May 1, 2020

How Time Can Help You When it Comes to Saving and Investing

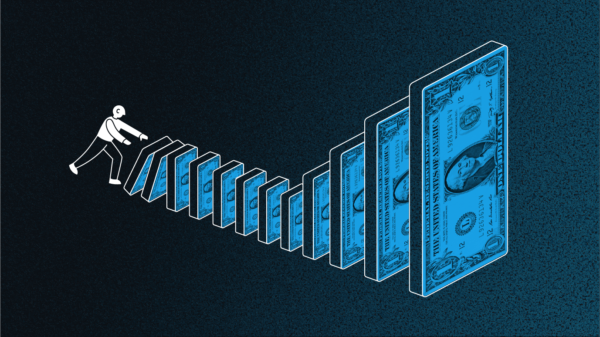

The sooner you start investing, the more compounding can work for you.

Part of your budget should always include saving. Maybe you can’t manage putting away 20% of your income, as some experts recommend. That’s okay. Putting away even a few dollars a week can really add up over time.

Strategies:

- Examine your variable expenses

each month. Do you really need a take-out coffee or sandwich every day? Over the course of a year, you can potentially save hundreds, or even thousands of dollars by packing your lunch or bringing coffee in a thermos.

- Start by building an emergency fund. The general rule is to have at least three to six months of expenses. But setting aside even a few hundred dollars for unexpected costs is great. Consider putting this money in an account that’s considered safe, such as an FDIC-protected bank account.

- Then think about investing money beyond your emergency fund, in an investing account. The average return for U.S. large cap investments for 2019 is estimated to be about 5.25%, according to some experts. And your money is likely to compound over time.

Compounding is any return earned on your principal, plus your past returns.Jargon Hack.

What is compounding?

Compounding

Find out

Example:

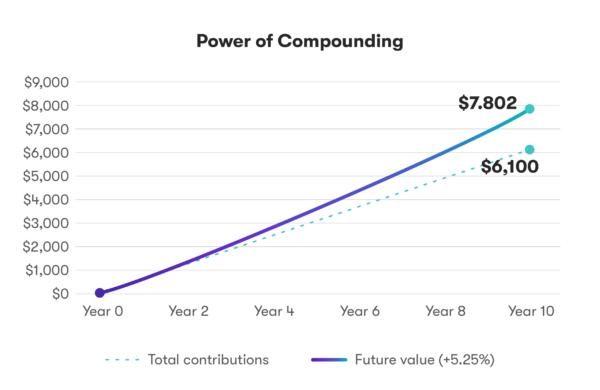

First, let’s explain compounding. Compounding is essentially a snowball effect involving the interest or earnings your money can make as it continues to earn more interest or some other return over time. For example, if you start with $100 and put $50 a month away for ten years, with an annual return of 5.25%. You’ll have slightly more than $7,800, but you’ll only have put away $6,100. Compounding could add about $1,700 to what you save.

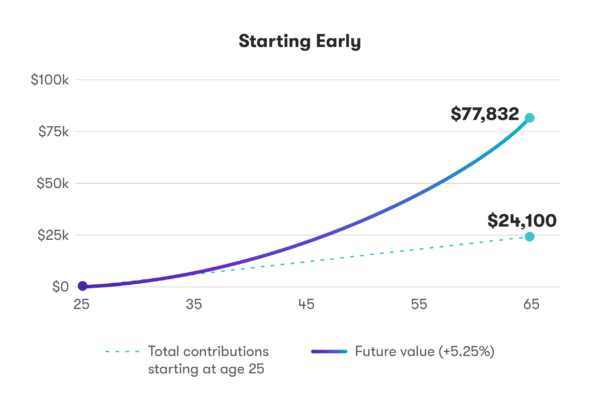

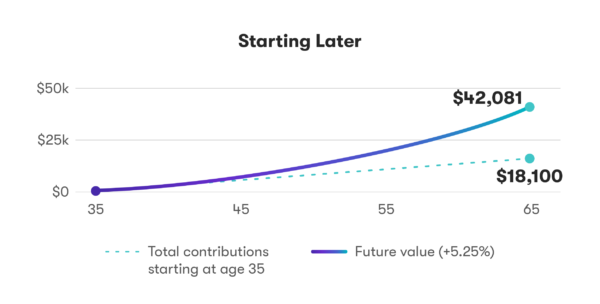

Now let’s show you how time can work on your side. The sooner you start investing, the more money can work for you through the power of compounding. Notice the difference between how much someone can save by the time they’re 65 if they start at 25, versus starting at 35.

For both charts, we assume you start with $100 and put $50 away each month, with an annual return of 5.25%. The person who starts at 25 will save a total of $24,100 over the next 40 years, compared to the person who starts at 35, who will save $18,100.

But the person who starts at 25 will end up with nearly twice as much money, just for starting ten years earlier.

By starting early, the person who starts at 25 will save $24,100 by the time they’re 65. Compounding will add an additional $53,732, for a total of $77,832.

By starting later, the person who starts investing at 35 will save $18,100 by the time they’re 65. Compounding will add $23,981.88 for a total of $42,081.88

As you can see, the person who starts ten years earlier winds up with nearly twice as much money, even though they only save $6,000 more dollars. The extra money that the person who invests for longer could wind up with is all thanks to the power of time and compounding.

What are you waiting for?

The sooner you get started saving and investing your money, the better. On Stash, you can start investing with any dollar amount.

With Auto-Invest, you can contribute to your investments on a regular schedule that works for you. By automating your investment strategy, you can maximize the power of compounding without having to remind yourself to invest regularly.

Find out more

What Is Compounding? An Explanation of Compound Interest

Compounding is one of the most important lessons for beginning investors to understand. This story will explain how your money can make money as it accumulates earnings and interest over time.

Read our learning guide on retirement savings, which will explain why it’s important to start saving as much as you can from an early age. We’ll also tell you about the different retirement accounts you can set up, and how a Roth IRA is different from a traditional IRA.

How to Set Up an Emergency Fund

Before you start investing, it’s best to have some savings set aside for those times in your life when unexpected expenses arise. We’ll explain what an emergency fund is, and how you set one up.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How to Save Money: 45 Best Ways to Grow Your Savings