Apr 18, 2022

Find Out About Portfolio Diversification Analysis!

If you have an investment account, Stash’s diversification tool will make recommendations to help you stay on track.

When you start investing, one of the things you’ll hear about frequently is how critical diversification is to building your portfolio.

Your portfolio is the sum of all your stocks, bonds, ETFs, and cash.

And diversification means not putting all of your eggs in one basket. The lesson is pretty simple: If all your eggs are in one basket and you happen to drop it, all the eggs will break. The same goes for investing. If you concentrate too much of your holdings in one stock, one fund, or even one sector of the economy, it can increase your risk substantially.

That’s why Stash is excited to tell you about our new tool, called portfolio diversification analysis. It’s designed to help you create a portfolio to meet your financial needs and goals.

What is your portfolio diversification analysis?

Portfolio diversification analysis is available to any Stash customer with an invest account, and it can help you take small steps to craft a more diversified portfolio.

Here’s how it works: We take three pieces of information to analyze your portfolio and calculate a diversification score These are: your risk profile, the appropriate asset allocation given your risk level, and your current portfolio.

Let’s break it down.

Your risk profile determines your appetite for risk and your ability to take on risk given your time horizon, financial circumstances, and investment goals. The risk profile dictates your target asset allocation. If you are more conservative, you’ll have more bonds in your portfolio. If you have an aggressive risk profile, you’ll have more stocks. Someone with a moderate risk profile will have a mix of both bonds and stocks.

By examining your risk profile and your appropriate mix of stocks and bonds, we then compare the target asset allocation to your current portfolio to see how much it differs. The score not only takes into account your target asset allocation compared to your current portfolio, it also takes into account your underlying investments. Having exchange traded funds (ETFs) in your portfolio, for example, increases your diversification score. ETFs are baskets of stocks or bonds, and can often hold hundreds of investments therefore naturally improving diversification.

What Does the Diversification Analysis Mean?

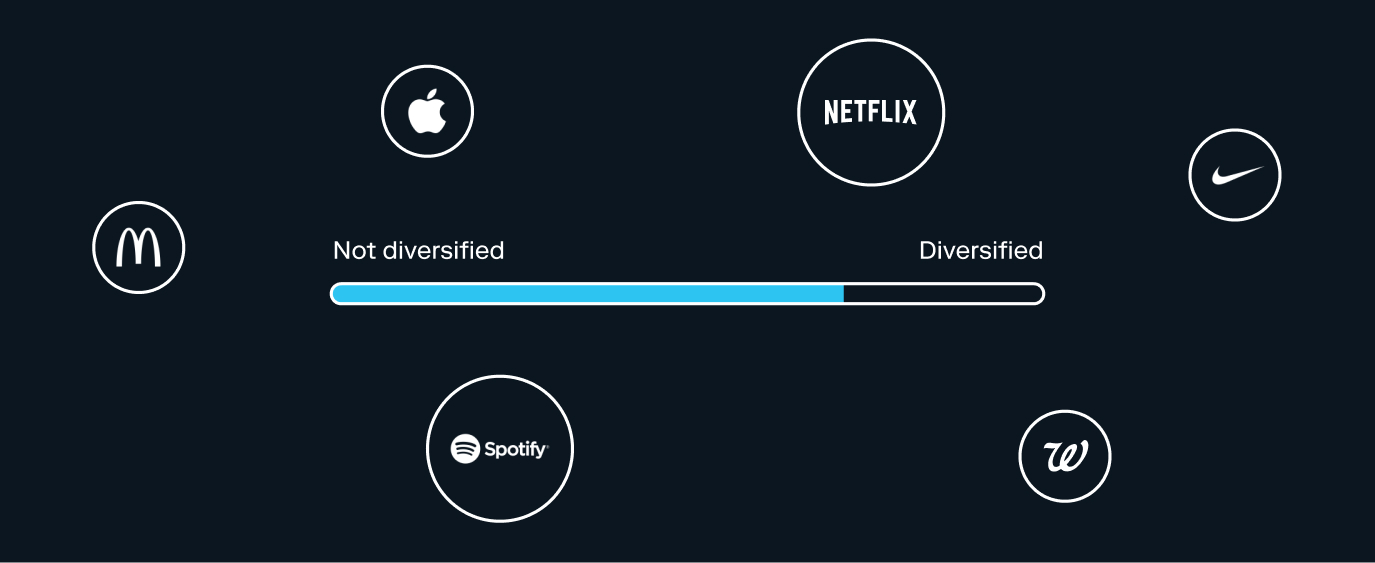

Think of your diversification analysis as an investing report card for your portfolio. It will show you a bar that ranges from “Not diversified” to “Diversified.” This score is dynamic, and it reveals your portfolio at the current time. If your score appears as “Not diversified,” don’t be discouraged, you can take steps to improve it. We are here to guide you, and we’ll show you how!

Understanding your score

First, click into “View analysis breakdown.” The tool will list the four different investment categories that we think you should be invested in, plus the target percentage of assets for each, based on your risk tolerance.

These four categories are U.S. companies, foreign companies, up and coming (emerging) markets, and bonds. The categories will remain the same for everyone, but the allocation will change based on your risk profile.

The screen will then highlight which categories need attention. Categories in green show areas where you’re on track, but red is where we think your portfolio needs attention in order to achieve diversification. You can improve your score by buying some of the ETFs recommended by the Stash investment team.

What Do I Buy? How Do I Improve?

If you click on “Get recommendations,” the tool will lead you to the investment categories that need improvement, and the corresponding suggested ETFs that can help you diversify.

For example: If you score only 2 points out of the recommended 5 points in Up & Coming Markets (emerging markets), one of the suggestions you’ll receive is to purchase an emerging markets ETF, such as Colossal China. These incremental ETF purchases will help move the needle to further diversify your score.

In investment categories where you receive a good score, it means you are diversified, and you will not receive a recommendation to improve. For example, if the U.S. Companies category shows a score of 57 points when the suggested allocation is 57 target points, “Get recommendations” will not show you additional ETFs to purchase. However, if your allocation is less than the recommended percentage, we’ll show you U.S. ETFs such as Match the Market to purchase.

Let Stash be your financial home

Stash is always looking for ways to help you improve your financial life, and to help you make better decisions around saving and investing money. Remember, changes do not happen overnight. Take small steps to build a diversified portfolio in order to help reduce risk, and use the portfolio diversification score to help you improve.

If you are on track, congratulations but don’t stop there! Auto-Stash can help you make regular contributions to your portfolio, so you can grow your investments over time through the power of compounding.

Check out portfolio diversification analysis in app or on the web now!

Get the AppDisclosure: Stash through the “Diversification Analysis” feature does not rebalance portfolios or otherwise manage the Personal Portfolio Account for Clients on a discretionary basis. Each Client is solely responsible for implementing any such advice. This investment recommendation relies entirely on the responses you’ve provided regarding your risk tolerance. Stash does not verify the completeness or accuracy of such information. Investing involves risk, including possible loss of principal. No asset allocation is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful. Diversification and asset allocation may not protect against market risk or loss of principal. This information should not be relied upon as research. Carefully consider any ETF’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the ETF’s prospectus which may be obtained by visiting the ETF’s prospectus pages. Carefully review and consider the information available on the Stash App about each investment recommendation, in any applicable ETF prospectus, and in any applicable public company filing or report before making any investment decision. These investment recommendations are constructed to provide clients with explicit guidance on how to allocate to a globally diversified set of investments for the purposes of long-term investing. Clients make contributions to their Personal Portfolio account and are responsible for directing purchases and sales of specific investments. For clarity, while Stash provides investment recommendations to Clients, Stash does not have authority to execute its investment recommendations on behalf of any Client without such Client’s consent and approval of each specific transaction through the Personal Portfolio Invest account.

The Diversification Analysis is based on a Client’s portfolio composition compared to a suggested allocation. The Diversification Analysis calculates the Client’s overall portfolio diversification and is used to reduce risk by encouraging the Client to diversify further. The calculation is performed by assessing the Client’s portfolio holdings and grading each asset held by its underlying exposures. The asset is graded by qualities such as asset type, regional exposure, and percentage allocation within the portfolio. For each risk profile available on Stash, a desired portfolio allocation is created by the Stash Investment Committee. The desired allocation is used to compare to the Client’s portfolio in efforts to provide advice on how to improve diversification.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month