Apr 5, 2023

11 Best Short-Term Investments for Beginners in 2023

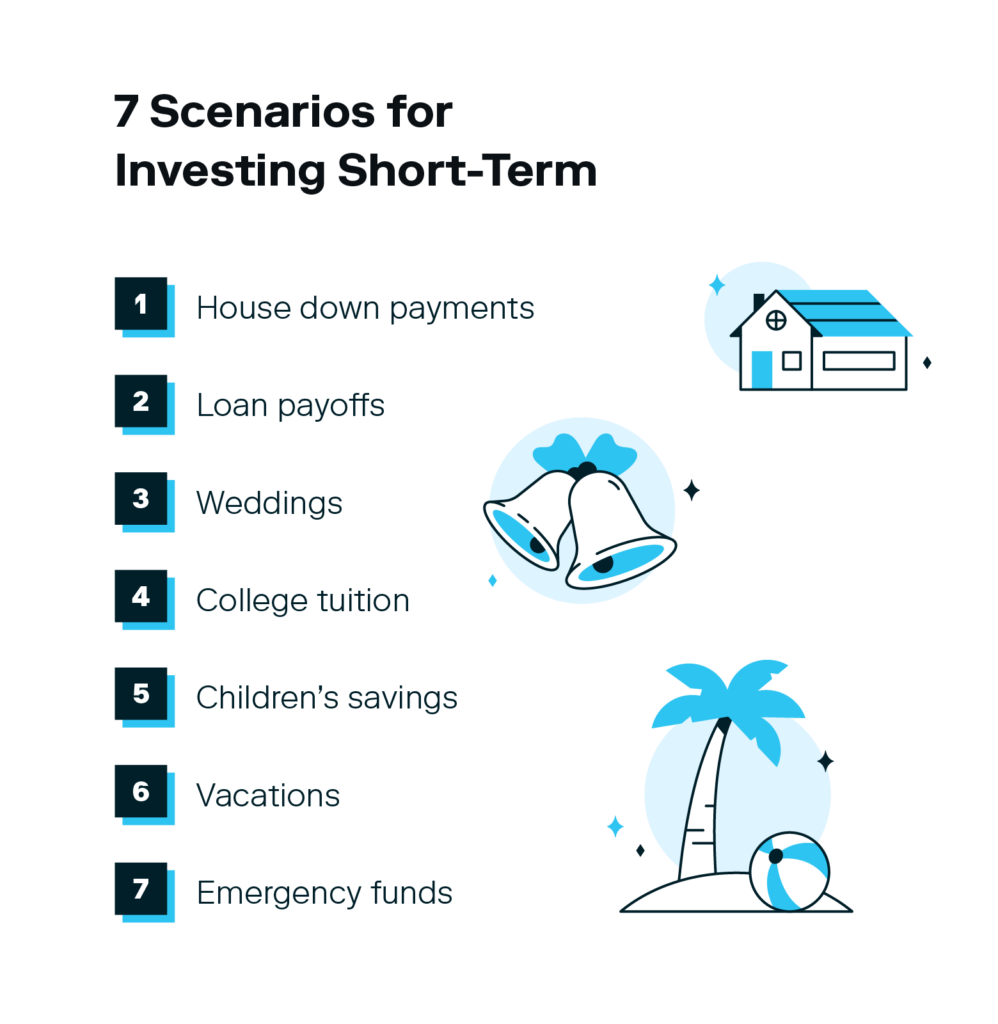

Are you approaching that age when it seems everyone you know is getting married or buying a house? For many people, there comes a time when it feels like there’s one big purchase right after another—how do people do it?

Short-term investments are a great way to prepare your pockets for these life-changing events or simply help you dip your toes into investing to earn passive income.

Short-term investments are ideal if you want to see returns one to three years later. For anything over three years, you’re looking at a long-term investment. Short-term investments have minimal risks, positive income-generation capabilities, and are less likely to be hit by inflation over time.

Short-term investments make investing easy for beginners because they are liquid, low-risk, stable, and have low transaction fees. Some of the best short-term investments are high-yield savings accounts, money market accounts, and government bonds. Read on for more!

So instead of storing your money in a checking account, which may cost you in fees, try investing it to earn more money than you started with.

Try one of these 11 best short-term investments to get started:

- High-yield savings accounts

- Certificates of deposit

- Money market accounts

- Money market mutual funds

- Cash management accounts

- Short-term corporate bond funds

- Short-term government bonds

- Municipal bonds

- Treasury bills

- Arbitrage funds

- Real estate investment trusts

1. High-yield savings accounts

Best for: super short-term savings, such as saving for a trip or building an emergency fund

High-yield savings accounts work similarly to standard savings accounts where deposited money earns interest. However, the two differ in benefits and requirements. High-yield accounts often have higher minimum balance requirements as well as higher interest rates—anywhere from 10 to 25 times higher—compared to traditional savings accounts.

The best part about high-yield savings accounts is you can withdraw money when you need it. There’s no need to wait until you meet a time requirement.

| Pros: | Often allowed to withdraw funds for free up to six times a month and FDIC-insured |

| Cons: | Lower return with lower interest rates compared to other investments |

| Potential interest rate: | 3–4.5% |

| Risks: | Minimal to none |

2. Certificates of deposit (CDs)

Best for: saving for near-future spending

Certificates of deposit (CDs) are bank-issued savings investments that earn interest over a fixed length of time. They can be short- or long-term investments, depending on the CD’s maturity date. Term lengths range from just a few months to five or 10 years. You can face a financial penalty for withdrawing early.

Interest rates for CDs are locked in when you open the account. They’re similar to high-yield savings accounts but with more interest earned over time. You can earn more interest with CDs because they pay higher interest rates in exchange for an agreement to store away your money for a specific amount of time.

After a CD matures, the funds can be withdrawn or rolled into a new CD. If you do nothing, the funds will be rolled into a new CD and continue earning interest.

| Pros: | Guaranteed returns, varying term lengths, and FDIC-insured |

| Cons: | Restrictions on withdrawals |

| Potential interest rate: | 2–5% (Longer term lengths typically mean higher rates) |

| Risks: | Minimal to none |

3. Money market accounts (MMA)

Best for: large but very short-term savings goals, such as a car down payment or loan payoff

Money market accounts are very similar to high-yield savings accounts and CDs, but offer more flexibility on withdrawals. Account holders can access funds in an MMA at any time and through an ATM or by writing a check. However, similar to traditional savings accounts, banks may place a limit of six monthly withdrawals.

Minimum balance requirements are typically higher than standard savings accounts. Some may vary from $100 to several thousand dollars.

| Pros: | Accessible through ATMs or checks and FDIC-insured |

| Cons: | Limit on withdrawals and high balance requirements |

| Potential interest rate: | 1.5–5% |

| Risks: | Minimal to none |

4. Money market mutual funds

Best for: the adventurous investor with a hands-off approach

A money market mutual fund is a collective investment where several investors contribute funds for the fund manager to distribute into various short-term securities. Brokers and other financial firms manage these mutual funds. They invest the mutual funds into other short-term investment types within this list.

Money market mutual funds often have balance requirements and incur transaction fees and expense ratios. Though account holders are hands-off, they can make quick withdrawals and investment changes.

| Pros: | Higher yield than money market accounts and regulated by U.S. Securities and Exchange Commission (SEC) |

| Cons: | Not FDIC-insured |

| Potential interest rates: | Variable |

| Risks: | Low risk |

5. Cash management accounts

Best for: novice investors wanting a hands-off experience

Cash management accounts are another alternative to traditional savings and checking bank accounts. They often have the flexibility of traditional checking accounts but with the added benefit of earning interest.

Rather than being held by a singular bank, cash management accounts are operated by brokers or robo-advisors. Your broker or advisor disperses your investments into different accounts at partnering banks for you. Depending on the firm you work with, you may receive a debit card or checkbook to make withdrawals easily.

| Pros: | Flexible with easy withdrawals and great for FDIC insuring large amounts of money |

| Cons: | Often online-only institutions but with less money-management features |

| Potential interest rates: | 2–4% |

| Risks: | Very secure, low risk |

6. Short-term corporate bonds

Best for: conservative investors looking to diversify their portfolio risk

Companies sell short-term corporate bonds to fund new ventures, expand into new markets, pay off debt, and so on. Similar to other short-term investments, short-term corporate bonds have maturity dates and earn interest.

Corporate bonds are subject to default risk. A business can go under and default on its bonds. If this occurs, bondholders don’t receive their principal and interest returns. You should be wary of the companies you purchase bonds from—the newer the business, the higher the risk.

Corporate bonds should not be confused with buying stock in a company. Publicly-traded companies sell ownership shares (stock) to investors. If the company grows, investors can sell their shares for more than they paid for. Buying stock is a much riskier, long-term option.

| Pros: | Diverse and potential for high returns |

| Cons: | Higher risk than other bonds and not FDIC-insured |

| Potential interest rate: | 2–10% |

| Risks: | Higher end of low-risk tier |

7. Short-term government bonds

Best for: conservative investors looking for wealth preservation

Short-term government bonds work similarly to corporate bonds but are backed by the federal government rather than a company. Citizens who buy bonds are essentially loaning money to the government for things like infrastructure improvements and debt payoff.

The federal government’s bonds are less risky than corporate bonds since the government is more financially reliable. However, the returns aren’t quite as high, which makes this short-term investment better for wealth preservation rather than growth.

| Pros: | Backed by the U.S. government and easy to trade |

| Cons: | Not FDIC-insured |

| Potential interest rate: | 1–4% |

| Risks: | Low risk |

8. Municipal bonds

Best for: investors looking for tax advantages

Municipal bonds are funded by state and local governments. Again, bond sales pay for the state, county, or city to pave roads, build schools, and so on.

The bonds earn interest, and bondholders can cash in once the bond matures. Often, investors don’t pay taxes on federal, state, or local municipal bond interest.

The smaller the government, the higher the risk of default. However, the risk for municipal bonds is fairly low and actually comes from inflation rather than defaults. But, even though municipal bonds hold the highest risk of government bonds, they also come with higher return potential.

| Pros: | Higher returns compared to federal government investments and often tax-free |

| Cons: | Can be impacted by inflation |

| Potential interest rate: | 2–6% |

| Risks: | Lower risk |

9. Treasury bills (T-bills)

Best for: safe investors looking to invest for less than a year

The U.S. Treasury sells short-term bonds called treasury bills (T-bills). The Treasury offers two other types of bonds—T-bonds and T-notes—but T-bills are best for short-term investors. T-bills are typically sold in $100 increments and sometimes at a slightly discounted rate. Term lengths can be as short as a few weeks up to one year.

| Pros: | Backed by the U.S. Treasury |

| Cons: | Lower yields and can be impacted by inflation |

| Potential interest rate: | 4.5–5.2% |

| Risks: | Low risk |

10. Arbitrage funds

Best for: conservative investors looking to profit from a volatile market

Arbitrage funds are a type of mutual fund that is fairly diverse but low-risk. With an arbitrage fund, a group of investors purchases bonds, stock, or other securities in the cash market and sells the investments in a different market for a higher selling price.

Like other mutual funds, one manager handles an arbitrage fund. They purchase and sell various investments simultaneously.

This type of investment is generally safe due to the constant movement of securities, though the returns aren’t guaranteed to be significant. Arbitrage funds rely on capitalizing on price differences in varying markets, which might not always exist or be as steep.

Arbitrage funds are treated as equity funds for tax purposes, meaning the tax rate depends on the holding period. Holding periods longer than a year are taxed like long-term capital gains, whereas holding periods of less than a year are taxed like short-term capital gains.

| Pros: | Good investment in an unstable market and taxed like equity funds |

| Cons: | Unpredictable returns |

| Potential interest rate: | Variable |

| Risks: | Low risk |

11. Real estate investment trusts (REITs)

Best for: investors looking for real estate sector exposure

Real estate investment trusts (REITs) are companies that finance or own income-producing real estate properties of various types. The five main types of REITs are:

- Retail

- Residential

- Health care

- Office

- Mortgage

Investing in REITs is not the same as owning real estate, which would be a long-term investment. Instead, REITs allow individuals to help fund a real estate development project by buying shares.

It’s much more affordable than purchasing property, and shareholders earn passive income through the company’s profits.

| Pros: | Investment portfolio diversity and opportunity to invest in real estate at a lower cost |

| Cons: | Subject to fluctuations in interest rates and property value |

| Potential interest rate: | Variable |

| Risks: | Low to medium |

What to look for in a short-term investment

Many short-term investment types share several commonalities, including the four characteristics that make a good short-term investment—high in liquidity and stability and low in risk and transaction cost.

Liquidity

A defining characteristic of a short-term investment is liquidity, meaning investors can easily cash in or access their funds. Short-term investments typically last no more than three years, with many maturing in less than a year.

Low risk

Short-term investments are notoriously known for being safe, low-risk investments. This is because of their guaranteed returns from interest, low chances of loss, and the FDIC insurance that most banks offer.

Stability

The short-term investing market is not as volatile as the stock market. The value of short-term investments doesn’t typically fluctuate much.

Low transaction cost

Short-term investments often require a short stack of cash to get started in comparison to other investments, like a house. Some offer options for investing with as little money as possible. Though, some money market accounts have minimum balances of $1,000 or more.

Investing made easy.

Start today with any dollar amount.

FAQ about short-term investments

Still have questions about short-term investments? Here are your answers.

What is considered a short-term investment?

To be considered a short-term investment, the investment should last no longer than three years (possibly much shorter). Short-term investments are low-risk, liquid, and predictable, but generally lower reward.

Are short-term investments risky?

Typically, short-term investments aren’t risky, which is why they’re great for conservative or novice investors. However, some short-term investments are riskier than others, like corporate bonds and real estate investment trusts.

What is the safest short-term investment?

While nothing is guaranteed, most short-term investments are safe. High-yield savings accounts, certificates of deposit, and government bonds are some of the safest short-term investments available today.

What is the best short-term investment?

The best short-term investment really comes down to your individual goals and lifestyle. When selecting which is best for you, take note of your priorities and ask yourself the following questions:

- Am I investing to build wealth or to protect my savings?

- Am I okay with a potential loss in principal?

- Do I want the safest short-term investment?

- Do I want the short-term investment with the highest return?

- When do I need to access my investments?

- Do I want to handle my investments myself, or do I want someone else to?

Investing doesn’t have to be intimidating. Download Stash today and start investing like a pro.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement