Oct 9, 2022

Shorting a Stock: An Overview + Risks To Know

| Short Selling Definition: Short selling involves buying a security whose price you believe is going to fall and selling it on the open market, with the intention to buy it back later at a lower price. While long-term investors profit from stocks that rise in value, short sellers aim to profit on stocks that decline in value. |

Short selling is a high-risk way to profit from falling stock prices. Also known as “selling short” or “shorting a stock,” it’s essentially placing a bet that a stock price is going to decline.

And, yes, it can be a way to make money if you’re certain a stock price is going to dip. But compared to long-term investing, this kind of speculative trading makes it much harder to achieve consistent, dependable returns. Above all, there’s far more risk involved.

Here’s what to know about shorting a stock.

How does shorting a stock work?

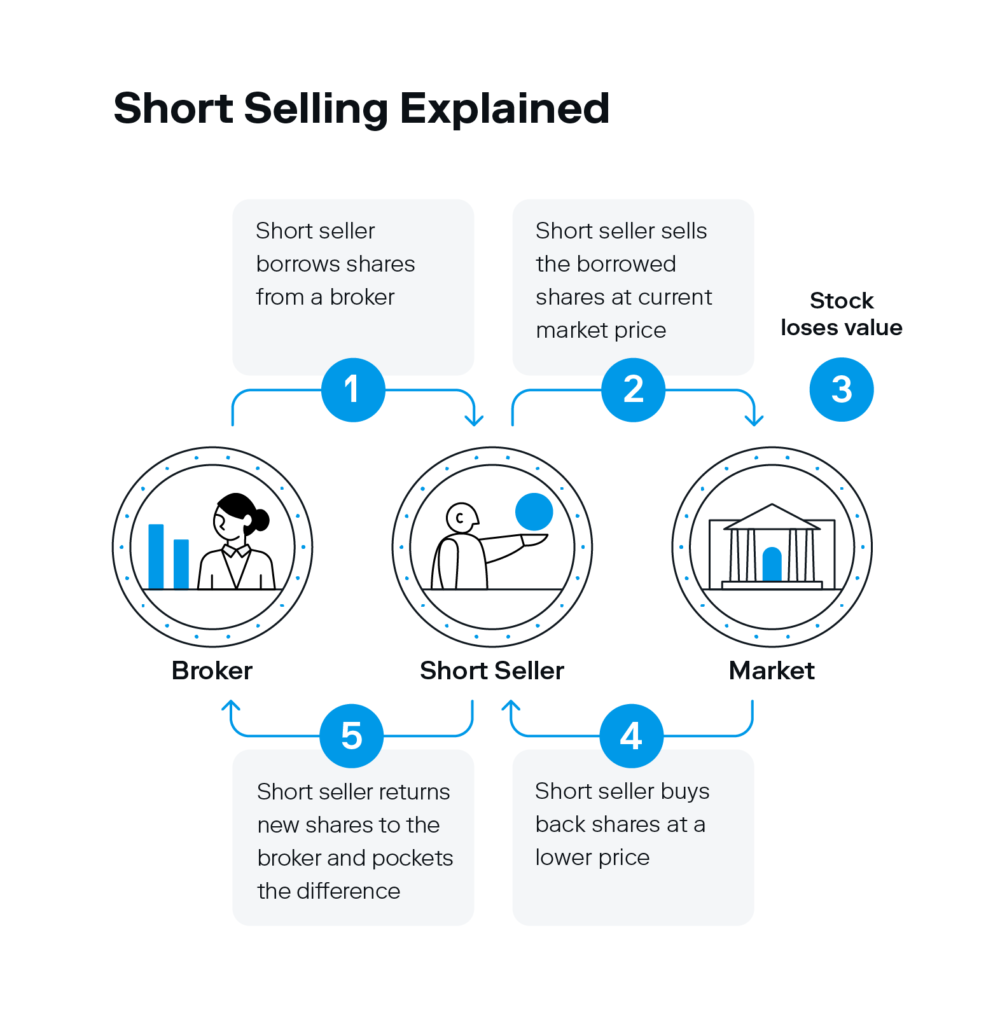

Short selling stocks occurs when a trader borrows shares of a stock from a broker (who sells them on the market on the trader’s behalf) in anticipation that the price will go down. If it does, the trader buys back the shares at the lower price, returns them to the broker, and pockets the difference as profit.

To understand short selling, it helps to first understand the two broad ways investors can profit from stocks: taking a long position or a short position.

- Long position (buy low, sell high): A long position means an investor has bought and owns shares of stock. Their goal is to buy shares at a low price, then hopefully sell them later at a higher price after the stock increases in value.

- Short position (sell high, buy it back low): A short position means an investor borrowed stocks from a broker and doesn’t actually own them yet. Their goal is to sell their borrowed shares on the stock market for a higher price in the hopes that the stock price will fall. If it does, they buy the shares back at a lower price before returning them to the broker and netting the difference as profit.

So, an investor in a short position who borrowed 20 shares is said to be short 20 shares. They owe those 20 shares to whomever they borrowed them from—typically from a broker or brokerage—and must fulfill the loan contract by purchasing the shares in the market.

Now that we understand short vs. long positions, here’s an example of how short sellers make money:

John Doe thinks Amazon stock will soon go down in price. To profit from that prediction, he decides to short Amazon. He goes to his broker to borrow 10 shares of Amazon, which are currently selling for $100 a share, then immediately sells all 10 on the stock market for $1,000 (10 x $100 = $1,000). John’s prediction comes true, and the share price drops to $50 a share—so he uses the $1,000 to buy back 10 shares for only $50 each and returns the original shares to the broker, resulting in a profit of $500.

While the process sounds simple enough, the risks of short selling are incredibly high. That’s because you can only profit from shorting a stock if the stock price decreases—and if the price goes up, so do your losses. Since there’s no limit to how high the stock price can rise, there’s also no limit to how much you can lose. The maximum profit you can make on a short position is the price you shorted the stock for.

| Investor Tip: Buying and holding investments for years—ideally, decades—allows you to reap the benefits of average stock market returns, which have historically hovered around 10%. |

Why short a stock?

If short selling is so risky, why short a stock in the first place? Investors who take on short selling typically do so for one of two reasons: speculation and hedging. Speculation refers to a high-risk strategy where the aim is to turn a quick profit by capitalizing on price fluctuations. The allure comes from the potential of yielding significant profits, but it’s not without the potential for significant losses as well.

While your typical long-term investor makes investment decisions based on thorough research of a company’s financial health and potential for future growth, speculative short sellers invest based on short-term price movements. If the short seller’s speculation turns out to be wrong, they’ll have to buy back their shares at a higher price, resulting in a loss.

Investors may also choose to short a stock to hedge a long position in order to limit their losses. For example, let’s say you own shares in a company that you anticipate will perform negatively in the near future, but you want to hold on to your shares. An investor may hold onto those shares for the long term while also shorting the stock, with the intention to buy them at a lower price if the price does decline. The aim is to balance out the losses of your long-term shares without having to sell them.

Pros and cons of short selling

Shorting a stock can lead to massive returns—or massive losses. In a typical long position (when a trader buys shares of stock), the most you can lose is only as high as your original investment—and you’d only lose 100% of that amount if the stock price plummets to zero.

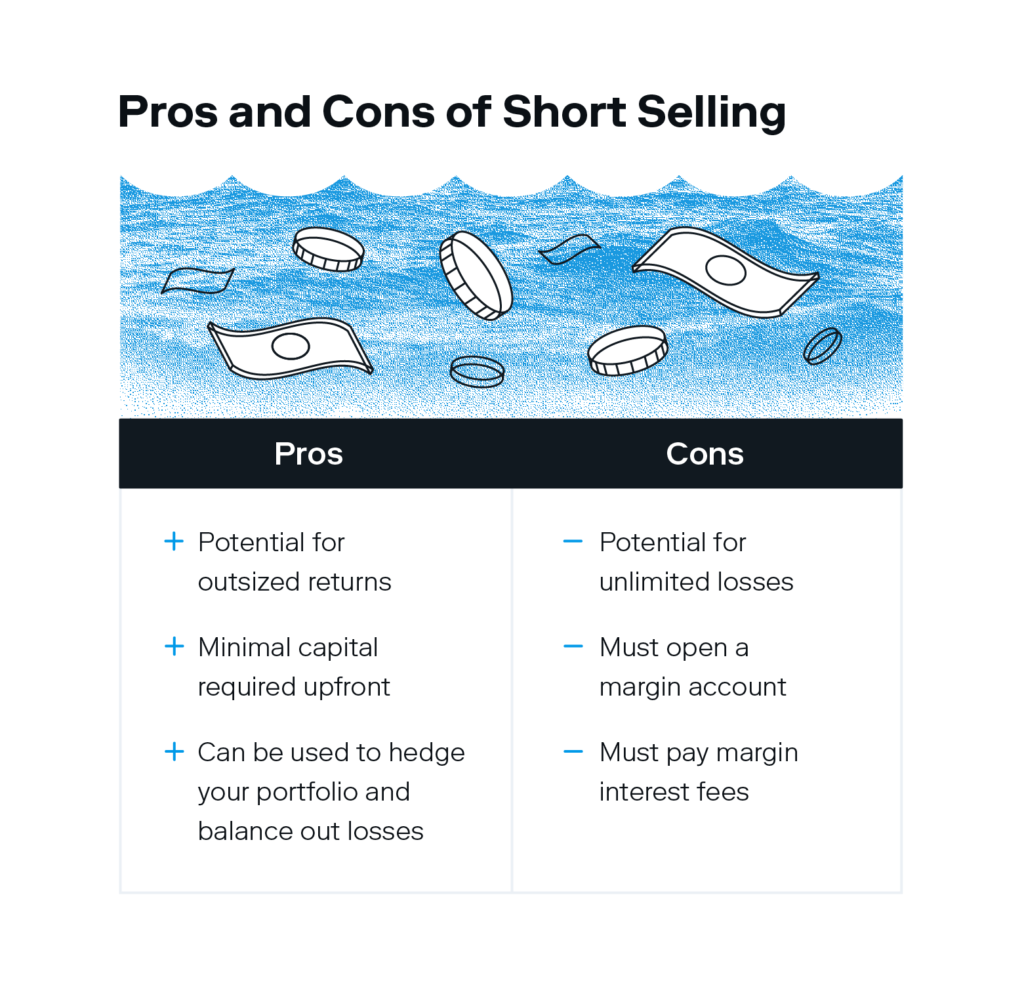

That said, short selling still comes with a handful of advantages:

- Potential for outsized returns: If a trader accurately predicts a price movement, they’ll reap a sizable profit in a short amount of time.

- Minimal initial capital required: Since only the broker’s fee is required upfront, short selling offers the chance to turn a hefty profit without a large initial investment.

- Can be used to hedge your portfolio: By taking a short position in an asset you’re already long in and whose price you believe will soon decline, you can limit the overall losses if it does.

While the advantages of shorting a stock are real, there’s ultimately more potential on the downside than there is on the upside. Traders risk losing far more than 100% of their original investment by shorting a stock.

Here are the cons of short selling:

- Unlimited loss potential: Since there’s no limit to how high a stock’s price can go—theoretically, it could rise infinitely—there’s also no limit to the amount you’d pay to replace the borrowed shares if they don’t drop in price as expected.

- Margin account required: Short selling requires a margin account with a broker, for which there are many limitations outlined by the SEC.

- Margin interest fees: Margin interest rates (that is, the interest you’re required to pay on any short sale) can add up quickly and eat away at your profits.

More considerations + risks of short selling

Aside from the potential for unlimited losses, short selling comes with some additional risks investors should consider.

- Margin calls: If the value of your investment in a margin account drops below the minimum requirement for borrowed shares, your broker may activate a margin call, which requires you to make a payment toward the account to maintain your position.

- Dividends: Short sellers aren’t entitled to dividend payments for borrowed shares—they get deducted from your margin account and are paid to the broker instead.

- Short squeezes: If traders catch wind of a short selling opportunity and all attempt to short the same stock at once, the stock price might actually rise as a result. If more purchases are made that day, driving the price higher, short sellers are forced to close out their positions.

Short selling can be incredibly lucrative if you can make accurate price predictions. But trying to anticipate how the stock market will behave—and betting against the crowd—is inherently risky. Generally speaking, people aren’t good at predicting the future. While all investments come with some level of risk, many experts agree that day trading is one of the riskiest.

For investors looking to steadily grow their wealth over time with far less risk, a long-term strategy is a more dependable avenue. While it won’t help you make a quick buck, it’ll deliver steady returns that can grow into a sizable nest egg for your retirement years.

FAQs about shorting a stock

Find answers to any lingering questions about shorting a stock below.

Why do short sellers have to borrow shares?

Shorting a stock is only possible if a trader first borrows the shares on margin before they’re sold on the market. If the shares were never borrowed, there’s nothing to profit from.

What is a short squeeze?

A short squeeze occurs when many investors decide to short a certain stock in anticipation of the price declining, and the price rises instead. If the price rises quickly, a high volume of short sellers will all be closing out their positions at the same time, driving the price even higher and creating a short squeeze.

Is short selling bad?

While some have argued that short selling is unethical because it’s placing a bet against the growth of a company, it has no direct impact on a company’s health and is widely seen as an acceptable investment strategy.

What is naked short selling, and why is it illegal?

Naked short selling is when an investor illegally shorts a stock using shares they never actually borrowed, profiting off the nonexistent shares. It is banned in the U.S.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement