Apr 1, 2019

Why You May Have a Financial Literacy Problem

Stash’s 2019 FinLit Survey helps explain it

Here’s a question: If you borrow $1,000 at 20% compound annual interest rate, and you make no payments, how long would it take for the amount you owe to double?

Stumped? You’re not alone. Less than half of Stash customers answered that question correctly on our 2019 Financial Literacy survey. (The correct answer is three and a half years.)

Every year Stash conducts a study of its users, to understand how well they grasp financial basics. In February, Stash polled 4,800 customers about their financial knowledge and habits, including the use of credit, investing and retirement fundamentals, as well as basic financial principles such as how interest rates and inflation affect borrowing and saving.

While the results of Stash’s 2019 survey show slight improvements among our customers compared to our 2018 survey, lack of financial literacy continues to be a big problem in the U.S. for everyone. The Stash survey shows that so-called Generation Z, those who are currently between 18 and 24, may particularly need more financial education.

Meanwhile, managing credit continues to be a big problem across all age groups. One way you can see that is in the ever-increasing amount of debt that consumers take on. Consumer debt is at a record high, of more than $4 trillion, which comes out to about $4,300 per household.

Here are some top takeaways from this year’s survey:

Gen Z may need more education

So-called Generation Z, people who are currently between 18 and 24 years old, showed less knowledge of financial basics than older generations, particularly when it comes to using credit.

For example, two-thirds of Gen Zers demonstrated confusion about the advantages and disadvantages of credit.

- Gen Z more likely, by 10 percentage points, to say that credit cards could be used to pay for things they couldn’t afford, as well as to alleviate the burden of large expenses by allowing them to pay a monthly minimum.

- 71% of Gen Z respondents said it was important to pay their balances in full each month, compared to 77% for all other generations, and 80% for those in the Baby Boom generation.

- Gen Zers were more likely to believe that maintaining a balance on credit cards can improve your credit score than all other generations, by six percentage points. (27% vs. 21%.)

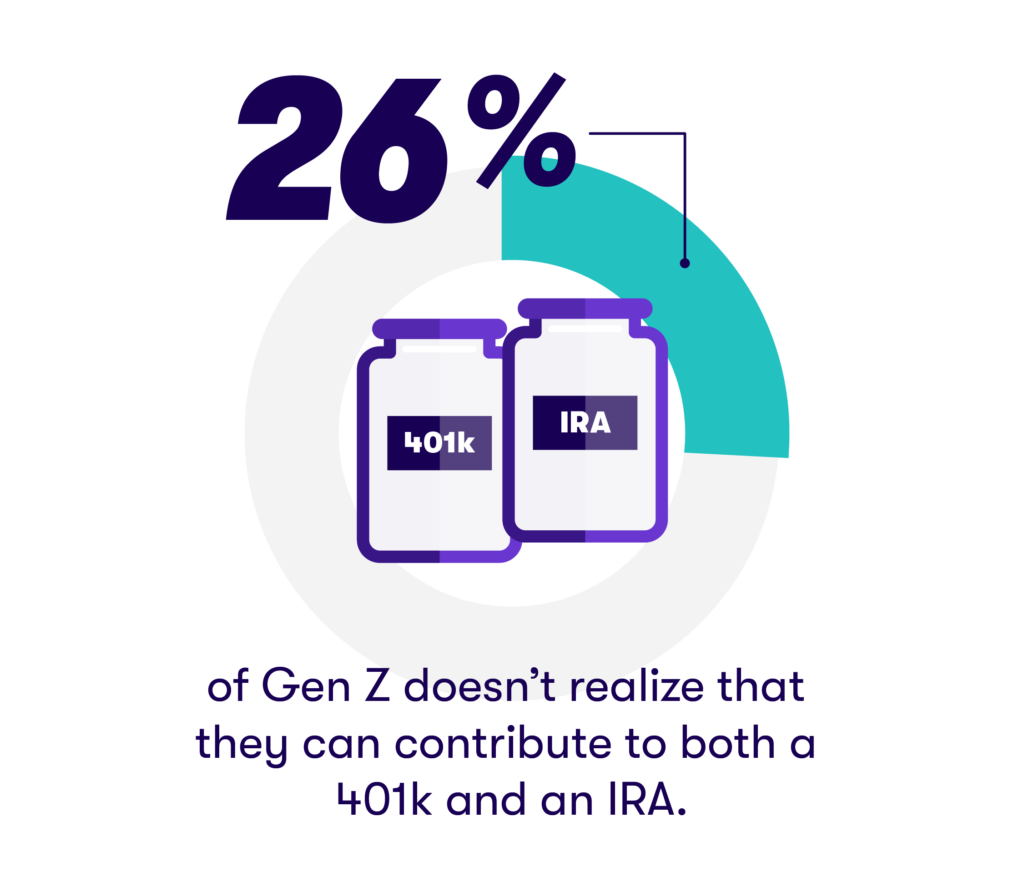

- When it comes to retirement accounts, 74% of Gen Zers know they can fund both a 401(k) and an IRA, about 10 percentage points less than other generations. Similarly, 85% know that a retirement account is actually a brokerage account, compared to 95% for other generations.

Women vs. Men

Women and men showed very similar knowledge of financial basics, with some differences related to investing and use of credit. In fact, 81% of women answered all questions on the survey correctly, compared to 84% of men.

However, there were differences, particularly when it comes to some of the more technical aspects of investing:

- 81% of women said it was reasonable to expect a rate of return between 0% and 15% for a fund with moderate growth goals, compared to 88% of men.

- Nearly 30% of women said money would do better in a savings account or emergency fund rather than a brokerage account to keep up with inflation, compared to 20% of men.

- About 35% of women don’t understand the relationship between inflation and interest (vs. 24% of men).

In contrast, women seemed to know more about credit, with 44% saying one potential benefit of having a credit card is to build credit, compared to 39% of men. Similarly, slightly more women than men said the best tactic with credit cards was to pay your balance in full each month (78% compared to 76%).

Check yourself

Becoming financially literate is a lifelong process. Check out some of these questions. If you answer “no” to more than one of them, it may be time to start brushing up on your financial knowledge.

- Do you spend less than you earn?

- Do you always pay your bills on time?

- If you have debt, do you pay more than the monthly minimum?

- Have you created an emergency fund that can cover three to six months of expenses?

- Do you have medical, home-owners or renters insurance, to insulate you from financial shocks?

- Have you created a retirement savings plan?

- Do you know your credit score, and what it means?

The survey was conducted online within the United States by STASH using SurveyMonkey technology in February 2019. The survey was completed by 4,800 people. Of the 4,800 individuals: 39.73% (1,907) identified themselves as females, 59.96% (2,878) identified themselves as males, and .31% (15) identified themselves as “other.” “Gen Z” is defined by birth year of clients between the ages of 18-24 and “Millennials” is defined by birth year of clients between the ages of 25-34 as of February 2019. This material has been distributed for informational purposes only, and is not intended as investment, legal, or tax advice.

Related Articles

Credit Cards vs. Debit Cards: The Differences Can Add Up

How To Pay Off Your Student Loans Faster

How To Pay Off Credit Card Debt

What Is the Debt Snowball Method?

Planning Your Finances as a Member of the Military

How to Build Credit: Why You Need It and How to Get It