Mar 15, 2022

What Is Stockholders’ Equity? Everything You Need to Know

How can you tell if the companies you’ve invested in are faring well? One indicator can be stockholders’ equity. Read on to learn what it is, how it works, and how to determine a particular company’s stockholders’ equity.

In this article, we’ll cover:

- What is stockholders’ equity?

- How does stockholders’ equity work?

- Components of stockholders’ equity

- How to calculate stockholders’ equity

What is stockholders’ equity?

Stockholders’ equity is the value of a firm’s assets after all liabilities are subtracted. It’s also known as owners’ equity, shareholders’ equity, or a company’s book value. Stockholders’ equity is not the same as cash on hand. You might think of it as how much a company would have left over in assets if business ceased immediately. Any stockholder claim to assets, though, comes after all liabilities and debts have been paid.

How does stockholders’ equity work?

When a company first goes public, it raises money by offering stock. Over time, the company’s shares will change in value; the company may also issue more shares or buy some back from investors. All these things affect stockholders’ equity, as do the assets and liabilities a company accrues over time.

Investors and financial analysts use shareholders’ equity as one way to assess a company’s financial situation. Usually, if the number is positive, the company can afford to pay off its liabilities, while a negative number could indicate financial trouble. Keep in mind that book value alone is not a definitive indicator of fiscal health, and it should be considered along with the company’s overall balance sheet, cash flow statement, and income statement.

Where is stockholders’ equity reported?

Stockholders’ equity is listed on a company’s balance sheet, which is a snapshot of a company’s financial position at any given time. The balance sheet lists total assets and total liabilities, then provides details of stockholders’ equity in a separate section.

Here’s an overview of what you may find in the assets and liability sections of the balance sheet.

Assets

- Short-term assets: Also called current assets, items that are either cash, a cash equivalent, or can be converted to cash within one year. Though current assets vary from industry to industry, they often include things like cash/foreign currency, prepaid expenses, inventory, accounts receivable, and investments.

- Long-term assets: Items that have a useful life of more than one year and can’t be converted into cash quickly. These assets may include property, plant, and equipment (PP&E), meaning land, buildings, machinery, and vehicles. Long-term assets could also include patents, trademarks, client lists, investments made in other companies, stocks, bonds, and real estate.

Liabilities

- Short-term liabilities: Also referred to as current liabilities, financial obligations that are due and payable within one year, usually covered by current assets. Examples include accounts payable, dividends, short-term debt, and taxes owed.

- Long-term liabilities: Financial obligations that are not due and payable within the next 12 months. These might include debentures and deferred tax liabilities. Things like mortgages, loans for equipment purchases, and land, are part of long-term liabilities, except for the portions that will be paid off within the next year.

Components of stockholders’ equity

Stockholders’ equity is generally determined by four key components:

- Paid-in capital: Also known as contributed capital or share capital, this section of stockholders’ equity reports how much the company has received by issuing stock.

- Retained earnings: The cumulative amount of earnings recorded between a company’s formation and the most current balance sheet, minus the cumulative amount of dividends. These past earnings have not been distributed as stockholder dividends.

- Accumulated or other comprehensive income: Items that are not included in retained earnings and the company’s net income. These may include pension benefits, unrealized gains/losses, and foreign currency translation adjustments.

- Treasury stock: Shares of a company’s own stock it has repurchased from investors. Treasury stock is subtracted from stockholders’ equity.

How to calculate stockholders’ equity

To calculate the total stockholders’ equity, you need to follow a simple process. First, add together the money invested by shareholders (paid-in capital), the profits kept in the company (retained earnings), and any other comprehensive income. Then, subtract any shares of stock that the company has repurchased (treasury stock) as it is considered a liability. To find the stockholders’ equity, use this formula: Total Assets minus Total Liabilities equals Stockholders’ Equity.

Stockholders’ equity formula

With the relevant data in hand, the formula for calculating stockholders’ equity is simple:

Total Assets – Total Liabilities = Stockholders’ Equity

Stockholders’ equity example

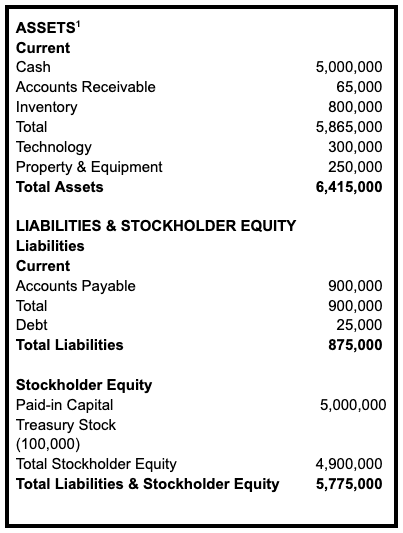

To see how this is calculated in practice, here’s an example of what a hypothetical company’s balance sheet might look like, including assets, liabilities, and stockholders’ equity.

Stockholders’ equity: key takeaways

The formula for calculating stockholders’ equity is deceptively simple, as it encompasses a lot of small details about assets and liabilities. But once you get a feel for the ins and outs of the corporate balance sheet, it becomes easier to quickly assess stockholders’ equity. You can look to this important piece of information for a snapshot of your current investment’s overall health or in vetting a future investment.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month