May 15, 2018

No Retirement Savings? You’re Not Alone. Here’s How You Can Fix It.

Most people expect to work into their retirement years

We get it—saving for retirement seems like it’s a long way off. And you’re probably tempted to put it off for a few more years, while you get other pieces of your financial life together.

A word of advice: Start saving for retirement now!

There’s a retirement savings crisis in the U.S., and the sooner you start putting money away, the better.

About half of the consumers think it’s likely that Social Security won’t be there for them when they need it

The depth of the crisis is demonstrated by a new study from Northwestern Mutual*, a part of the bank’s most recent Planning & Progress survey. Northwestern is based in Milwaukee, Wisconsin.

Here’s what Northwestern found:

- One in five people in the U.S. have no retirement savings at all.

- Baby Boomers, the generation now closest to retirement, have between $0 and $25,000 saved on average.

- A quarter of survey respondents reported they had $200,000 or more saved, and 16% have between $75,000 and $199,999, according to CNBC, which took a deeper dive into the survey numbers.

- On average, U.S. consumers have about $85,000 in retirement savings.

Social Security might not be there

Here are some other things to keep in mind: about half of the consumers think it’s likely that Social Security won’t be there for them when they need it. A further 66% say it’s likely they will outlive their retirement savings, while 55% say they will have to work past 65, primarily because they won’t have enough money saved to live comfortably.

Of course, how much you need to retire depends on a variety of factors, including where you retire and what your expected spending will be like when you no longer work.

A general rule of thumb is that you’ll need to replace between 70% and 80% of your pre-retirement income. For someone making $40,000 a year, that comes out to $1.8 million for a 30-year retirement, according to American Association of Retired Persons (AARP).

The Northwestern Mutual survey was based on a Harris poll of 2003 adults, 18 years old and over, conducted in March 2018.

Retirement accounts can help you save

So if you haven’t started saving for retirement, or you’re nearing retirement and realize how far behind you are, don’t despair. Now is the time to start.

Two retirement accounts most anyone can open to start saving for retirement are traditional individual retirement accounts, or IRAs, and Roth IRAs. Both can have various tax advantages.

*The Northwestern Mutual survey was based on a Harris poll of 2003 adults, 18 years old and over, conducted in March 2018.

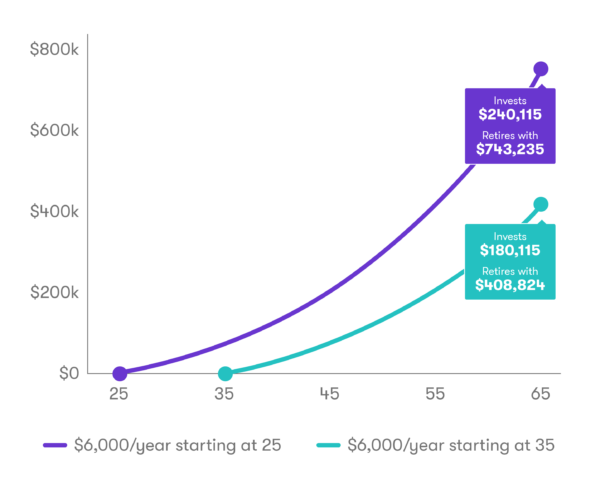

Disclaimer1: Expected returns or probability projections are hypothetical in nature and may not reflect actual future results. This is a hypothetical illustration of mathematical principles, is not a prediction or projection of performance of an investment or investment strategy, and assumes weekly contributions at a 5% annual rate of return (compounded annually) and does not account for fees or taxes. It is for illustrative purposes only and is not indicative of any actual investment. Actual return and principal value may be more or less than the original investment.

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Budgeting for Young Adults: 19 Money Saving Tips for 2024

Roth vs. Traditional IRA: Which Is Best for You in 2024?

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024