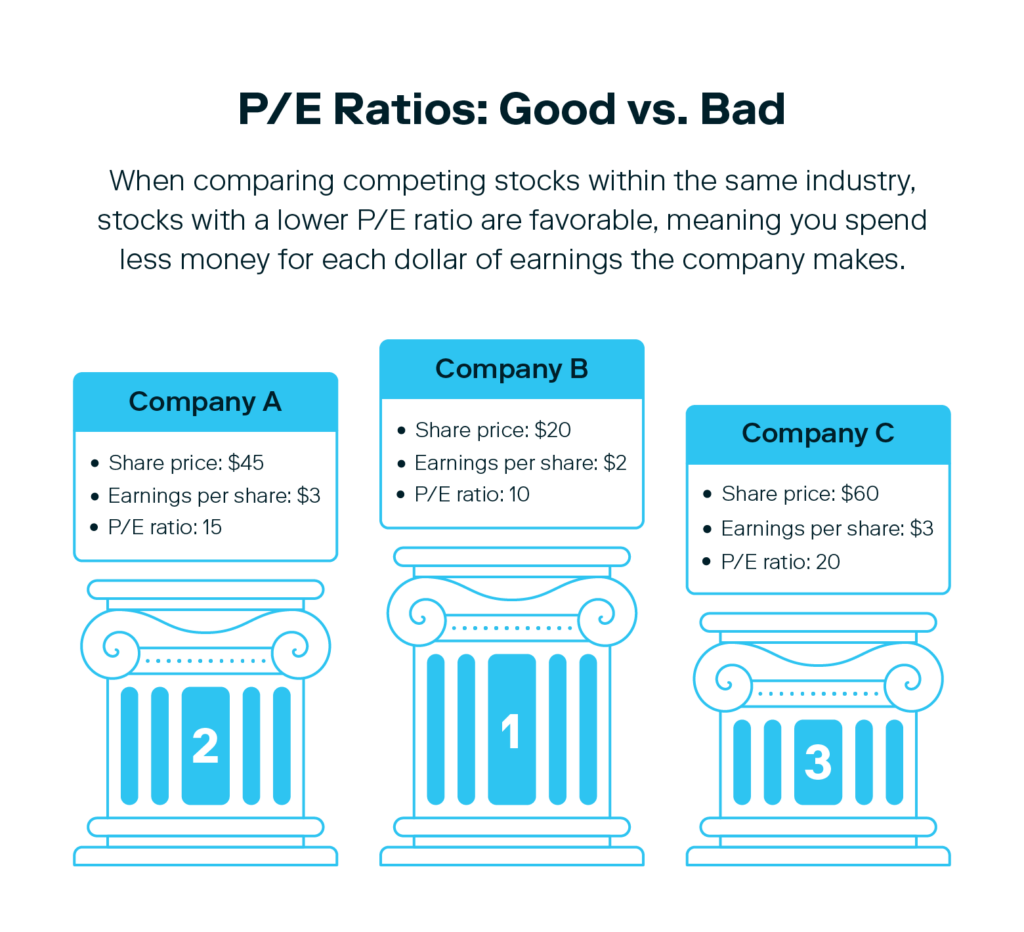

How to tell if a P/E ratio is good or bad

The difference between a good and bad P/E ratio is not as cut and dry as it may seem. Generally speaking, investors prefer a lower P/E ratio, but to fully understand if a P/E ratio is good or bad, you’ll need to use it in a comparative sense.

Typically, the average P/E ratio is around 20 to 25. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio.

But it doesn’t stop there, as different industries can have different average P/E ratios. For example, a P/E ratio of 10 could be normal for the utilities sector, even though it may be extremely low for a company in the tech sector. Because of this, it’s important to always compare P/E ratios with other companies within the same industry.

So what is a good price-to-earnings ratio? To help you learn more about what makes a P/E ratio good or bad, we’ve broken down what a low and high price-to-earnings ratio generally means.

Generally, a low P/E ratio is good

When comparing a P/E ratio to the market average or competitors, a stock with a lower P/E is generally good. This is because you are spending less money for each dollar of a company’s earnings.

Generally, a high P/E is bad

On the other hand, a higher P/E ratio can be seen as a worse deal, as you are spending more money for each dollar of company earnings.

Now that you have a feel for what a low or high P/E ratio can mean, let’s find out how you can calculate the P/E ratio of a stock.

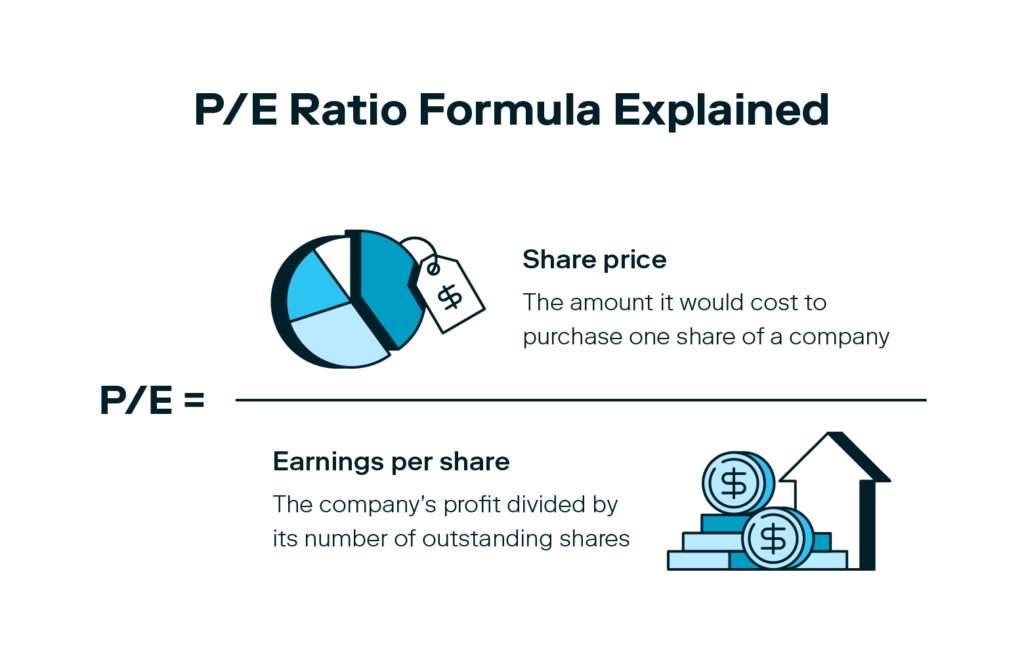

How to calculate P/E ratio using the P/E ratio formula

Ready to dive in and start calculating the P/E ratio of your favorite stocks? To calculate a stock’s P/E ratio, you’ll need to know the stock’s earnings per share (EPS) and its share price. To discover a stock’s EPS, you’ll divide the company’s net profits by its current share price.

Once you have those two numbers, you can input them into the P/E ratio formula.

How to calculate price-to-earnings ratio using the P/E ratio formula:

- P/E ratio = Share price ÷ earnings per share

For example, let’s say you wanted to calculate the P/E ratio for Apple (APPL). For the sake of this example, let’s pretend that the current stock price of APPL is $150.50, and its EPS is $6.10.

By plugging those numbers into the P/E ratio formula, you divide $150.50 by $6.10, which gives you a P/E ratio of 24.67, which is within the market average.

To take things a step further, let’s compare APPL to one of its competitors: Microsoft (MSFT). If MSFT has a current stock price of $255.75 and an EPS of $9.65, its P/E ratio is 26.50, which is higher than APPL.

Because of this, value investors would consider APPL to have a more ideal P/E ratio than MSFT.

Tips for using P/E ratio to analyze a stock

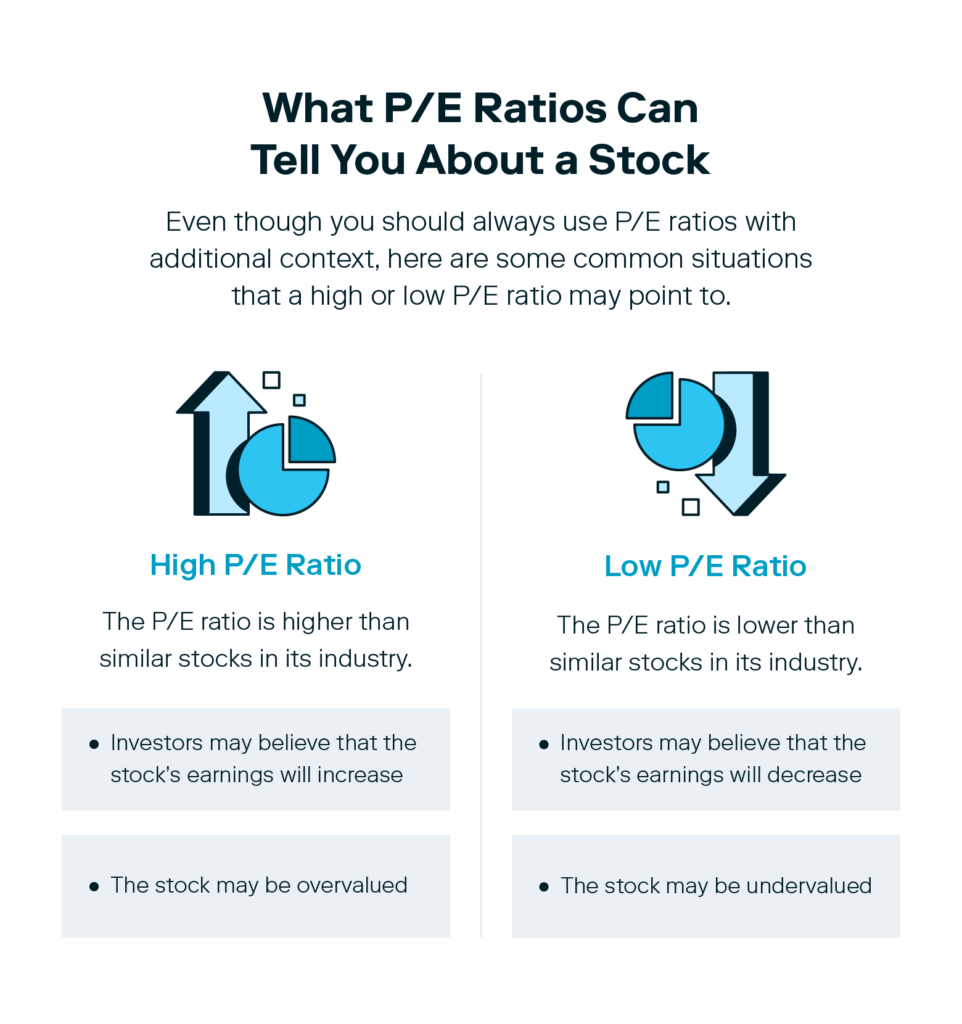

Now that you understand how to use the P/E ratio to value a stock, you might wonder what investors can expect when analyzing a P/E ratio. Follow these tips to help you understand what a high or low P/E ratio can tell you about a stock:

- If the P/E ratio is high: In some cases, a high P/E ratio can mean investors believe that the stock’s earnings will increase in the future. On the other hand, a high P/E ratio can indicate that a stock may be overvalued.

- If the P/E ratio is low: Alternatively, a low P/E ratio may indicate that a stock is undervalued. This can lead to investors seeing the low P/E ratio as an opportunity to buy the stock expecting the price to eventually rise to reflect the company’s increased earnings. Other times, a low price-to-earnings ratio can mean that investors believe that the company’s profits will decline in the near future.

With an understanding of what a P/E ratio can teach you about a stock, it’s important to also keep the ratio’s shortcomings in mind.

Recognizing shortcomings

As you can probably tell, a P/E ratio isn’t that useful on its own, and it shouldn’t be a standalone metric that informs your investment decisions. While it may seem like a simple calculation, it does have its shortcomings.

For example, determining a company’s earnings can sometimes be difficult. This is because accounting practices can differ from company to company, with some trying to hide costs to help inflate earnings.

Additionally, companies may have negative or no earnings, leaving you with either a “0” P/E ratio or a negative one, which is not useful for comparison purposes.

Another downside of P/E ratios is that you cannot use them to compare companies from different sectors. For example, you wouldn’t want to use a P/E ratio to compare Walmart (WMT) to Boeing (BA), whereas it may be helpful to compare Google (GOOG or GOOGL) to Yahoo (YHOO).

Lastly, even if a P/E ratio indicates that investors see a stock as a cheap buy compared to its earnings, it doesn’t mean that you should buy it. The price could be cheap for other reasons, such as a decline in customers.

Whether you’re brand new to investing or have been building your portfolio for years, knowing the answer to “What is a good P/E ratio?” is valuable information that can help bring added insight into a stock’s health.

But it’s crucial to remember that a P/E ratio is only one metric, and it shouldn’t inform your investing decisions by itself. Because of this, you should take the P/E ratio with a grain of salt and always do your research when short or long-term investing.

Investing made easy.

Start today with any dollar amount.

FAQ about P/E ratios

If you still have more questions after learning the answer to “What is a good P/E ratio?” we’ve got you covered.

What is a normal P/E ratio?

A normal P/E ratio is close to the average P/E ratio range of its industry. For example, if an industry has a P/E ratio of 20 to 25, then a stock with a P/E ratio of 23 would be normal for that industry.

What is an industry P/E ratio?

An industry P/E ratio is the average P/E ratio of all companies in a specific industry. For example, the industry P/E ratio for the financial services sector would include the average P/E ratio of Wells Fargo, Bank of America, JPMorgan Chase, and other related stocks.

What is the difference between an absolute vs. relative P/E ratio?

The difference between an absolute and a relative P/E ratio is that a relative P/E ratio is the current P/E ratio compared to a benchmark of either the industry average or the historical P/E ratio of the individual stock.

For example, if the median P/E ratio of XYZ over the past ten years is 20 and its current P/E ratio is 15, then its relative P/E ratio is 75% or 15 divided by 20.

What is the difference between a trailing vs. forward P/E ratio?

The difference between a trailing P/E ratio and a forward P/E ratio is that a trailing P/E ratio uses the most recent earnings for the trailing twelve months, and the forward P/E ratio uses the future earnings expectations for the upcoming year.

What is the difference between a P/E ratio vs. earnings yield?

The difference between a P/E ratio and earnings yield is that earnings yield is the inverse version of the P/E ratio, calculated by dividing the stock’s EPS by its share price.

Unlike the P/E ratio, the earnings yield is expressed as a percentage and used to compare stocks to different assets such as fixed-income securities like bonds or Certificates of Deposits.

What is the difference between a P/E ratio vs. PEG ratio?

The difference between a P/E ratio and a PEG ratio is that the PEG ratio factors in expected growth. You can calculate the PEG ratio by taking the trailing P/E ratio and dividing it by the expected future growth rate.

For example, if the trailing P/E ratio of XYZ is 25 and its earnings growth rate for the next five years is 15%, then its PEG ratio is 1.67, or 25 divided by 15.

Generally speaking, experts consider a PEG ratio of one or less undervalued, as its price is low compared to its expected future growth.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement