May 26, 2023

How to Set Up a Backdoor Roth IRA: A Step-by-Step Guide

| What is a backdoor Roth IRA? A backdoor Roth IRA is an investment strategy that allows individuals to avoid Roth income limits by rolling traditional IRA funds into a Roth IRA. This strategy is particularly appealing to high-earners. |

Are you one of the 36.8 million people contributing to a traditional IRA but making $150,000 or more? Did you know that high-income individuals can open a Roth IRA to save on taxes, even though the IRS technically doesn’t permit it?

It’s true. The IRS sets this rule to create a level playing field amongst lower-paid investors, but there’s a catch—you still can with a backdoor Roth IRA. Backdoor Roth IRAs are a loophole around Roth income limits.

And if you’re laughing to yourself, thinking that this strategy doesn’t apply to you, you never know what—or how many dollar signs—the future holds. If new career opportunities open up for you, you may find yourself in a higher salary bracket and unable to open a Roth IRA the typical way.

Follow along to discover the ins and outs of backdoor Roth IRAs, including how to start one and adhere to tax implications.

What is a backdoor Roth IRA?

Best for: single investors with an adjusted gross income (AGI) of over $153,000 and joint filers earning $228,000 or more

The backdoor Roth IRA is an investing strategy, not a true IRA type. In the grand scheme, a backdoor Roth IRA works the same as a regular Roth IRA but is funded differently and subject to a few tax particularities.

Anyone can open a traditional IRA—there are no income limits—yet high earners can’t open a Roth IRA without using a backdoor strategy. Reminder: the key distinction between Roth and traditional IRAs is taxes. Pre-tax dollars fund traditional IRAs, whereas Roth IRA contributions are after-tax.

The backdoor Roth strategy lets investors convert traditional IRA funds into Roth IRA investments and reap the tax benefits—tiptoeing around Roth income limits legally. As of 2023, the IRS does not crack down on this strategy.

Who qualifies as a high earner? In 2023, the IRS income requirements for Roth IRAs are:

- $153,000 for single or head of household filers and those married filing separately (and not living together)

- $228,000 for joint filers and qualifying widow(er)

Married individuals filing separately who earn $10,000 or less (and living with one another) also do not qualify for Roth IRAs. However, those in this income bracket should prioritize other financial goals, like increasing their incomes and building savings, before considering a backdoor IRA.

| Pros | Cons |

|---|---|

| Opportunity for high earners | Counts toward contribution limits |

| Tax-deferred growth | Subject to the taxation pro rata rule |

| Tax-free withdrawals | No withdrawals for five years |

| No required minimum distributions | High initial taxes |

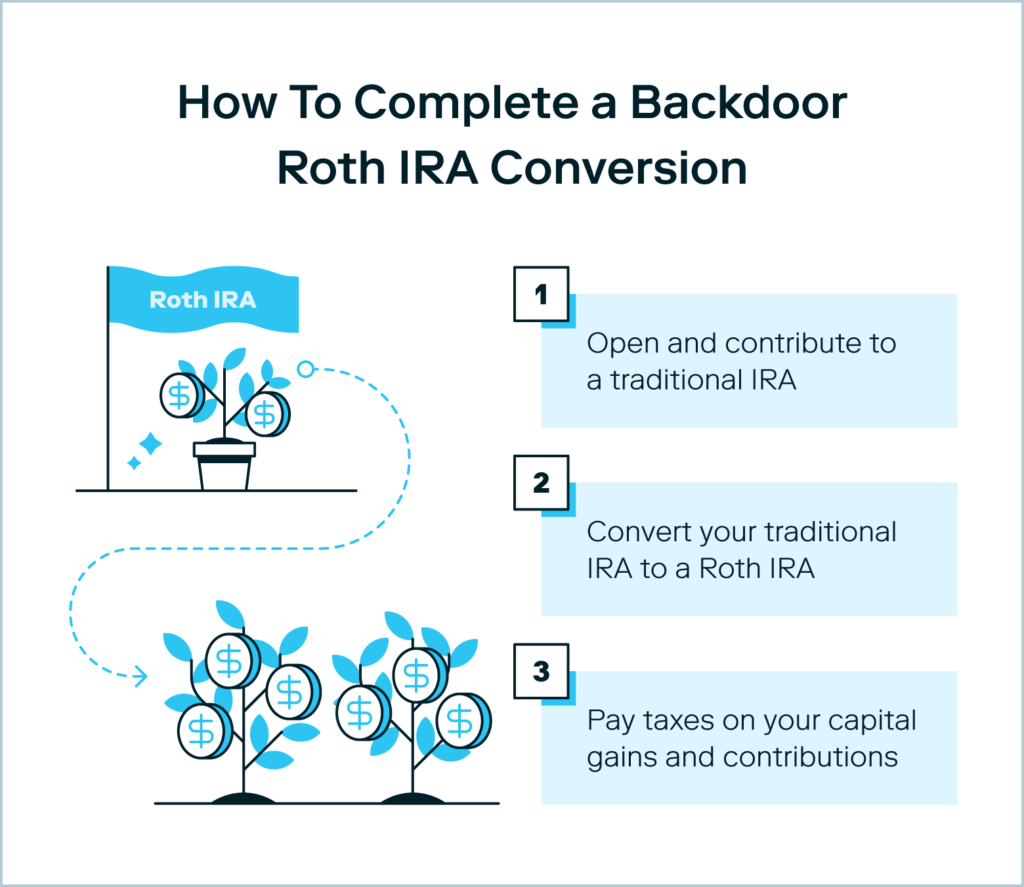

How to set up a backdoor Roth IRA

Backdoor Roth IRAs may seem intimidating, but they aren’t overly complicated to set up. Here’s a simple three-step guide to help you set up your backdoor Roth IRA.

1. Contribute to a traditional IRA

The first and simplest step of the backdoor Roth strategy is to open a traditional IRA. You can skip this step if you already have a traditional IRA. Some employer 401(k) plans may allow rolling funds into a Roth IRA. However, individual traditional IRAs typically fund backdoor Roth IRAs.

When opening a traditional IRA, pick a company you trust. You can either work with a brokerage or robo-advisor—both have advantages and disadvantages. However, if your sole strategy is to transfer to a backdoor Roth IRA, you may want to opt for assistance with a broker.

After you open the account, you can begin to contribute pre-tax dollars. You can contribute throughout the year or max out your contributions right away to begin the transfer process. Maxing out your contributions isn’t necessary, but it’s wise if you can afford it.

Take control of your tomorrow with an IRA.

Set aside money for retirement-and save on taxes-with a traditional or Roth IRA.

Learn more2. Turn your traditional IRA into a Roth IRA

Converting your traditional IRA into a Roth IRA should be simple. The first part of this step is to open a Roth IRA if you haven’t already. From there, each brokerage handles the transfer process differently—it could be the click of a button, or you may need to complete paperwork. Consult your broker to make sure.

Transfers are possible in one of three ways:

- Rollover: If you withdraw from a traditional IRA, you must transfer it to a Roth IRA within 60 days.

- Same trustee transfer: You plan to use the same financial institution to operate your Roth IRA that maintained your traditional IRA.

- Trustee-to-trustee: The financial institution holding your conventional IRA transfers a predetermined percentage of your assets to the new broker or bank maintaining your Roth IRA.

Keep in mind how much you want to transfer into the Roth IRA. You can roll over as much or as little as you’d like, though the more you convert, the higher your taxes will be.

Investor tip: Wait a few months after contributing to your traditional IRA before converting it to a Roth IRA. If you max out your traditional IRA and instantly convert it to a Roth, the IRS may see this as a single transaction and penalize you.

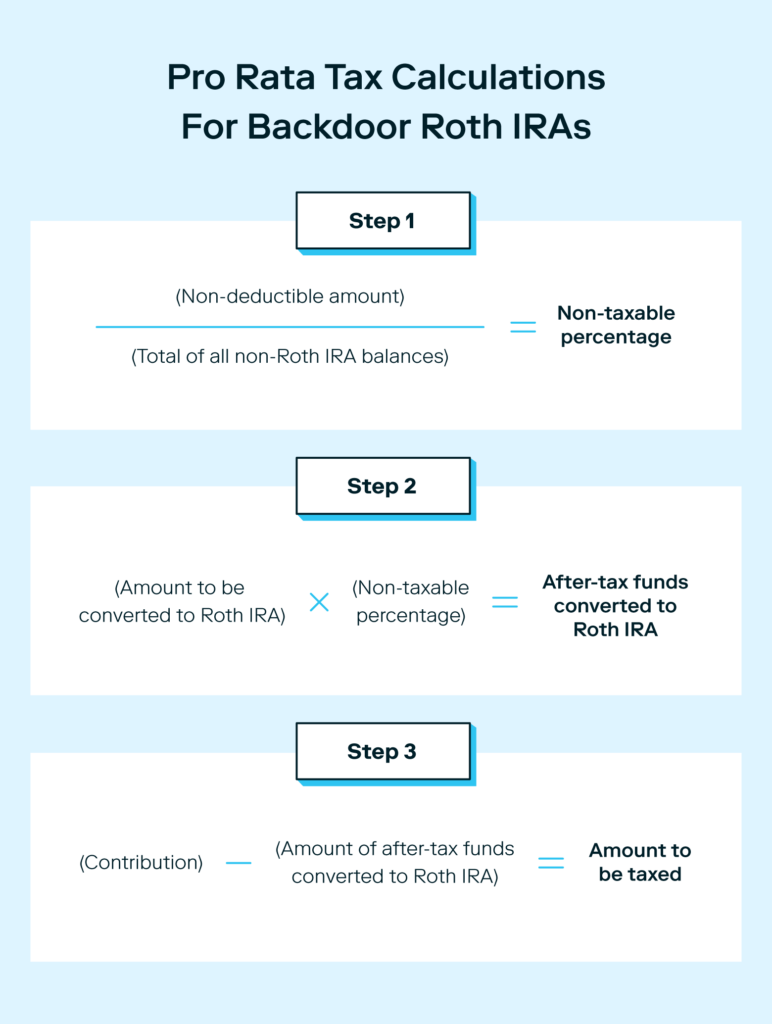

3. Pay taxes with the pro rata rule

Backdoor Roth IRAs aren’t a strategy for skirting taxes. Roth contributions are always after-tax, even with a backdoor approach.

The downside here is you can be taxed on your entire Roth contribution amount—including contributions and earnings from your traditional IRA. Backdoor Roth IRAs are subject to the IRS pro rata rule, which determines how pre-tax assets will be taxed upon transferring to an after-tax account like a Roth IRA.

The pro rata rule states backdoor Roth IRAs are taxed proportionately between pre- and after-tax contributions. It takes the percentage of your aggregated IRA balances and configures the percentage that still has yet to be taxed.

For example, imagine that you have $43,500 in a traditional IRA. Say you contributed the annual max of $6,500 to a new traditional IRA and then rolled that contribution only into a backdoor Roth IRA. To the IRS, you have $50,000 in traditional IRAs, but only 13% of your IRA total is after-tax dollars (from that last contribution). This means only $845 is tax-free (13% of $6,500), so you owe taxes on the remaining $5,655.

During tax season, you’re responsible for completing the backdoor Roth IRA tax form, the standard 8606 Form, to claim your nondeductible IRA contributions.

Additionally, if you benefited from a tax break from your traditional IRA contributions beforehand, you’ll be expected to repay those deductions. These tax stipulations may increase your taxes in the short term, but withdrawals are tax-free, so you will likely benefit in the long run.

Disclosure: This should not be construed as tax advice. Please consult a tax professional for additional questions.

Roth IRA: Withdrawals of the money (Contributions) you put in are penalty and tax free. Prior to age 59½, withdrawals of interest and earnings are subject to income tax and a 10% penalty. All earnings are tax free at age 59½ or older, assuming your first contribution was more than 5 years prior. Income Eligibility applies.

When shouldn’t you open a backdoor IRA

Backdoor Roth IRAs aren’t for everyone. This strategy can lead to unexpected costs or may not benefit you as you envision.

Here are a few examples of when it makes sense not to open a backdoor Roth IRA.

- If you’re allowed to contribute to a Roth IRA—there’s no reason to make investing harder than it should be

- If you have short-term financial goals, like paying off personal loans

- If you might need your savings within the next five years

- If you’re older than 60 and your backdoor Roth IRA could negatively impact your Social Security and Medicare benefits

- If your tax rate might be lower in retirement

FAQ

Not sure if a backdoor Roth IRA is right for you? Let us answer all of your remaining questions.

Are backdoor Roth IRAs still allowed in 2023?

Yes, backdoor Roth IRAs are legal in 2023, but that might not always be true. Since 2010, the IRS has allowed the backdoor Roth IRAs loophole. However, this could change in the future if the IRS changes violation determinations—and previous administrations have considered it.

Do you pay taxes on backdoor Roth IRAs?

Yes, you must pay taxes on a backdoor IRA. Traditional IRA contributions are tax-free. However, when you transfer your funds into a Roth IRA, those assets are viewed as contributions, so the entire amount is taxed—principal, earnings, and interest. However, you will not pay taxes again when you withdraw.

What is a mega backdoor Roth IRA?

A mega backdoor Roth IRA is a specific type of backdoor Roth strategy where maxed-out 401(k) employer plans fund the account.

Traditional 401(k) plans have a $20,500 annual contribution limit. However, some employers offer after-tax 401(k)s, which allow an additional $43,500 in annual contributions (totaling $66,000, including employer matching). Rolling both maxed-out plans into a Roth IRA is considered a mega backdoor Roth IRA.

Mega backdoor Roth IRAs can be tricky, even for the experienced investor. Consider turning to a tax professional to convert funds to a mega backdoor Roth.

Who qualifies for a backdoor Roth IRA?

Anyone eligible to contribute to a traditional IRA also qualifies for a backdoor Roth IRA. However, many people eligible for a traditional IRA also qualify for a Roth IRA, meaning the backdoor IRA strategy isn’t necessary.

Backdoor Roth IRA rollovers make the most sense for individuals earning more than the IRS’s income requirements. If your income is less than the IRS’s requirements, you can contribute directly to a Roth IRA and do not need the backdoor option (some may only qualify for a reduced contribution limit).

Are backdoor IRAs worth it?

Yes, a backdoor Roth IRA may be worth it if you’re not eligible, based on income limits, to contribute directly to a Roth IRA. While your assets can grow exponentially in a traditional IRA, you could save thousands in taxes by converting to a backdoor Roth.

Backdoor Roths aren’t as complicated as they sound. Tax season can make backdoor Roths a little tricky, but they’re still manageable as long as you fully understand how they work.

Investing made easy.

Start today with any dollar amount.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement