Apr 13, 2020

How Investing Through Volatile Markets Can Increase Your Portfolio

Using Auto-Stash can help you set and forget your investments.

Let’s say you could travel back in time to the start of the Great Recession in 2008 and bring Recurring Transactions with you.

Sure, time travel isn’t possible, but take a look at what would happen anyway. In fact, if you had used Recurring Transactions’ Auto-Invest feature to invest $10 every week from 2008 through every market up and down since then, your investments could have been worth $13,284.

That’s why, looking forward through times of market volatility, it’s important to consider continuing to invest small amounts regularly.

Recurring Transactions is a set of financial management tools from Stash, including Round-Ups and Set Schedule, that you can use to save and invest money automatically, on your timeline. With Auto-Invest, you can save a specific amount of money into your Stash investing accounts on a schedule that works for you. Auto-Invest can help you make investing a part of your financial routine. While Recurring Transactions was created more than a decade after the 2008 financial crisis, we can potentially use it to provide insights into the future.

If you could turn back time

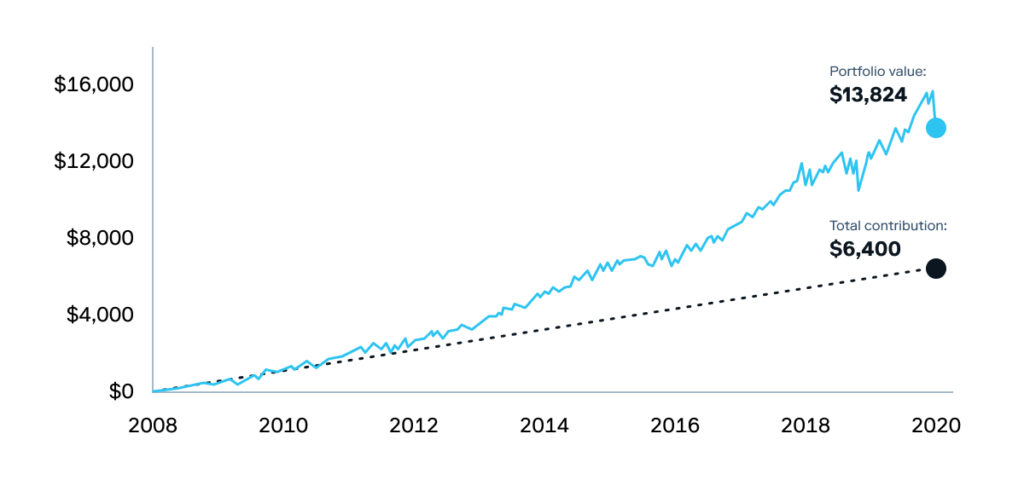

Here’s what your investing account might have looked like if you could have used Set Schedule from 2008 until March 2020:

Disclosure: Past Performance does not guarantee future results. The rate of return on investments can vary widely over time, especially for long term investments including the potential loss of principal. For example, the S&P 500® for the 10 years ending 1/1/2014, had an annual compounded rate of return of 8.06%, including reinvestment of dividends (source: www.standardandpoors.com). Since 1970, the highest 12-month return was 61% (June 1982 through June 1983). The lowest 12-month return was -43% (March 2008 to March 2009).The S&P 500® is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market. Calculations do not reflect the deduction of advisory fees and does not take taxes or withdrawals into consideration. The hypothetical assumes individual was invested in the S&P 500 index (assuming a 100.68% cumulative growth rate for this time period) from the time period of 11/30/2007 – 3/6/2020 with a $10.00 weekly investment contribution. This example assumes No other account account deposits, investments, fees, or dividend reinvestment. Through the power of compounded growth, assuming a cumulative growth rate of 100.68% the hypothetical value would be $13,824 on a $6,400 total contribution for the time period. Data source: FactSet.

If you had invested $10 per week in a diversified portfolio, using Set Schedule from 2008 to now, you could have more than doubled your investment of $6,400 dollars. Through all the market dips, including the most recent one that started in February, 2020 related to the Covid-19 pandemic, you could have almost $14,000 in your portfolio.

Back to the future

What you can learn from this model is that you shouldn’t be scared of market uncertainty. If you’re able to continue contributing a small amount of money on a regular basis to your investing accounts, you should do so.

The idea behind Set Schedule is something called dollar-cost averaging (DCA). DCA means investing over a specified period of time, for example months or even years, using a fixed amount of money. DCA allows you to buy shares of stocks or ETFs at different prices over the course of that time period. Sometimes you’ll buy less at a higher price, and sometimes you’ll buy more at a lower price, depending on the market.The price at which you buy those shares should average out over time. Compounding can also help amplify your investments over time.

No one can predict whether markets will go up or down. And dollar-cost averaging can be an important way to defend your money against market changes. By using Set Schedule, you can invest regularly and automatically in your diversified portfolio, without any extra effort. And by setting your investing schedule to automatic, you’ll remove emotions from the equation which might otherwise tempt you to time the market. That means you’ll be less likely to buy when stock prices are high, and sell when stock prices are low.

Investing with the Stash Way

Investing regularly is part of the Stash Way, our investing philosophy. The Stash Way includes regularly investing small amounts of money for the long term, in a diversified portfolio of stocks, bonds, and ETFs.

You can start investing on Stash with any dollar amount.