Nov 28, 2018

Retirement in America: The Stash 2018 Survey

When it comes to saving for the future, Stash revealed that 40% haven’t saved a dime.

Americans could be doing a lot better job saving for retirement than they are.

In fact, about 40% haven’t saved a dime for the years when they’ll no longer be working. What’s worse, about 10% say they’ll never have enough money to retire.

That’s according to a new survey by Stash, which reveals that U.S. consumers are having a hard time when it comes to building their nest eggs.

The survey of 2,167 adult consumers, was conducted online by SurveyMonkey in November 2018. Of those surveyed, 47% (1022) identified themselves as male, 53% (1145) identified themselves as female.

Seventy percent reported earning less than $75,000 annually.

Snapshot of retirement savings

For those who are not saving for retirement, the biggest reason cited is not having additional income to put toward retirement savings. Nearly 40% said debt from student loans and credit cards consumed all their extra cash each month, and about half said that pressing monthly expenses always ate up their cash.

Additionally, nearly half said retirement “felt too far away” to really worry about.

On the plus side: about 10% who aren’t saving for retirement said their extra monthly money goes to an emergency fund. And, surprisingly, 16% said they didn’t need to save for retirement because someone else had already put aside money for them.

For those who are saving, 20% said an increase in income enabled them to start putting money away; more than a third said it was because either an employer allowed them to set up a 401(k), or a trusted person in their lives urged them to start saving for retirement.

Later retirement, or no retirement at all

The survey also found that consumers may plan to retire later than previous generations. About half of all respondents said they will retire between the ages of 60 and 70. (In the 1990s, average retirement age was around 57, according to some surveys.)

And about 10% of respondents said they will never be able to retire.

When asked what the biggest barrier is to retiring at 65—the age at which Medicare and full Social Security benefits begin for many—about one quarter said it’s because wages are too low.

Nearly a third said programs like Social Security either wouldn’t exist or wouldn’t be sufficient to support retirement. Three-quarters of respondents said the average American won’t be able to retire at age 65.

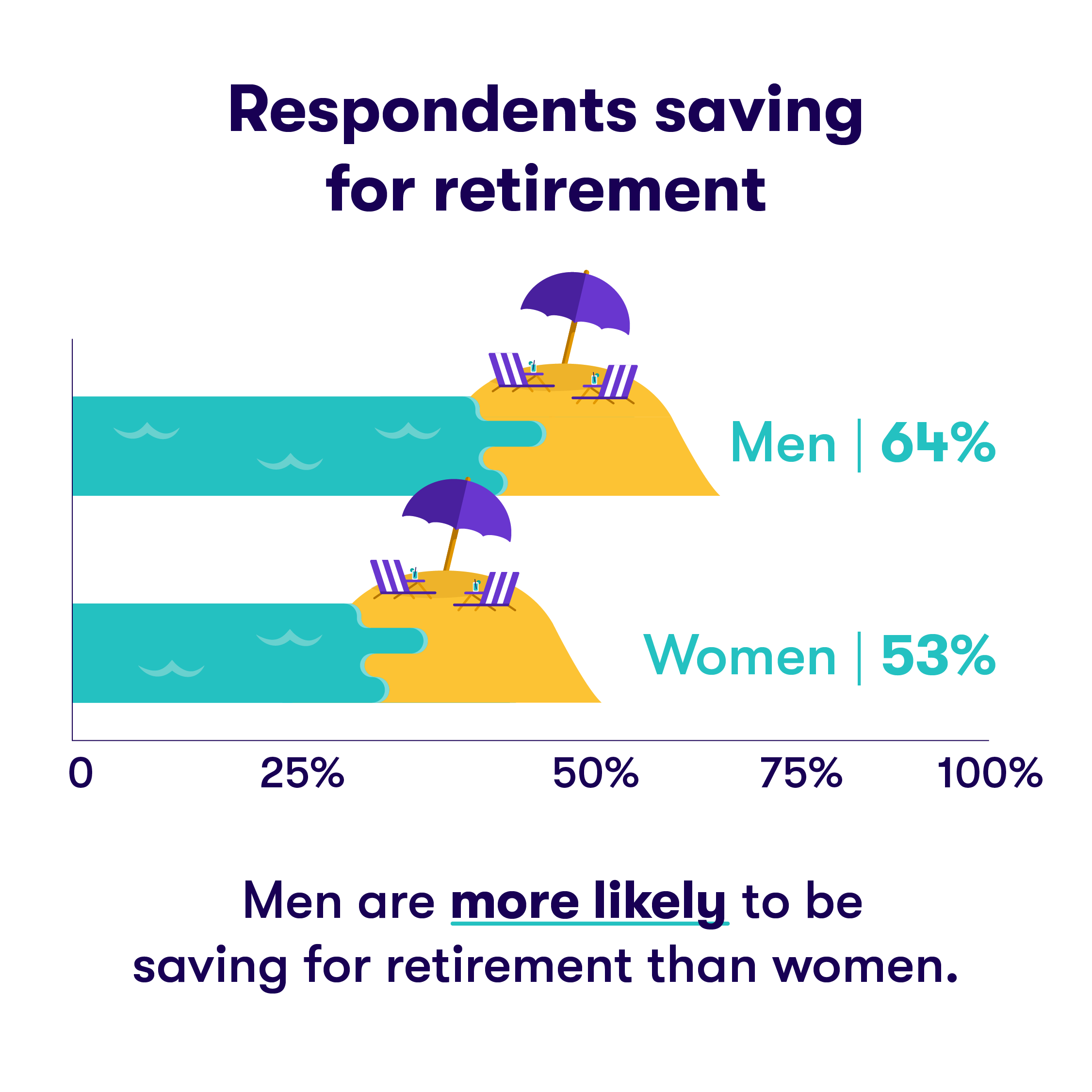

Women have a harder time saving for retirement than men

Whether it’s because they are saddled more with family expenses, because they may earn less than their male counterparts, or some other reason, women report saving less money for retirement than men.

- In general, men were 11 percentage points more likely to report saving for retirement than women.

- A higher percentage of men said they saved between 7% and 15% of their income in a retirement account. A higher percentage of women said they saved between 3% and 6% of their income.

- For those not saving for retirement, 26% of women said it was because they didn’t think they’d ever save enough to retire; 8% of men said they would not retire because of lack of savings.

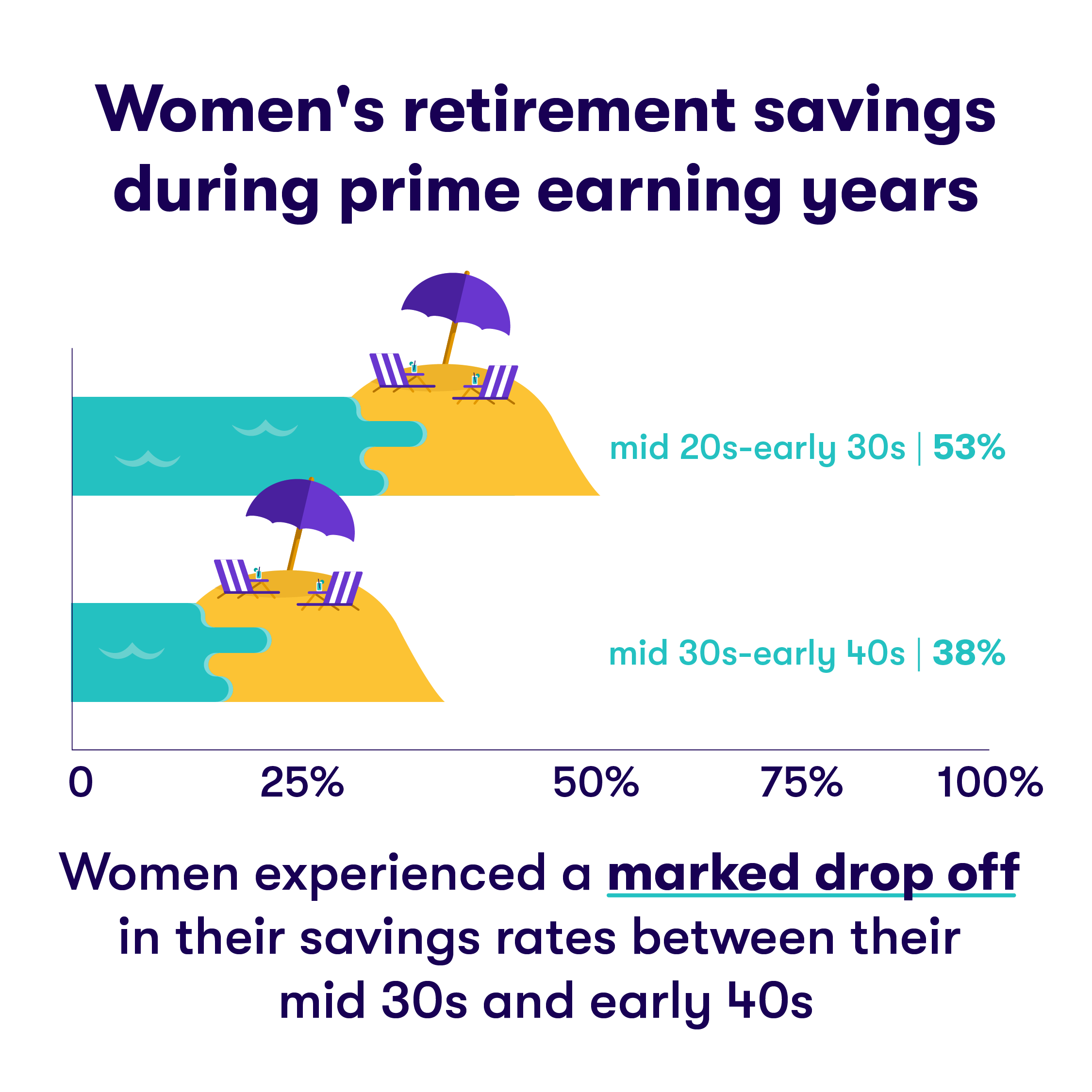

- Women experienced a marked drop off in their savings rates during prime earning years between their mid-thirties and mid-forties, with 38% saying they were saving, compared to 53% between the ages of 25 and 34. In contrast, 79% of men between 35 and 44 years of age said they contributed to retirement savings, compared to 70% of men between the ages of 25 to 34.

- Women ramped up saving again between the ages of 45 and 54, with 59% reporting retirement savings.

When it comes to retirement, age matters

By the time people hit their mid-thirties, retirement doesn’t seem so far-fetched.

About 55% of people between the ages of 18 and 34 report that they aren’t saving for retirement. But nearly 70% of those between the ages of 35 and 64 say they are saving for the years when they stop working.

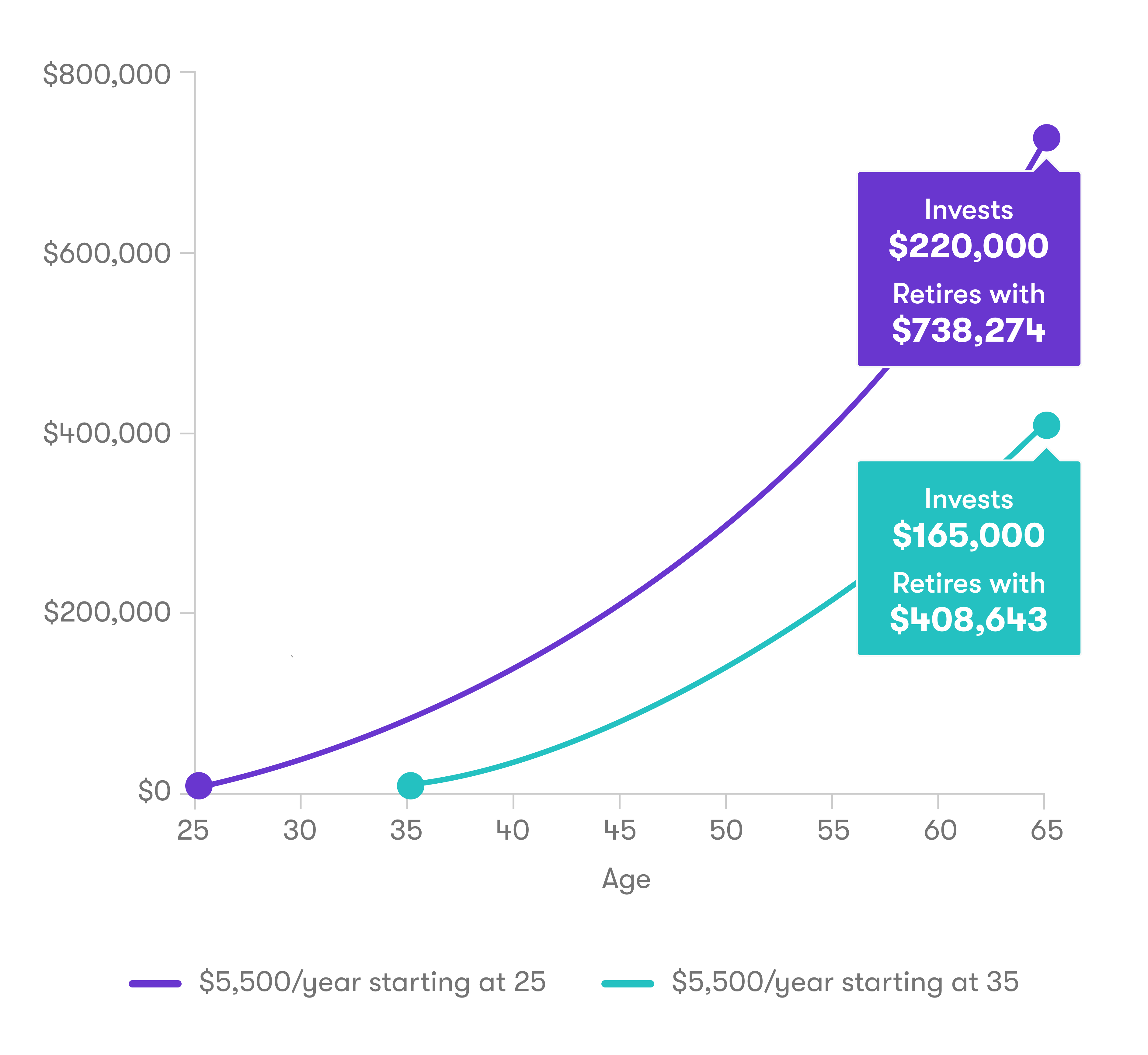

The age when you start saving and investing matters. Someone who begins putting money away regularly at age 25 could have nearly twice as much money as the person who starts at age 35.

Get inspired to Stash Retire

Opening a retirement account has never been easier. With Stash, you can start with just $5.

Related Articles

How Much Do I Need to Retire: A Guide for Retirement Saving [2024]

Roth vs. Traditional IRA: Which Is Best for You in 2024?

How To Plan for Retirement

Why It Can Pay to File Your Taxes Early

Stash’s Tax Checklist: Things You Need to Know Before You File

Your Stash and Taxes: The (Super) Basics