The post Stock Market Holidays 2024 appeared first on Stash Learn.

]]>| So can you invest today or not? The next U.S. stock market holiday is in observance of President’s Day. The market will be closed on Monday, February 19th for the holiday. |

Here are the stock market holidays for 2024:

- New Years Day: Monday, Jan. 1st (observed)

- Martin Luther King Jr. Day: Monday, Jan. 15th

- President’s Day: Monday Feb. 19th

- Good Friday: Friday, March 29th

- Memorial Day: Monday, May 27th

- Juneteenth National Independence Day: Wednesday, June 19th

- Independence Day: Thursday, July 4th

- Labor Day: Monday, Sept. 2nd

- Thanksgiving Day: Thursday, Nov. 28th

- Christmas: Wednesday, Dec. 25th

Stock market holidays and early closings

In 2024, there are 10 days that the stock market closes and two days with early closings, limiting trading hours. During these holidays, traders and investors cannot buy or sell shares of companies listed on the stock exchange. The dates of these holidays are set far in advance.

Here are the U.S. stock market holidays and early closings recognized in 2024:

| Holidays | Stock market closings and early closings in 2024 |

|---|---|

| New Years Day | Closed Monday, Jan. 1st |

| Martin Luther King Jr. Day | Closed Monday, Jan. 15th |

| President's Day | Closed Monday, Feb. 19th |

| Good Friday | Closed Friday, March 29th |

| Memorial Day | Closed Monday, May 27th |

| Juneteenth National Independence Day | Closed Wednesday, June 19th |

| Day before Independence Day (July 3rd) | Closes early at 1:00 p.m. (Eastern Time) |

| Independence Day | Closed Thursday, July 4th |

| Labor Day | Closed Monday, Sept. 2nd |

| Thanksgiving Day | Closed Thursday, Nov. 28th |

| Black Friday (Nov. 24th) | Closes early at 1:00 p.m. (Eastern Time) |

| Christmas Day | Closed Wednesday, Dec. 25th |

Bond market holidays and early closures

Similar to the stock market, the bond market observes several holidays throughout the year, during which the market is closed or has limited trading hours that affect your ability to purchase bonds. These holidays can impact trading activity, settlement dates, and other aspects of the bond market. In addition to observing the same holidays the NYSE and Nasdaq do, the bond market also closes on Columbus Day and Veterans day.

Here are the bond market holidays and early closings recognized in 2024:

| Holidays | Bond market closings and early closings in 2024 |

|---|---|

| New Years Day | Closed Monday, Jan. 1st |

| Martin Luther King Jr. Day | Closed Monday, Jan. 15th |

| President's Day | Closed Monday, Feb. 19th |

| Day before Good Friday (April 6th) | Closes early at 2:00 p.m. (Eastern Time) |

| Good Friday | Closed Friday, March 29th |

| Friday before Memorial Day (May 26th) | Closes early at 2:00 p.m. (Eastern Time) |

| Memorial Day | Closed Monday, May 27th |

| Juneteenth National Independence Day | Closed Wednesday, June 19th |

| Day before Independence Day (July 3rd) | Closes early at 2:00 p.m. (Eastern Time) |

| Independence Day | Closed Thursday, July 4th |

| Labor Day | Closed Monday, Sept. 2nd |

| Columbus Day (Indigenous Peoples' Day) | Closed Monday, Oct. 14th |

| Veterans Day | Closed Monday, Nov. 11th |

| Thanksgiving Day | Closed Thursday, Nov. 28th |

| Black Friday (Nov. 24th) | Closes early at 2:00 p.m. (Eastern Time) |

| Friday before Christmas Eve (Dec. 22nd) | Closes early at 2:00 p.m. (Eastern Time) |

| Christmas Day | Closed Wednesday, Dec. 25th |

| Friday before New Year’s Eve (Dec. 29th) | Closes early at 2:00 p.m. (Eastern Time) |

Investing made easy.

Start today with any dollar amount.

Stock market and bond market closing FAQ

What days is the stock market closed this year?

In 2024, the U.S. stock market is closed:

- Monday, Jan. 1st

- Monday, Jan. 15th

- Monday, Feb. 19th

- Friday, March 29th

- Monday, May 27th

- Wednesday, June 19th

- Thursday, July 4th

- Monday, Sept. 2nd

- Thursday, Nov. 28th

- Wednesday, Dec. 25th

Why is the stock market closed on Good Friday?

The stock market is closed on Good Friday due to both historical tradition and some practical considerations. While the initial reason for the closure was a religious observance, the lower trading volume and the desire for a long weekend break have made it a standard practice in modern times.

Is the stock market closed for Columbus Day?

No, the stock market is open on Columbus Day (Indigenous Peoples Day), which is on Oct. 14th, 2024. The bond market, however, is closed on Columbus Day.

The post Stock Market Holidays 2024 appeared first on Stash Learn.

]]>The post How To Build a Holiday Budget and Stick to It appeared first on Stash Learn.

]]>In this article, we’ll cover:

- Benefits of holiday budgeting

- How to make a holiday budget

- Avoiding debt during the holiday season

- Tips for saving on holiday expenses

- How to save up for holiday expenses

Benefits of holiday budgeting

No matter what traditions you observe, extra expenses can quickly mount during the holiday season. Creating a budget can help ensure you have money to spend on festivities, start the new year in a solid financial position, and keep stress from souring your celebrations.

- Ensure your expenses are covered: A holiday budget safeguards the money you need for your regular living expenses and bills, preventing you from unintentionally spending it on holiday extras.

- Protect your savings and investments: By allocating funds specifically for holiday spending, you can avoid the temptation to dip into your savings or disrupt your investment plans.

- Avoid going into credit card debt: With a budget, you’re less likely to rely on credit cards which can leave you with high-interest debt lingering long after the holiday season ends.

- Reduce stress: Knowing you have a plan for your holiday spending can lift a weight off your shoulders. A budget removes the guesswork and lets you enjoy the holidays without the nagging worry of overspending.

How to make a holiday budget in 3 steps

The goal of a holiday budget is to allocate a percentage of your income and savings to holiday spending while maintaining enough money for your other financial commitments. If you already have a budget, now’s the time to work holiday expenses into your plans. Be sure to integrate specific line items for things like gifts, travel, and entertainment into your existing budget.

And if you haven’t yet established a monthly budget, the holidays are an opportune time to start. Making a holiday budget may help you start a long-term budgeting habit.

1. Define your holiday spending categories

The holidays can bring a wide array of expenses unique to each person’s traditions; without a detailed plan, it’s all too easy to overlook certain costs. To know exactly what you should budget for your holidays, first, determine what your typical holiday spending looks like based on previous years. Then think about what you’re planning to do this year and make a list of all your anticipated expenses.

A reasonable budget for the holidays depends on the traditions you observe and what’s important to you. Consider planning for these common seasonal purchases:

- Holiday gifts: Think of everyone on your gift list, as well as presents you’ll buy for things like office gift exchanges or Secret Santa gifts if you celebrate Christmas.

- Greeting cards: Be sure to consider the cost of both cards and postage if you’re mailing holiday greetings.

- Dining and groceries: Include the costs of dining out as well as money for extra groceries if you’re hosting gatherings.

- Entertainment and activities: Check the cost of tickets and entry fees for the events you plan to attend this season.

- Decorations and attire: Remember to include expenses for replacing worn-out decorations, as well as special clothing you may need for a holiday party.

- Holiday travel: If travel is on your agenda, plan for the cost of tickets and accommodations, and remember additional expenses like travel insurance and pet care while you’re away.

- Charitable donations and tips: Giving back is an important part of the holiday spirit for many people, so budget for donations you want to make and tips for service workers.

2. Fund your holiday budget

Once you’ve identified the various expenses that the holiday season entails, the next step is to determine how much you’ll need for each and ensure you have the funds set aside.

- Determine spending limits for each category: Look back at last year’s spending to help gauge what you might need this year. This historical insight can serve as a baseline for setting spending limits for each category of your holiday budget.

- Reduce your expenses: To free up funds for your holiday spending, look for ways to save money on other expenses. You might want to make temporary sacrifices in some areas to make room for holiday purchases.

- Tap into extra money: If you receive any extra income during the holiday season, such as a bonus from work, you could use it to bolster your holiday budget. You may also want to look for additional sources of money, like old gift cards that still have a balance or picking up a short-term side gig.

- Take unpaid time off into account: If you’ll be taking unpaid vacation time for holiday travel or observance of special days, remember to factor the reduction in income into your budget.

3. Track and control your spending

Amidst the bustle of holiday shopping, it can be easy to lose track of your planned spending limits. By tracking your spending meticulously, you can be sure you don’t blow your holiday budget.

- Consider a budgeting app: A budgeting app can give you real-time insight into how much you’re spending by automatically tracking every transaction. This constant monitoring can alert you to issues so you can adjust your spending habits before they become a concern.

- Try a mini envelope budget: Envelope budgeting involves allocating cash into different envelopes for each spending category. By using this approach for your holiday expenses, you can physically see what you have left to spend, which can be a powerful deterrent from going over budget.

- Use your debit card, not your credit card: While it’s tempting to defer the cost of your holiday expenses by putting them on your credit card, relying only on your debit card can help you ensure you’re only spending money you have in the bank. If you can find a debit card that offers rewards, all the better.

- Remember the reason for the season: It’s easy to get caught up in the thrill of holiday spending and forget the reason you’re celebrating in the first place. Before you decide on a purchase, reflect on whether it adds meaning and joy to your personal experience of the holidays.

Don’t let debt put a damper on your holidays

If you defer paying for your holiday expenses, the joy of the season can turn into the stress of lingering debt when the new year dawns. By planning and spending within your means, you can create lasting memories without the worry of paying off debt once the holiday lights dim.

Avoid credit card debt

Credit card debt can be particularly insidious during the holiday season. It’s easy to swipe now and worry later, but this can lead to a significant financial hangover. In 2022, 35% of U.S. consumers found themselves saddled with debt from holiday spending. Credit card debt in particular often carries high interest rates, which can quickly compound, making it harder to pay off in the long run.

Beware of buy now, pay later offers

Buy now, pay later (BNPL) offers might seem convenient to spread out holiday expenses, but they come with caveats. These plans allow you to purchase items immediately by paying for just a portion of the cost and then paying off the rest in installments. While this can make large purchases seem more manageable, it can also lead to spending beyond your means. If you’re not careful, BNPL plans can accrue interest or fees, and missed payments may impact your credit score. It’s crucial to fully understand the terms and consider whether the long-term costs are worth the short-term convenience.

Tips for saving on holiday expenses

The holiday season doesn’t have to be synonymous with extravagant spending. With a few smart strategies, you can trim your holiday expenses without diminishing the sparkle of your celebrations.

How to save on holiday gifts

- Arrange a gift exchange: Organize a gift exchange among your family or friend group where every individual draws a name. This way, everyone receives something special, and each person only needs to purchase one gift, keeping expenses down.

- Set spending limits: If you’re exchanging gifts with someone, agree on a spending cap that works for your holiday budget. This way, no one feels pressured to overspend, and everyone can enjoy the spirit of giving without financial stress.

- Give as a group: If you want to present someone with a high-cost gift, consider pooling resources. For example, joining forces with siblings or cousins to buy a collective gift for a parent or grandparent allows for a more substantial present without the full burden falling on one person.

- DIY your gifts: Handmade presents are not only personal and thoughtful, but may also be kinder to your wallet. Crafting or baking homemade gifts can also be a fun event to enjoy with family or friends, adding a low-cost activity to your holiday season.

How to save on other holiday expenses

- Go the potluck route: If you’re hosting a holiday gathering, consider making it a potluck. With each guest contributing a dish, you save money on groceries and add variety to the feast.

- Find free fun: Look for no-cost holiday activities in your community. Free events like tree-lighting ceremonies, holiday markets, and winter festivals can create cherished memories without expensive tickets or entry fees.

- Take inventory of what you have: Before rushing out to buy new decorations or holiday attire, scour your home storage for forgotten holiday treasures. Reusing and repurposing decorations and clothing can save you money while being environmentally conscious too.

- Make your own decorations: Gifts aren’t the only holiday cost that can benefit from a DIY mindset. Find free online tutorials for crafting holiday decor to adorn your home; just be careful not to overspend on supplies. Plus, a decoration-making party can be an inexpensive holiday activity, and could even become a treasured tradition.

- Trim travel expenses: What you should budget for a holiday vacation depends on multiple factors, but how you get there and where you stay are often the two biggest expenses. If you’re flying, research the travel dates with the lowest costs; if you’re driving, maximize fuel efficiency. You might also consider staying with family or going in with others on a short-term rental instead of shelling out for a hotel. If you do opt for a hotel, remember to include the cost of lodging tax in your budget.

How to save on holiday shopping

November and December are the biggest months of the year for retail businesses. Alluring sales and an onslaught of ads can easily send you into a holiday shopping frenzy that undermines your budget. To avoid being swept up in the fray, go into your shopping excursions with thoughtful strategies to bolster your self-control.

- Avoid impulse buys: Don’t let sales and flashy marketing tempt you into an unplanned spending spree. Remember, retailers are great at creating a sense of urgency for holiday shoppers. Before you head to the store or browse online, make a list, check it twice, and have a plan for sticking to your budget for each item.

- Be prudent with promos: Promotional emails and texts can alert you to genuine savings, but they might also entice you to buy things you don’t need. If you find that these messages trigger unnecessary spending, consider unsubscribing during the holiday season.

- Treat yourself sparingly: It’s easy to be drawn to items for yourself while shopping for others. Bookmark the things you’re interested in and revisit them after the holidays so you can use gift cards or take advantage of post-holiday sales.

- Watch out for Black Friday and Cyber Monday mania: The days after Thanksgiving have become holidays in and of themselves as stores kick off the holiday shopping season with the promise of huge savings on hot items. While you can find significant discounts, not all deals are as good as they seem, and it’s easy to buy more than you’ve budgeted for in the face of the hubbub. To save money on Black Friday and Cyber Monday, plan your purchases ahead of time, compare prices, and stay focused on the items on your list instead of impulse purchases.

How to save up for holiday expenses

Setting aside money in advance of the holiday season can alleviate the financial pressure of end-of-year expenses. By saving up for the holidays throughout the year, you’re less likely to feel the pinch when the festive months roll around.

- Start saving early: Start saving up for holiday expenses long before the season starts. A budgeting framework like the 50/30/20 rule can guide you on how much of your paycheck you should regularly put into savings throughout the year.

- Create a holiday sinking fund: A sinking fund is a dedicated savings pot for a specific goal. Building up a sinking fund specifically for your holiday budget can help you spread the cost of holiday expenses over time, making them more manageable when the season starts.

- Do your holiday shopping all year long: If you identify your holiday expenses early, you can spread your spending out over time. That way you can take advantage of a great deal on a perfect present to stow away for gift-giving time or shop post-holiday sales for discounts on things you’ll want for the following year.

- Grow your money in an interest-bearing account: Placing your holiday savings in an account that earns interest, such as a money market or high-yield savings account, allows your money to grow through the year. Compounding interest can add a little extra to fund your holiday budget.

Think beyond your holiday budget

Adhering to a holiday budget is more than just a seasonal discipline; it’s a practice that safeguards your financial health well into the future. When it comes to good money management, planning ahead is key. While you build your holiday budget, consider mapping out January’s expenses as well to give you perspective on the impact your holiday season financial decisions will have on your longer-term savings and investment objectives. With a well-managed holiday budget, you can ensure that the joy of the season transitions seamlessly into a prosperous new year.

Investing made easy.

Start today with any dollar amount.

The post How To Build a Holiday Budget and Stick to It appeared first on Stash Learn.

]]>The post 5 Tips for Saving Money on Black Friday and Cyber Monday appeared first on Stash Learn.

]]>In 2020, holiday shopping arrived while the Covid-19 pandemic was in full swing, and before the widespread rollout of vaccines. Consumers reportedly spent an average $312 during the four-day stretch from Thanksgiving to Cyber Monday.

And because of the pandemic, consumers shopped more online, and over a more extended period of time. Total online sales during the 2020 holiday season increased to $209 billion, a 24% jump year-over-year. Holiday retail sales totaled $789.4 billion, an 8.3% increase compared to 2019.

For 2021, both in-store and online sales are expected to increase between 8.5% to 10.5%.

In-store shopping is expected to account for 33% of holiday sales, according to a survey from consulting firm Deloitte, compared to 28% in 2020.

Your health and safety are still the most important thing to keep in mind during Black Friday shopping this year. So if you do plan to shop in stores, remember to wear a mask if required.

Here are Stash’s tips for taking advantage of deals without overspending on Black Friday, Cyber Monday, and beyond.

1-Build a budget and stick to it

Before you start adding items to your cart this year, you need a budget. And If you haven’t set one up, consider using one like the 50-30-20 budget. First, figure out your monthly income and then break that into three different categories: necessary, fixed expenses (50%) variable expenses (30%), and savings and investments (20%). Your holiday shopping will come from your savings, and your discretionary income. You can use this budget template to stay on track.

You might have also been saving specifically for your holiday spending, so take any funds you’ve set aside into consideration as well. Once you have a set amount of money in mind, you can avoid spending money you don’t have on gifts for other people, or for yourself. You might want to create a partition1 in your Stash account that’s dedicated specifically to money that you’ll use for holiday gifts.

2-Don’t get distracted by unnecessary purchases

While it’s nice to pick up something for yourself while you’re doing your shopping this holiday season, don’t get overwhelmed by items that aren’t in your budget. Don’t go to a store or browse online unless you know exactly what you’re looking for and what it’ll cost.

Consider writing out a list of all the things you want to buy, and then see if you can find discounts by shopping around.

3-Do your research and compare prices

If you have a specific item in mind that you want to buy during the holiday sales, figure out how to get the best price for it. Maybe you’re planning to buy a slow cooker for your sister or a tablet for your kids. Look around for which store is offering the best price for what you’re buying. Something on your list may go on sale on a specific day or at a specific time.

You might also be able to get cash back, discounts, or rebates through third-party sites such as Rakuten to get Black Friday deals. Or you can use extensions like the Honey app to get discounts and promo codes for certain online purchases.

4-Use a card that earns rewards

You might have a card that you can use to earn rewards or cash back points. Try to use those reward cards when you’re doing holiday shopping on Black Friday so that you can earn rewards while also getting the best prices.

With Stash’s Stock-Back® card2, you can earn a percentage of every qualifying purchase back for each purchase that you make. So when you buy something from Amazon, you can earn a percentage of that purchase back as Amazon stock.

5-Make sure that you can return items

Lastly, make sure that you (or the person you’re shopping for) can return whatever you purchase. If you find a better price for the item or change your mind, you’ll want to be able to return it. Be aware of the return policies where you’re shopping and keep any receipt that you receive.

Consider these steps to help you avoid spending too much money on gifts this holiday season. And remember to stay safe while you shop this year!

The post 5 Tips for Saving Money on Black Friday and Cyber Monday appeared first on Stash Learn.

]]>The post Shopping for the Holidays on One Income? Here’s How appeared first on Stash Learn.

]]>If your household income has been reduced because of the pandemic, you might find it difficult to buy gifts for the holidays this year.

Nevertheless, it’s important to try to stay within your budget even if it’s smaller. That can help you avoid the holiday debt hangover, when you rack up charges on gifts, gatherings, and other holiday-related expenses, only to face a big outstanding balance in the new year. If you’ve suffered a pay cut or job loss this year, the debt hangover could be far heftier.

Here are some suggestions for planning holiday spending without racking up debt:

Create a list and cut it in half. It’s a tried-and-true tactic for a reason. Without a concrete plan, spending on those Amazon purchases for friends and family, and on strings of festive lights and sprigs of mistletoe, can add up quickly.

Instead, if your income has been reduced, consider creating a holiday budget for roughly half the number of folks you originally intended to include. Have 20 people to shop for? See if you can trim down that list to 10.

While it may be difficult to only purchase gifts for one set of cousins, parents, siblings, consider batching your gifts so there are fewer to buy. Do you really need to buy a gift for your brother, wife, and three kids? Or can you come up with a gift basket with goodies that appeal to the entire family? Instead of spending $120 for a family of five, you could cut it down to, say, $40.

Consider cutting back on expenses to save for the holidays. You may have already adjusted your budget if your household income took a hit. Aim to spend less than you earn.

But it couldn’t hurt to comb through your spending again, and see what can be cut or reduced during the last months of the year. Any savings can be reallocated toward holiday expenses. For example, you can bring down the cost of your gas bill. According to the U.S. Department of Energy, a household can save up to 10% on its bill simply by dropping the heat 7 to 10 degrees for eight hours a day. “A 1-degree drop in temperature will typically result in 1% savings off your annual bill,” says Joelle Spear, a certified financial planner and partner with Canby Financial Advisors in Framingham, Massachusetts.

Similarly, If you’ve already looked into cutting back on your monthly and yearly subscriptions, such as magazines, streaming services, or beauty products, don’t forget the ones renew automatically through your PayPal or your phone’s App store, suggests accredited financial counselor Brittany Davis, founder of Brittany Davis & Co. in Memphis, Tennessee.

“The worst part is that these automated payments are hidden under so many layers of clicks,” Davis says, who specializes in budget management. “Just spend the extra 10 or 20 minutes, and you could potentially save $50 extra dollars or more per month.”

Go Secret Santa. There’s no need to go berserk and buy presents for everyone you know. By taking the Secret Santa route, where your identity remains anonymous and you purchase a gift for just one person in a group, you can potentially save money. “It might seem a little old-fashioned, but pull names and buy a gift for the person you’re assigned to,” says Davis. “The fun is in the secrecy — the gift isn’t just the surprise, the gifter is a surprise as well.”

Think about a temporary side hustle. If you’ve cut back on expenses as much as you possibly can, consider looking into some seasonal work. Look for gigs that are within your realm of expertise, that don’t require a lot of equipment or supplies. Also, consider side hustles that tend to be in higher demand during the holidays and might offer higher than average pay.

Ramp Up Your Savings Now

Set up a separate savings account for holiday spending. The easiest thing you can do is to set up a separate bank account just for holiday spending, explains Davis. After all, money you don’t see is money you don’t spend. “Use the power of tech and automation to your advantage,” says Davis. “If you send the holiday money to a separate savings account, it’s more likely to not be spent. Resist the temptation to spend from it by remembering who/what it’s for.”

Auto-save for the holidays. Start putting your money in a separate savings account as soon as possible, recommends Davis. ”If you’re still gainfully employed or are side hustling, take it a step further by setting up an auto-transfer from your bank each time to receive a paycheck,” she says.

Keep it going. You can also set a stop-transfer deadline, but Davis suggests you keep it going. After all, the holidays will be back in 2021. If you need that money for other expenses, keep auto-saving, but switch it so that the money goes toward a general emergency fund.

Saving with Stash. You can set up a partition within your Stash account specifically for holiday gifts and set a reminder for yourself to add more money to that partition when you get paid.1 Or if you’ve set up Direct Deposit, you can automatically add money to Stash for your holiday shopping partition with each paycheck. Plus, with Stash’s Set Schedule, you can make regular, automatic investments in your portfolio so that you’re not forgetting your long-term investing.

The post Shopping for the Holidays on One Income? Here’s How appeared first on Stash Learn.

]]>The post Non-Profit Organizations and Charities: What You Need to Know appeared first on Stash Learn.

]]>Charities support important causes, and giving to one—either for yourself or for someone else—can make a big difference in another person’s life, whether it’s assistance recovering from a natural disaster, helping to feed the hungry, or providing education to someone in underprivileged circumstances.

Here’s everything you need to know about giving to a good cause:

What’s a charity?

There are more than a million public charities in the U.S.

Charities are non-profit organizations that have tax-exempt status. That means they don’t operate to make a profit, and they typically don’t pay state or federal taxes. They also must have an active fundraising program, and are involved in some purpose furthering the public interest or the common good.

Generally speaking, there are public charities and private foundations. The key difference is that the general public supports and funds public charities, whereas one person or a family, or some other group of people, controls and funds a private foundation.

When most people think about charities, they are thinking of public charities. But private foundations can also be involved in giving (The Bill & Melinda Gates Foundation is one example).

Examples, according to the Internal Revenue Service (IRS), can also include places of worship, medical research organizations, colleges and universities, some fraternal societies and even non-profit cemeteries (yes, that’s a thing).

Donations could save you money

Let’s talk a little more about taxes.

If you give to a qualified charity, the value of your donation might be tax-deductible. That means what you give can reduce your total income tax.

You might have to itemize your expenses, however, to qualify for charitable deductions.

Depending on the charity, you can give cash as well as non-cash items such as household goods, clothing, even used cars.

Always check and make sure that your gifts are tax-deductible. Many times they aren’t.

Tips for giving to non-profit organizations and charities

Give to qualified charities. These are charities that have been granted tax-deductible status by the IRS, which means you can also get a deduction for your giving.

Special note: The IRS sets charitable donation deduction limits based on adjusted gross income. This information should not be construed as tax advice. It’s always best to consult a tax expert for anything related to your taxes, such as charitable giving.

Keep proper documentation of your donations. For cash gifts, that means a canceled check, credit card statement, or a bank statement.

Get a receipt. If you’re giving non-cash items, you’ll need a receipt from the charity you’ve given to, listing the value of the goods you’ve donated. (If they are used items, you’ll need to list the fair market value, which is what you might get if you try to sell them.) If those goods are worth more than $500, you’ll also need to fill out separate IRS form called the 8283, which itemizes what you’ve donated.

Don’t give blindly on social media. Be wary of GoFundMe or other crowdfunding campaigns. It’s easy to get caught up in the heat of the moment, particularly when there is so much going on in the world around us, and scammers love to prey on these emotions.

Check out the Federal Trade Commission (FTC) for more information on charity scams.

Crowdfunding donations are also typically considered personal gifts by the IRS, and are not tax-deductible, unless the money is going to a qualified charity.

Numerous sites rate qualified charities.

Make sure you’re choosing a charity where the majority of your donation will reach the intended recipients, and won’t be eaten up by the administrative costs of the organization, or other expenses, which can sometimes happen.

Charity Navigator ranks more than 9,000 qualified charities for financial transparency, and compiles lists of the top ten in different categories, such as the ones that are most popular, or the ones with the most expenses.

Charity Watch and Guidestar are two others that provide charity rankings. Another is GiveWell, which focuses less on financial data, and more on the results the charities have for their particular causes.

So whether it’s the famine in Yemen, malaria in Africa, or supporting good causes in your neighborhood, there’s a charity for you.

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]The post Non-Profit Organizations and Charities: What You Need to Know appeared first on Stash Learn.

]]>The post Holiday Hangover: Stash’s Post-Holiday Financial Recovery Guide appeared first on Stash Learn.

]]>The average American is likely to spend roughly $1,000 during the holiday season—by no means a small amount for many people. And for some, it’s an insurmountable sum. As of November 2018, 15% of Americans were still trying to pay off debt accrued from the previous holiday season.

Whether holiday cheer has blinded your financial judgment, or you simply didn’t budget for Secret Santa and stocking stuffers, odds are your bank account took a hit over the past month or two.

But if you find yourself in debt or are possibly reeling financially from the holiday season, there are some things you can do to get back on track. Even if you’ve racked up some credit card debt or blown your budget, you should pick yourself up off the mat and get ready for another year.

Get back on track, by tracking your spending

If your bank account balance is giving you an anxiety attack, you may need to go on a zero-spending streak to avoid going into debt. Buy groceries and pay rent and other fixed expenses, but if you can, put off non-essential expenses until after the next paycheck or two.

You may want to try another method to keep your spending under control, such as going on a “cash diet, which involves using only cash for every transaction, until you feel comfortable going back to your debit card.

Repad your accounts

If your savings took a hit during the holidays, it’s time to replenish these accounts—namely, any rainy-day or emergency savings funds you’ve built up.

It’s vital to have money in reserve for all of the financial curve balls that life can throw at you. There are some expenses you can cut, and other ways to increase your income, which can help you rebuild your funds.

Repair your credit

If you were one of the many Americans who went into debt over the holidays, don’t panic—you can pay it down and repair any damage to your credit score.

Even if you can’t pay off your credit card in one fell swoop, you should be able to keep your score up by making regular payments. The trick, however, is to make sure you’re tackling your debt in a timely manner, and making more than just the minimum payments, as interest can set you even further back over time.

And avoid additional spending on credit as the new year commences.

Budget for next year

The time to plant a tree was 20 years ago, and the second-best time is right now.

Apply that same logic to next year’s holiday shopping spree, and plan ahead. So start budgeting money now for all the gifts, decorations, and anything else you want to buy when the next holiday season rolls around.

Calculate how much you spent this year, anticipate what you’ll need next year, and start stashing money away each month so that when Santa comes knocking, you’ll be ready.

The post Holiday Hangover: Stash’s Post-Holiday Financial Recovery Guide appeared first on Stash Learn.

]]>The post It’s The Most Profitable Time of the Year: Inside Santa’s Workshop appeared first on Stash Learn.

]]>He’d be faced some unique challenges, to say the least, including maintaining a large, elvish workforce, building out huge factories and storage facilities, and of course, dealing with the health consequences of eating millions of cookies.

As a fun little exercise, we attempted to calculate out some of the business costs Santa faces, as well as how big of a market the big man is trying to serve.

Tighten your sash, we’re about to slide down a strange chimney.

Santa’s market

There are more than 525 million children under the age of 14 who are likely to celebrate Christmas in the world. We can use this as our bare-bones estimate—there are likely tens or hundreds of millions more.

So, we’ll say that Santa has to visit at least 525 million kids on Christmas night. And if we say that Santa gives each kid three presents, we know that he’ll need at least 1.575 billion gifts ready for delivery.

How he does it remains a mystery, so we’ll give him the benefit of the doubt that he can get it done. We just need to know the size of the market.

Santa’s workforce

If you need at least 1.5 billion toys ready for delivery every Christmas, it’s going to require a lot of labor. But just how much?

To calculate how much elf-power would be needed to produce the appropriate number of toys, we could use an equation such as this:

So, what if we have 525 million kids, and each needs three toys, elves work 364 days per year for 8 hours, creating four toys per hour? By plugging in these variables into the equation, we find that Santa’s elf workforce would total up to 135,216.

As for what these elves are being paid? The North Pole is actually outside of any nation’s exclusive economic zone—an area stretching out from a country’s shoreline in which that country’s laws and regulations would apply—so there wouldn’t be any specific regulations related to wages that would apply. In other words, there are no rules Santa would have to abide by.

But, for fun, if you wanted to apply the U.S. federal minimum wage of $7.25 per hour, your average worker elf would earn a measly $21,112 per year working 8 hours per day, 364 days per year.

Equipment and facilities

Here are some quick estimates for some of the other costs Santa should expect to encounter:

- Reindeer: $1,000 each, plus $2,000 annual upkeep.

- Sleigh: $5,500, plus insurance.

- The suit, plus dry cleaning: ~$500.

- Health costs (too many cookies): ~$16,000 per year.

As for factory and warehouse space, the costs could vary. We can presume that Santa already owns plenty of North Pole acreage, so his costs likely revolve around construction and heating.

We don’t know how much space Santa would need—but we could possibly compare it to perhaps a similar commercial complex, Amazon’s recently announced global hub in Cincinnati. That hub will have more than 3 million square feet in which to conduct operations, and have a footprint of 1,100 acres.

The total cost is expected to be $1.5 billion. Santa may end up paying more for a similar facility, since transporting materials to the North Pole is likely to present logistical challenges.

Taxes

The North Pole is a wild, lawless land. As such, there wouldn’t be any taxes to pay—because there isn’t a government to pay them to (although, interestingly enough, if you are a Santa Claus actor in Belarus, you’re expected to pony up).

But, again, if Santa wouldn’t want to end up on the IRS’ naughty list. It’s difficult, if not impossible to tell what types of taxes Santa would owe to the IRS, but we do know that he’d likely be able to reduce it considerably—perhaps as much as 50%—due to charitable contribution deductions.

The bottom line

Santa’s not running a cheap outfit up north. He’s giving away billions of dollars in gifts every year, employing tens of thousands, and is faced with some weighty infrastructure and upkeep costs.

All told, he’s running an operation that costs billions of dollars. But that may be a small cost to eat in exchange for tens of millions of happy kids on Christmas morning.

Receive more fun stories, direct to your inbox, by subscribing to the Stash newsletter.

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]The post It’s The Most Profitable Time of the Year: Inside Santa’s Workshop appeared first on Stash Learn.

]]>The post How to Have a Fabulous (and Frugal) New Year’s Eve appeared first on Stash Learn.

]]>Restaurants advertise decadent prix fixe menus that only a king could afford, and clubs and bars pull in “celebrity” DJs and charge mind-blowing covers. Even your crummy local pub will charge double digits for you to wash your wings down with cheap sparkling white wine.

In general, prices are higher than ever because bar owners know that NO ONE wants to feel FOMO at midnight.

Instead of wasting your money waiting in line behind a velvet rope, consider throwing your own event at a fraction of the cost.

Here’s how to enjoy a more frugal (but still fabulous) New Year’s Eve for under $50.

Throw a Best Bubbles Party

It’s super easy. Have each guest bring a very cheap bottle of Prosecco or Champagne. You purchase one expensive bottle (have your guests help you split the cost). Then, host a blind taste test party in which everyone ranks the all the different bubblies and tries to pick out the classy stuff. Once rated, tally the results, and reveal the “Best Bubble” Award to a bottle right before midnight. Cheers, everyone’s a winner!

Total cost: <$15 per person

Host a Golden Globe Nominations Watch Party

The Golden Globes are Sunday, January 6, and New Year’s Eve is the perfect time to prepare by watching some of the TV shows and movies that made the nomination list. It’s a great excuse to binge watch with friends, and you’ll be more invested in The Golden Globes when they happen the following Sunday. When the clock strikes midnight, hit play on your Grammy nomination playlist!

Total cost: $0 to $30 depending on your television plan and snack needs.

Throw your own event (at a real bar)

As a gal who has produced a lot of events, I’ve learned that NYE can actually be a money-maker, if you play your cards right.

You may be surprised to find out how many local bars and venues wouldn’t mind hosting your dream party. Yes, even at the last minute

Even if you charge a wildly low $5 cover and agree to pay the venue 50 percent of the door money, you’ll be able to pay for all your drinks from ticket sales and still tip the staff generously.

Total cost: If you’re an organized person with a lot of friends, you can actually come out a few hundred dollars ahead. What a great way to start 2019.

The Purge

Much like the movie in which everyone gets their demons out on a designated “Purge Night,” this purge is meant to let you indulge. (To be clear, indulge with food, not human blood.)

Throw a party in which each guest brings a dish they’ll try to swear off in 2019—double mocha chocolate chip brownies, anyone? Everyone gets to pretend sugar, alcohol, and cheese don’t count one last time before heading into the New Year.

Total cost: Approximately $25—whatever is the cost of making your favorite dish!

Slow It Down

On a night that most restaurants are serving rich, heavy meals, you can make one just as satisfying in a slow cooker. In fact, New Year’s Eve is the night for throwing a great cut of meat and fresh vegetables in the pot early in the morning, and letting it simmer all day.

Your dinner will be just as flavorful and filling as anything being served at a fancy restaurant, and at least one third the cost. (Pssst, Here’s a personal favorite recipe.)

Total cost: Approximately $10 per serving.

Do a double feature

There are a lot of movies where New Year’s Eve is a big part of the plot. When planning your double feature, I’d recommend one good one, such as “When Harry Met Sally,” and one bad one to make fun of over drinks with your friends—“New Year’s Evil,” perhaps?

Total cost: $9 total for both digital rentals. Have your friends bring the popcorn.

Throw an ‘Around the World’ party

Throw a house party in which you honor traditions from around the world every hour on the hour, as each part of the globe passes over into 2019.

For example, eat 12 grapes to celebrate New Year’s in Spain. Throw buckets of water out the window as they do in Puerto Rico (try not to hit your neighbors). Bake a coin into a cake and see who gets the “lucky” piece as they do in Bolivia. Carry an empty suitcase around the block as they do to bring good luck in Colombia.

Check out these international ways to celebrate—there’s more than can fit in one New Year’s Eve house party.

Total cost: Split the celebrations with your other guests, and you’ve got a great party for $10 per person.

No matter what you do, just remember that waking up on January 1 with money in your pocket is better than starting off the year broke.

Happy 2019!

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]The post How to Have a Fabulous (and Frugal) New Year’s Eve appeared first on Stash Learn.

]]>The post 7 Tips For Staying Calm About Money During the Holidays appeared first on Stash Learn.

]]>Dr. Greg Cason*, an LA-based psychotherapist and star of Bravo’s ‘LA Shrinks” gets to the heart of holiday money fights with family—and offers tips on how to keep it together, no matter your situation.

Cason shares his advice on our podcast “Teach Me How to Money,” including these key tips for staying civil during what is likely the most stressful time of the year—the holidays.

The following are excerpts from Cason’s conversation with Stash editorial director Lindsay Goldwert, edited for clarity.

1. Remember: People can be financially stressed during the holidays.

“Around the holidays, people have generally overextended themselves [financially], and they’ve done so in the spirit of giving…but many feel resentful about the holidays, that they have to dress up, that they have to go to parties, that they have to buy wine, bring gifts, and give tips.

People [can] be resentful about that…going down the list, it can be a lot, so it’s understandable how people can [become stressed].”

2. Think carefully before giving gift cards.

“Personally, I find gift cards [to be] a chore. I have to go use them somewhere—I have to drive to a place and purchase something that, maybe, I wasn’t intending to. Even if it’s a grocery store I go to all the time, I have to remember to bring my gift card and use it.

But, then again, other people think they’re the perfect gift. People are all over the map on this…so I think it’s best just to look at gifts as well-intentioned, meaningful salutations and acknowledgment of goodwill, and then we can receive them with full grace.”

3. Avoid talking about money around the dinner table.

“Or religion, or sex.”

4. If you’re lending people money, don’t expect to be paid back.

“The best thing a person who lends money can do [is to think of it] as a gift that they will never get back. Otherwise…the relationship may suffer. It’s really a tough thing in general.”

5. If you need to borrow money, be careful about how (and when) you ask for it.

“If I were asking for money…I wouldn’t do it [close to the holidays] because you want to keep the holidays sacred. Don’t mix your personal stuff with anything family-related.

[And] don’t ask for money in front of people—do it alone with the person. I would tell them what you need, and why you need it. Also, be respectful. Showing respect may be [saying something like], ‘I understand this is difficult, and I want to be respectful of you.’

I would also offer to sign something…so that you both know the terms. Your relative isn’t a bank. They’re not going to be sending you out notices.”

6. If you do borrow money, communicate.

“Silence is a killer.

Silence will [lead to your loved ones] filling in the blanks, and what they’ll fill in the blanks with is that you’re forgetting about them, that you don’t want to pay them back, and that you’re taking advantage of them. Openly communicate what’s going on.”

7. Keep in mind that gifts are symbolic. Give and receive with grace.

“With every gift you receive this holiday season, see it symbolically, as an expression of goodwill, and receive it that way. You’ll see the other person light up [when you receive] their gift.

When you give a gift, give it fully and completely with the same kind of love. That person will also feel joy, even if the sweater doesn’t fit.”

Get more tips for keeping your finances in order by subscribing to Stash’s “Teach Me How to Money” podcast.

The post 7 Tips For Staying Calm About Money During the Holidays appeared first on Stash Learn.

]]>The post 7 Cheap Ways to Bust Holiday Stress appeared first on Stash Learn.

]]>Along with the holiday cheer, there are traffic jams, crowded airports, flight delays, stormy weather, and emotional exhaustion. And let’s not forget the very American tendency of going into debt to afford holiday gifts.

It’s all part of the omnipresent social pressure to act like everything is just perfect.

It’s okay to feel overwhelmed. Let’s look at some affordable ways to de-stress that don’t require a $1,500 investment in a spa vacation.

Take a bath break

Is there a bathtub in your hotel room, parents’ house, or cousins’ apartment? Announce that you’re commandeering it for an hour and wish to be completely undisturbed. Use waterproof earbuds to play relaxing music if the sound of family threatens to overwhelm your chill environment.

Bring a candle. Bring six candles. Bring a cool glass of water. Some folks swear by Epsom salts to relax tired muscles. Get some fresh mint leaves at the grocery store and toss those in the water. If relaxation and easy slumber are more your speed, use lavender essential oil or the leaves of the plant itself.

No need to be near a garden. I once took mint tea bags from the airplane and popped them into my flimsy motel tub. It did the trick.

Use a meditation app

I adore Headspace, the app co-founded by former monk and ex-circus performer Andy Puddicombe. I’ve been using it for nearly two years, and it has introduced me to practices that have truly changed my life for the better.

I still act impulsively at times, but mindfulness meditation has helped me learn the value of inserting a pause between desire and action. The app is currently marked down from $96 to $58 for a year’s subscription.

You can also subscribe at a monthly rate of $12.99, or buy a lifetime subscription at $399. It’s also a good gift idea.

Listen to a history podcast

History podcasts remind us that our drama, whatever it may be, ain’t the end of the world. In fact, whatever we’re going through is likely nothing compared to what some folks have endured.

Try “Stuff You Missed In History Class,” one of my longtime personal favorites. The brilliant Karina Longworth hosts “You Must Remember This,” a fascinating podcast on the secret history of Hollywood. Or take a stroll through “The History of Rome,” an oldie but goodie (in more ways than one.)

Watch something soothingly ridiculous

Laughter can indeed be the best medicine at times. I watch the magnificent Comedy Central series “Broad City” whenever I need to lose myself in great writing, wonderful comedic timing, and insane situations. The fact that the show also has a beautiful, loving heart helps, too. Ilana Glazer and Abbi Jacobson and others help cure what ails me.

What’s your go-to laugh riot? Take a half-hour break. Hide in your car or the basement and watch a show or silly short video on your phone if you need to. Lie and say you’ve got to catch up on “work.” Then laugh your head off.

If anybody walks by, claim this is part of some important new initiative at your job. Refuse to explain further, citing top-secret work “stuff.”

Get the group therapy text going

Set up a group text among trusted pals to whom you can vent frustration over the holidays. Agree in advance that you may text each other during certain hours of the day (or perhaps any time of day or night). And remember to lock your phone from the prying eyes of random relatives.

Keep a diary

Revive the ancient art of handwriting! Call your diary a Secret Book Of Venting All My Feelings, or whatever you like. Keep it hidden and safe and pour out your rage into it whenever you need to. Carry a small notepad in your back pocket or purse. You can always throw it out (NOT in the home in which you’re staying) or tear it up later.

One simple exercise? Write a letter to the person who’s driving you the craziest. Never send it, obviously.

Exercise

I don’t like to exercise for exercise’s sake. I do like to take a walk as an escape from unpleasant people, or simply to clear my head and refresh my spirit. Make a daily walk a practice during the holidays. Pick the warmest time of the day if that suits you. You’ll be glad for the solace.

Don’t forget to breathe

Sounds simple, right? But slowing your breathing is a surefire way to slow your heart rate and relax a little bit. While meditation is a sustained practice of focus, you can use breathwork for just a few seconds at a time in order to calm down.

I like to do this: Inhale for five even counts into my belly. Hold for seven even counts. Exhale for eight even counts. Take a pause and then repeat as necessary. Sometimes even two of these breath cycles can get me back in the correct frame of mind, distracting me from unpleasant or unhelpful thoughts and allowing me to better deal with the situation at hand.

Remember, you don’t need to spend a lot of dough in order to relax. In fact, the answer to feeling more free and clear may, in fact, be free itself!

Be well and take good care, and best wishes for a happy holiday season and beyond!

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]The post 7 Cheap Ways to Bust Holiday Stress appeared first on Stash Learn.

]]>The post 7 Stocking Stuffers for Under $5 appeared first on Stash Learn.

]]>There’s no need to drop a lot of dough on stocking stuffers. Here are some fun ideas from all of us at the Stash team. And all of them $5 and under.

7 Stocking Stuffers for $5 and Under

Slinky

This classic toy is great for sending down the stairs or teaching kids that it doesn’t need a plug or a screen to be fun. This lesson may be short-lived but at least the adults will enjoy it.

Socks, from $5, joyofsocks.com

People knock socks as the ultimate downer holiday gift. But on laundry day, when your giftee is out of socks and realizes that there’s that extra pair from you? Hero.

Huge gummy bear, $3.99, economycandy.com

Anyone can give the gift of candy. But a massive 14 oz gummy bear? That will make you the hit of the holiday party. Caution: Don’t eat it all in one sitting or you may end up feeling like Rudolf the Horribly Nauseated Reindeer.

Star Wars trading cards, $5, economyCandy.com

Before VR and CGI there was the Jedi. Harken back to a time when the Force was portable and you could trade it with your friends.

Science-themed stickers, $3, redbubble.com

They’re not just for kids. A great sticker can liven up a laptop, a notebook, or a skateboard.

Earplugs $4.29, Muji.us

Functional, perfect for plane travel, and ideal for trying to get some sleep in a house full of noisy holiday guests.

Get Stash

Want to give someone you love the gift of a better financial future? Tell them to get Stash. They can start investing in funds and stocks for just $5.

The post 7 Stocking Stuffers for Under $5 appeared first on Stash Learn.

]]>The post Pizzas and Spiders and Paris, Oh My! The Enormous Expenses of “Home Alone” appeared first on Stash Learn.

]]>“Home Alone” is the story of Kevin McCallister (played by Macaulay Culkin), who is accidentally left behind by his family as they embark on an overseas trip during the holidays. After indulging in some alone time, Kevin ultimately has to fend off the Wet Bandits—two burglars played by Joe Pesci and Daniel Stern—who attempt to burglarize the McCallister home and have been breaking into nearby residences.

The movie was a holiday hit, and inspired several sequels. But there are aspects of the film—financial, mostly—that have left many perplexed in the nearly 30 years since it was released.

For example, how did Kevin’s parents, Peter and Kate McCallister (a successful businessman and a fashion designer, according to the movie novelization), afford to take his whole family (around 15 people) on a holiday trip to Paris? And how much would it cost to repair all of the damage done to the McCallister home following Kevin’s booby-trapping?

Well, ya filthy animals, we’re digging up some answers.

All that pizza

Total cost: $230

At the beginning of the movie, the McCallisters order pizza–a lot of pizza—from the fictional Little Nero’s pizzeria. It’s a big family, which calls for a big order. In the movie, the cost for the pizza totals up to $122.50.

Adjusted for inflation, that’s around $230. Talk about extra cheese—that’s a lot of mozzarella.

The trip to Paris

Total cost: ~$40,000

In the movie, the McCallister clan, and some members of the extended family—a total of 15 people (by most counts)—head to Paris for Christmas. Peter and Kate likely earn a decent income, meaning that they could probably afford the trip. But how much would it actually cost?

Roundtrip airline tickets to Paris on American Airlines would cost more than $35,000 for a group that size, according to one analysis.

And that doesn’t take into account hotel rooms, meals, activities, and the foie gras (~$50 per pound) that Uncle Frank likely choked down.

Repairing the house

Total cost: $220,000

By the end of the film, the McCallister residence is a mess. The place is partially flooded, paint cans dangle from the staircase, BB guns and blowtorches lie strewn throughout the house. How much would it cost to repair and restore everything?

The actual Home Alone house, a 4,250 square-foot home in suburban Chicago, is worth nearly $2 million these days, according to estimates. It last sold for almost $1.6 million in 2012.

After all the traps were sprung, and the burglars, the Wet Bandits, were vanquished, how much would the repair bill be for the castle de McCallister?

More than $220,000, according to one calculation. Most of that has to do with repair flood damage to the kitchen and basement.

Note: This is why it’s good to have homeowners insurance.

Replacing Buzz’s tarantula

Total cost: $70

Buzz, the bully son of the McCallister household, had a pet tarantula. Naturally.

But it gets loose and is presumably lost. How much would the little demon-spawn cost to replace?

Tarantulas vary in cost, depending on the breed. But we’ll go with $70, which seems to be a rough estimate.

The post Pizzas and Spiders and Paris, Oh My! The Enormous Expenses of “Home Alone” appeared first on Stash Learn.

]]>The post Secret Santa Do’s and Don’ts: How to Give the Perfect Office Gift appeared first on Stash Learn.

]]>If you’re assigned a colleague that you know and love working with, you’re golden. You know what they’re hobbies and interests are and what would bring a smile to his or her face. But what does Phil in accounting want? Or Jill in accounts payable?

Don’t let it be a source of holiday stress. These guidelines can help you give a nice gift that will go over smoother than eggnog served in an office mug.

Secret Santa Do’s and Don’ts

Do find out more about your Secret Santa giftee. Consider going straight to his or her direct colleagues to get the skinny. Does he love his dog? Is she crazy about golf? Maybe she’s passionate about vegan cooking. A few minutes and a little investigating can steer you in the right direction.

Don’t spend more than the recommended amount. Many office party organizers will set a guideline, usually around $25. Even if you know that Cheryl in payroll loves cashmere sweaters, do not bust out your credit card to buy it for her. It will make everyone else feel like a cheapskate and Cheryl may be uncomfortable with you having spent so much money on her.

Do include a nice card. A few lines will do. Try something that says, “I see you each day and you bring cheer to the office.” Even if it’s not true, you’re just the Secret Santa, not Human Resources.

Don’t give booze. While everyone loves getting into the holiday cheer, not everyone drinks. You may have a Secret Santa who is sober or struggling. Unless you know that they love a good glass of wine or a certain brand of tequila, steer clear.

Do wrap the gift. It’s the least you can do, for goodness sake. If you’re clumsy, get someone to help you. Don’t just hand over the gift in a paper bag that it came in.

Don’t be lazy. Nothing says “I put zero thought into this” than an Amazon gift card purchased 10 minutes before the event at your local drug store.

Do give thoughtful gift cards. While a generic gift card is a thumbs down, a well-thought-out one can be a wonderful gift. If Jane in legal is a knitter, a gift card from a crafting site or store would show her that you care while letting her choose what she wants. If Bob in ad sales loves to go camping, a gift card to an outdoor supply company could work.

Don’t be a creep. Do not give personal items. Do not give things with sexual connotations. If you think you’re crossing a line and the person may not receive it happily, do not do it. The last thing anyone wants is you spending the holiday party explaining yourself to HR.

Do receive your gift gracefully. Sometimes we get a gift where we want to say, “No really, you shouldn’t have.” Inside we may be shaking our heads and wondering when we can donate the gift to the nearest Goodwill (or garbage can) but be kind to the giver, especially if they were excited to give it to you. Good taste is not a job requirement, but kindness is a skill that will take you beyond the holidays and serve you for the rest of your career.

The post Secret Santa Do’s and Don’ts: How to Give the Perfect Office Gift appeared first on Stash Learn.

]]>The post Give Thanks to Yourself By Investing In Your Future appeared first on Stash Learn.

]]>As you tease your weird uncle for hoarding the stuffing, ponder the differences between white and dark meat, and plan the perfect Irish exit out of grandma’s side door after dinner, you can pat yourself on the back for doing something special for yourself.

Let’s take a look back at all the things you might have done in 2018.

You started saving for a rainy day.

You realized that you never want to be caught financially flat-footed. You started saving into your emergency fund. That safety net, containing at least a few months’ worth of expenses, will save you from adding to your credit card debt (or cause you to go without essentials) in case of an emergency medical bill or car trouble.

You started budgeting.

Everyone has been telling you to do it to make a budget. But you didn’t know how. This year, you learned different ways and methods to allocate your funds so that you know where each dollar is headed toward. And you even realized that you can save for the things you want (like a vacation) while you’re saving for the things you need (your retirement). Nice!

Get started: The Easiest Budget You’ll Ever Make

You started thinking about retirement.

You came to the conclusion that there’s a wonderful life to be led after you stop working. You took the plunge and opened an IRA or started taking advantage of your 401K at work. Big ups to you for realizing that while the future may be far away, you can make it golden, girl (or boy). Stacking savings toward your future can be the best investment you can make in yourself. We’re proud of you.

You started putting your money to work.

You learned the difference between saving and investing, an essential lesson that your friends and relatives at your Thanksgiving table may not know. You created a diversified portfolio, chock full of stocks, bonds, and ETFs that reflect your interests but also include different sectors and parts of the world. That’s something to be seriously proud of. You became an investor and that’s a real (turkey) feather in your cap.

You got smarter about your money.

A financial education can last you a lifetime. You learned all about compounding, dividends, and risk. You listened to the podcast and learned about inflation, diversification, and volatility. You also learned the benefits of buying of holding your investments rather than leading with your emotions and selling at the first raindrop in the market. No one can take that away from you, you learned it all on your own.

You stayed the course.

At Stash, we recommend one strategy above all else: Stay the course. That means saving and investing your money for the long-haul, and carefully thinking through your financial decisions.

You learned that investing is a marathon, not a sprint. You kept that in mind when the markets went wild. That’s a lesson that a lot people, even the billionaires on Wall Street, may not know.

Stash gives thanks for you.

Without you, there’s no Stash. We’re so grateful to you for including us on your financial journey. We’ll be here for you through all your milestones and goals, whatever they may be.

So take another helping of cranberry and stuffing Stasher. You deserve it!

Stash Learn Weekly

Enjoy what you’re reading?

[contact-form-7 id="210" title="Subscribe" html_id="default"]The post Give Thanks to Yourself By Investing In Your Future appeared first on Stash Learn.

]]>The post Black Friday Shopping Hacks: Get What You Need, Don’t Lose Your Mind appeared first on Stash Learn.

]]>She’s been scouring leaked Black Friday ads for weeks. She even made a chart to plot the best deals on her shopping list.

Broom, an accounts receivable coordinator who lives outside Baton Rouge, Louisiana, calls herself an obsessive “chart-making queen.”

“I make a goal list of items I’m looking for and sit there searching all the ads to see what is shown,” she says. Then she charts the items along with store locations, start times and pricing.

“That way I could identify and compare what would be the cheapest spot and what time that store opened,” she says.

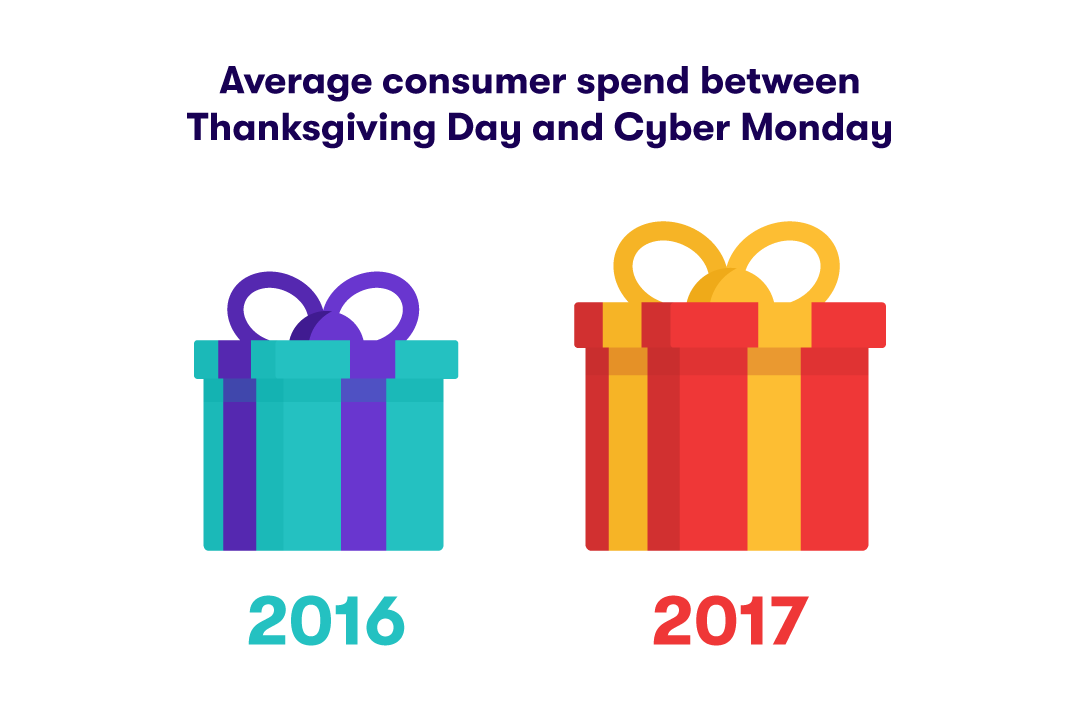

Black Friday means big business. In 2017, 174 million shoppers went Black Friday shopping, spending $7.9 billion, according to industry data. Between Thanksgiving Day and Cyber Monday, consumers spent an average of $335.47, according to the National Retail Federation, up 18 percent compared to 2016. (Shoppers between the ages of 25 and 34 spent the most—an average of $419.52.)

While you can save big time on all your holiday shopping, it’s important to have a game plan that includes making a list, sticking to a budget to ensure you’re not overspending, and strategizing.

Here are some Black Friday pointers from the pros:

Not all Black Friday prices are created equal

Broom ranks her stores by priority. One store may have a better price on a TV, for example, but Broom is willing to pay a slightly higher price at a different retailer if that second store also has good deals on other items on her list, like new pots and pans. She also takes advantage of price matching guarantees in those cases.

She jokes that she learned her Black Friday hacks from her mother, who joins her before dawn to strike on the best deals.

“It’s usually the two of us together to conquer the stores,” she says.

Broom uses BFAds.net to strategize for Black Friday. The advertising aggregator not only publishes all the Black Friday ads—leaked and officia—but also cross-references deals by categories and keeps a running tally of new deals listed.

Be early and be prepared with a list of must-haves

Michelle Gonsalves, a doctor who provides care in a hospital in southern Florida, used to get the jump on Black Friday by using her night shifts at the hospital to her advantage. While on her breaks, she scoured the ads and made a list of exactly what she wanted. Then she hit the stores right after her shift ended to be there when they opened.

“I arrived at the stores awake, freshly informed from reviewing ads an hour before, and ready to go, compared to everyone else who was sleepy and sluggish and had read ads the day before,” Gonsalves says. “Plus, I had extra incentive to finish quickly, as I had to work nights again that night. So I needed to go home and go to bed.”

Gonsalves has since transferred to the day shift, so she skips Black Friday in-store sales and the crush of crowds, which, she admits, means she misses the best deals.

“I do a lot of my shopping online now,” she says. “I probably spend more money.”

Create a list to rein in spending

Our hardcore Black Friday shoppers stick to lists to prevent overspending and unnecessary impulse buys, and try to get the lowest prices possible for each item, even if it means hopping from store to store.

“I love Black Friday shopping,” says Rochester, New York writer Marcia Layton Turner, who reviews deals ahead of time at GottaDeal. “Based on my list and the lowest prices announced, I make a plan for which stores to hit first.”

Like many Black Friday shoppers, Turner uses her downtime on Thanksgiving to begin scoping deals, but she also tries to pre-order her items online at Black Friday prices to save herself time in-store the next day. She also uses Black Friday to take advantage of once-a-year sales for items that are otherwise rarely discounted, such as Apple products.

Rebates, gift cards, and returns

“If I can buy it online, I check first for discount codes and to see if Ebates will give me a rebate. I stack coupons whenever possible,” Turner says. “Sometimes I’ll buy things and hold onto them and if the price drops after Black Friday, I’ll return them for the lower-priced item.”

Returning an item and then buying it again after a price drop is a move many retailers will honor, and it ensures you get the lowest price even after Black Friday is over. Some retailers might also refund you the difference in prices. Make sure you keep your tags and receipts.

Turner doesn’t just look for deals on gifts. She also shops for her business, especially technology items. And this year she’s looking to get a great deal on a flat-screen TV for her living room.

Another of Turner’s hacks? Stock up on gift cards with built in rebates and discounts that she can use too.

“Our local grocery store gives you $20 back on a $50 gift card,” she says. “So I’m trying to stock up on those, both to give as gifts and for buying gifts.”

Here are a few additional bonus tips from the pros, to help you stick to your budget and get the most out of Black Friday:

- Make sure to check refund and return policies before you buy. Nothing is more of a bummer than realizing you can’t get a refund for an item you no longer want. Avoid buyer’s remorse and overspending heartburn by making sure those amazing deals don’t come with restrictive return policies.

- Use credit cards wisely. If you think you’re in danger of overspending, use cash. But if you have a rewards credit card that you can pay off as soon as the bill hits, put that Black Friday shopping spree to work for you through cash back or travel points.

- Remember that bigger isn’t always better. It’s easy to get caught up in the shopping craze, but what matters most is not what you buy, but the thought you put into it. A thoughtful $20 gift along with a handwritten note can often mean more to the recipient than the latest must-have gadget for hundreds of dollars.

Invest in yourself, the best gift of all

A brighter financial future looks good on you! You can start a retirement account or start investing to help you reach your goals on Stash.

You can start with just $5.

The post Black Friday Shopping Hacks: Get What You Need, Don’t Lose Your Mind appeared first on Stash Learn.

]]>