May 31, 2018

A Look Inside the U.S. Health Care Industry

Everything you need to know about one of America’s largest sectors.

Like it or not, your health is big business.

Americans pay $3.4 trillion per year for health care and related services, according to industry data. By 2025, health care spending will represent almost 20% of the entire U.S. economy.

And no one is exempt. The average American, who has an employer-sponsored health insurance plan, spends $6,690 annually for coverage, according to Kaiser Family Foundation. For a family, the average annual cost is $18,764.

Further, only around half of the U.S. population is covered by employer-backed plans. Which means that people are either going without coverage (9%), are using a government plan like Medicaid or Medicare (35%), or are on their own.

Insurance, too, is only one component of the massive and multi-faceted health care industry. It may be the component that most consumers are familiar with (along with doctor’s offices and hospitals), but the sector comprises many other pieces.

Scalpel, please! Inside the health care sector

From a consumer’s perspective, it may seem like the health care industry is nothing more than a gigantic money vacuum. But it is much more than that.

The sector is made up of public and private companies, non-profit organizations, and individuals that provide medical care and services (hospitals, etc.), produce and develop new medications and equipment (pharmaceutical and biotech companies, laboratory equipment manufacturers), offer insurance, and facilitate patient care.

Millions of people working in the sector also, in a variety of roles. While you may think immediately of insurance adjusters and nurses, occupations like dentists, yoga instructors, midwives, and acupuncturists are also employed under the health industry’s umbrella.

The sector’s key players include large insurance companies like UnitedHealth Group and Aetna, pharmaceutical companies like Merck and Johnson & Johnson, and many others, like medical distribution company McKesson, CVS Health, and pharmacy management company Express Scripts Holdings.

But the playing field is far from set. Many of the biggest companies in the sector have been merging, creating larger companies with a wider reach. CVS and health insurer Aetna, for example, announced their intent to merge late in 2017, which would marry one of the country’s largest insurers with one of the largest drugstore chains, which officially closed in November 2018.

Other mergers are in the works, too, such as the proposed acquisition of another insurer, Humana, by Walmart.

Not willing to be left out in the cold, there are also companies on the outside who are looking to get in and disrupt the industry. Among them are Amazon, Berkshire Hathaway, and JPMorgan, which recently announced that they would team up to try and rattle the sector.

The sector’s economic gravity

Here’s the thing about health and medical care: Everybody needs it at one point or another. Which means there will probably always be customers, and money to make.

This is the primary reason the sector has such a massive amount of economic gravity. For proof, you really just need to dive into the numbers.

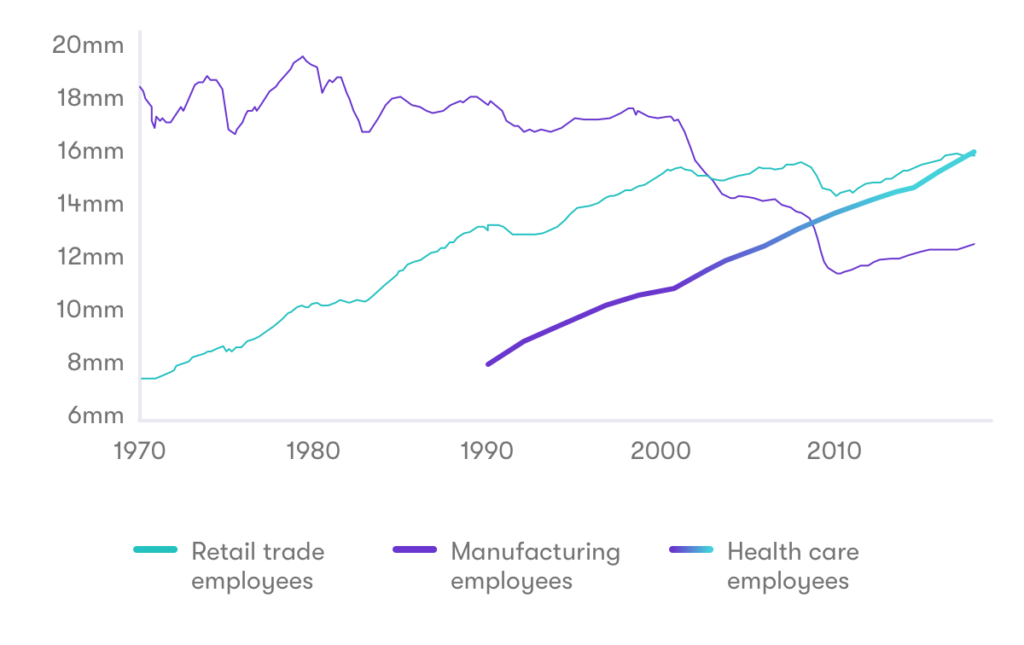

For one, the health care industry employs more people in the U.S. than any other. In 2017, the number of people working in health care surpassed the next two largest industries, manufacturing and retail.

The sector employs approximately 18 million people, according to the Centers for Disease Control, and 80% of them are women. It’s expected that the industry will continue to grow, too, with projections from the Bureau of Labor Statistics estimating that the health care industry will add 2.4 million new jobs by 2026.

These workers are paid relatively well, too, with median annual wages of nearly $65,000, nearly twice the national median income. But because the industry is largely subsidized by taxpayer funds–almost two-thirds of the industry receives taxpayer backing, worth approximately $2 trillion according to analysts–it eats up a lot of national resources.

The industry’s contributions

What type of benefits have Americans derived from all of that spending? For one, the average American’s life expectancy has increased considerably over the years. A child born today can expect to live to around 79, on average, according to the CDC.

For babies born in 1950, average life expectancy was only around 68. If you were born in 1900, it was around 47.

| Year | Average life expectancy |

|---|---|

| 1900 | 47 |

| 1950 | 68 |

| 2018 | 79 |

Improvements to sanitation, housing, and education have helped improved the quality of life worldwide. And most of the credit goes to the health care sector, which, in a variety of ways, has been the major contributor.

The health care industry is also one of the most innovative industries, and it would be difficult to list off all of the industry’s achievements and breakthroughs over the years. Those include the creation and discovery of vaccines, anesthetics, antibiotics, radiologic imaging, and more.

The (heart) beat goes on

Looking ahead, the industry’s set for massive growth according to industry analysts. America’s population is getting older, which is likely to translate into increased demand for health services, devices, and drugs.

In the near-term, unfortunately, health care costs aren’t expected to recede. Analysts are predicting that growing costs will outpace wage growth, tightening the financial vice on both households and the government. In 2018, PricewaterhouseCoopers projects medical costs to increase 6.5% over 2017.

A key issue facing the sector is uncertainty surrounding the law and regulations. That not only pertains to insurance companies grappling with regulations and rules under the current laws, but to pharmaceutical and biotech companies working on new drugs.

Despite those uncertainties, the industry’s biggest players can expect the profits to keep growing. Consumers, on the other hand, should probably plan to spend more on health care well into the future.

Want to learn more about investing in health care companies? Check out the themed funds and single stocks available on Stash.