Sep 2, 2022

How To Profit From Inflation: Best Inflation Investments To Know

If you’re wondering why your grocery bill seems higher than usual even though you’re buying the same foods, this is just one of the many real-life examples of inflation in action. In addition to the cost of goods and services going up, inflation can hurt people and the broader economy in a number of ways—particularly when it comes to your investments.

While there’s no way to know for sure when inflation will level out, you don’t have to avoid investing during inflation. In fact, it’s a great opportunity to revisit your portfolio to ensure you’re maintaining the value of your investments.

In this article, we’ll break down the best investments to consider if you’re eager to learn how to protect against inflation.

Keep reading to learn about the following best inflation investments:

Now, let’s get into how to profit from inflation.

How inflation works

Inflation is the rate at which prices for goods and services increase over a period of time, expressed as a percentage.

And inflation is normal. It’s why a gallon of gas cost $1.30 on average in July 1985, but now goes for $4.67 in July 2022.

One of the most common metrics measuring inflation is the Consumer Price Index (CPI), which is a measure of the average price urban consumers pay for goods and services. You can find it reported monthly by the Bureau of Labor Statistics (BLS).

A low, stable rate of inflation is around 2%, but that number can fluctuate significantly. For example, the 1970s and ’80s saw inflation of 10%–15%, which eventually leveled out to a more stable rate of 0%–2% in the 2010s. That number has shot back up in recent years, however—following the COVID-19 pandemic, inflation stood at 5.3% in September 2021, which was three times higher than it was in 2020. In June 2022, inflation rose to a whopping 9.1%.

Inflation can be caused by a variety of factors, such as higher demand for goods and services or production shortages.

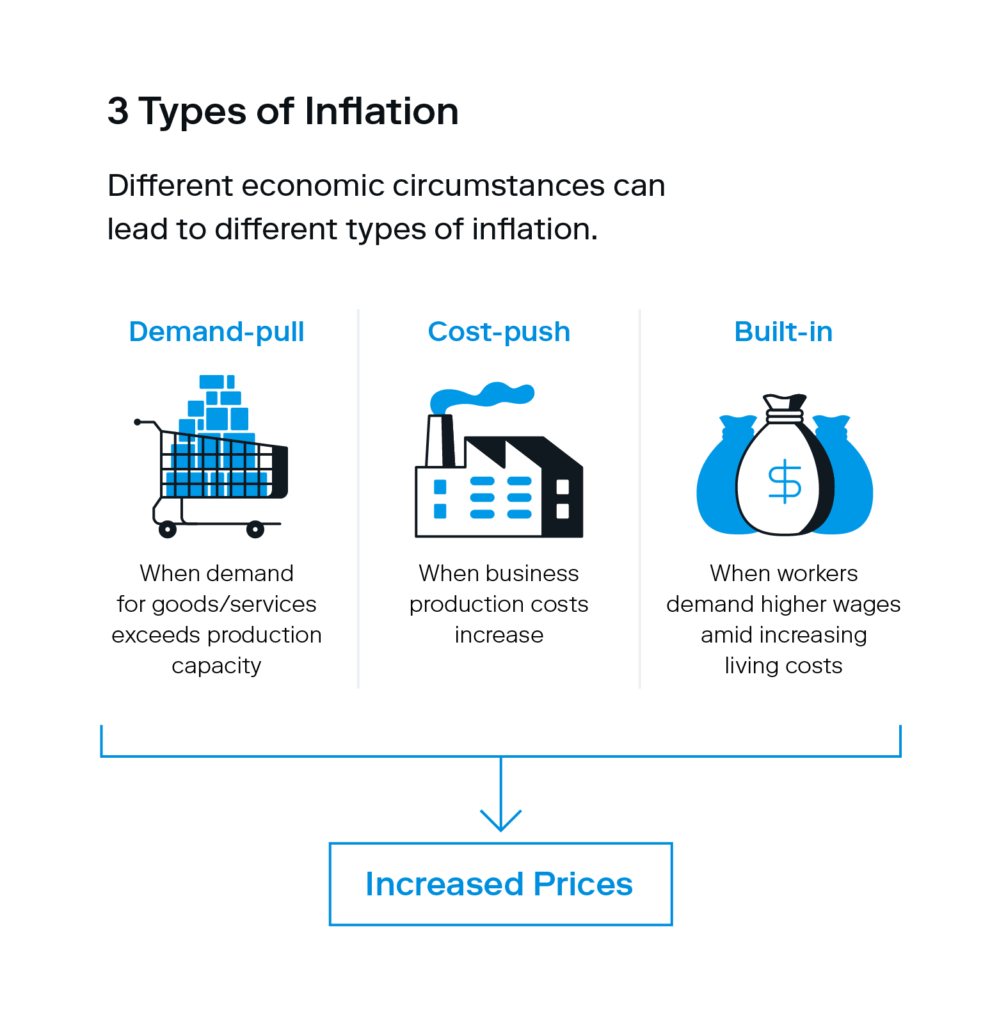

These are the three main types of inflation:

- Demand-pull inflation: Demand-pull inflation is when demand increases to a pace that supply can’t keep up with, resulting in increased prices.

- Cost-push inflation: Cost-push inflation is when business production costs (the price of raw materials or workers’ wages) increase and consumer prices are increased to make up for the extra costs.

- Built-in inflation: Built-in inflation is when workers demand higher wages amid increasing living costs. This can cause a feedback loop of companies raising prices in response to increasing labor costs.

No matter what type of inflation the economy faces, they can all impact you and your finances—the next section explains how.

How inflation affects your money

While the impacts of inflation can’t always be predicted, history can give us some general understanding of what to expect.

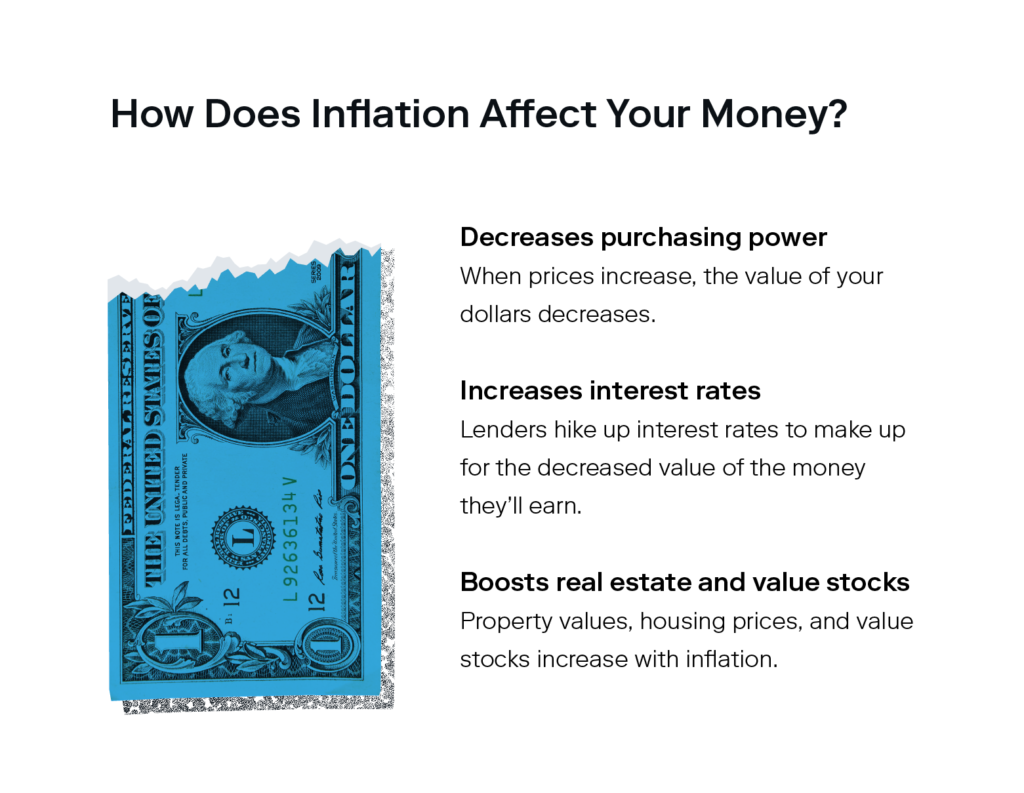

Decreases purchasing power

You’re likely already familiar with the most immediately noticeable effect of inflation. That is, price increases for goods and services. When prices increase, purchasing power decreases, meaning the value of your dollars is less than it was pre-inflation.

This also applies to money you have stashed in savings accounts. For instance, say the money in your savings account grows at 1% yearly, but inflation is 4%. That means the value of your savings actually shrinks by 3% annually.

Increases interest rates

As inflation increases, so can interest rates on things like loans and mortgages. Since inflation decreases purchasing power, lenders often hike up interest rates to account for the decreased value of the money they’ll be paid in the future.

Boosts real estate and value stocks

As inflation increases, so do property values and housing prices. That means real estate investors will see appreciation in their assets.

Additionally, value stocks—stocks that are trading below their true value—tend to fare better during periods of high inflation compared to growth stocks, or stocks that typically deliver higher returns at a faster rate.

Top-performing investments during inflation

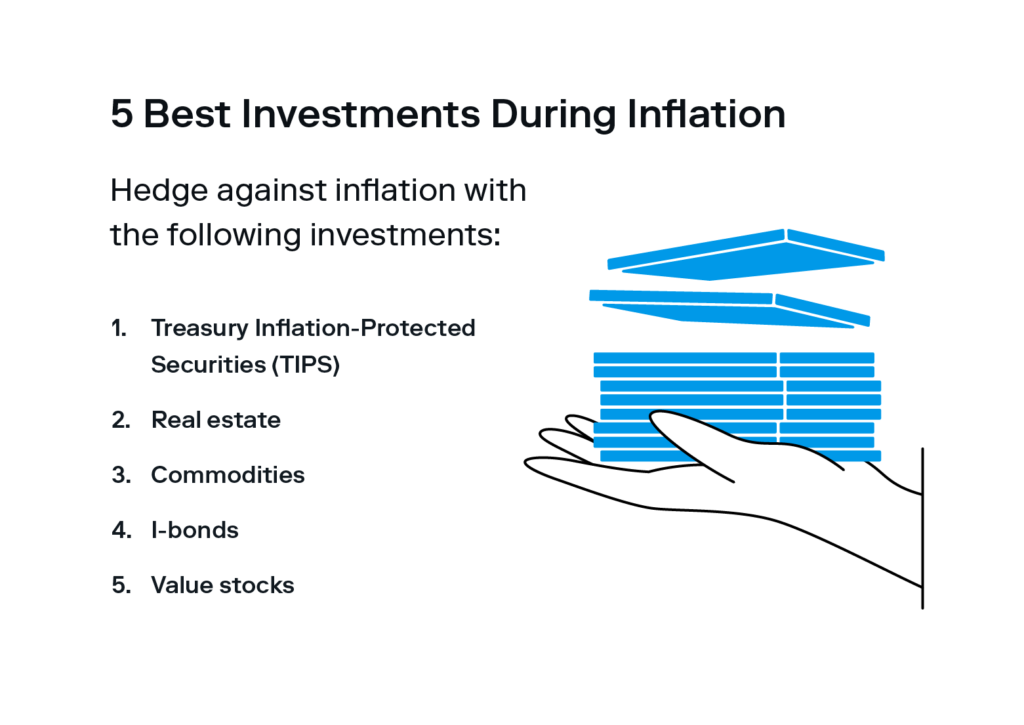

If you’re wondering how to profit from inflation, some investments perform better than others. Consider the following when deciding where to put your money.

TIPS

Treasury Inflation-Protected Securities, or TIPS, are a type of bond issued by the U.S. Treasury for the purpose of protecting investors from decreasing purchasing power.

TIPS are indexed to adjust in price as inflation rises, allowing them to maintain their real value. This makes them an attractive investment option for investors looking to preserve their capital.

Real estate

Real estate investments financed with a fixed mortgage rate are traditionally a wise bet during times of inflation. As mentioned, property values increase in tandem with rising inflation—but with a fixed mortgage rate, your monthly mortgage stays the same.

You can invest in real estate by buying property directly or by buying shares of a real estate investment trust (REIT), which allows you to own shares in real estate companies. This method works well if you don’t have the cash, time, or experience to buy and manage your own property.

Commodities

Commodities include things like raw materials and natural resources—think gasoline, steel, corn, or lumber—that are necessary for the production of goods.

Prices for commodities usually rise as inflation increases, which is why they can act as a “hedge” against inflation. As with most investments, inflationary hedge or not, commodity prices can still be volatile. Instead of going all in on a single commodity, invest in funds like commodity mutual funds that track the entire market.

I-bonds

Similar to TIPS, I-bonds (or inflation-indexed bonds) are designed to keep pace with inflation, making them a good investment if you’re wondering how to profit from inflation.

While you won’t see incredibly high returns from I-bonds, they do practically guarantee that you’ll earn back your principal investment—making them a good way to protect your purchasing power and add a low-risk asset to your portfolio. This becomes important during times of high inflation, when other investments like stocks are likely to plummet in value.

Value stocks

As mentioned above, value stocks tend to perform better during inflation than growth stocks. While their prices aren’t likely to increase as aggressively as growth stocks, they’re less volatile overall.

Value stocks tend to have low share prices relative to the company’s financial performance. For example, a company with a record of rising sales, earnings, and a positive cash flow represents an attractive investment, so the share price is likely to be higher. If a company checks all of those boxes but you see their share prices are relatively cheap, it’s likely a value stock.

Pros and cons of investing during inflation

| Pros | Cons |

|---|---|

| Preserves portfolio value | Exposure to risk |

| Maintains purchasing power | Derailment of long-term goals |

| Diversifies investments | Unbalanced asset allocation |

Every investment has pros and cons based on when you invest in them, and investing during inflation is no different. Here are the main advantages of investing during inflation:

- It can help you preserve your portfolio’s value.

- It offers an opportunity to review your portfolio and rebalance it if necessary.

- This might lead you to realize that you need to further diversify your portfolio, which is always a good idea—inflation or not.

Here are the main disadvantages of investing during inflation:

- You’re faced with more investment risk no matter what asset you choose.

- You could risk swaying from your long-term goals by allocating more toward those investments in response to inflation.

- You could risk overweighting your portfolio in a certain asset class.

The most important thing to remember is that there are no surefire answers to the question of how to profit from inflation, or how to turn a profit even when the market is strong.

Instead, it’s best to focus on what you can control—meaning knowing your ideal risk level, regularly rebalancing your portfolio, and keeping a long-term frame of mind when it comes to riding out tough economic times.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement