May 23, 2018

The Cheapest Places to Live in the U.S.

Want to buy a house? Here’s where you can do it.

Looking to buy a house? Depending on where you live, it could be a lot more expensive than you thought.

Home prices in many American cities continue to rise. The median price of a new house in the U.S., as of the beginning of 2018, was $337,200, according to government data.

And yet, that looks downright reasonable compared to some of the country’s most expensive housing markets.

The median price for a house in San Francisco, for example, is now more than $1.6 million, according to industry data. In New York City, it’s $1.5 million.

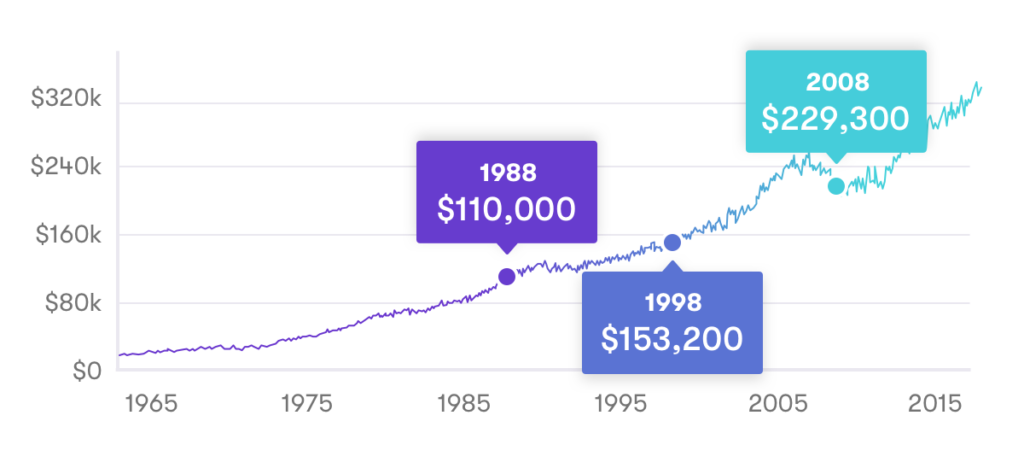

While those markets are outliers, prices nationwide have been on a slow and steady rise for decades.

To illustrate, consider the median price of a new house 30 years ago, in May of 1988. At that time, the median price was $110,000, according to government data. 20 years ago, in 1998, it was $153,200. And 10 years ago (in the midst of the housing crisis), it was $229,300.

Despite the considerable rise in housing costs, millions of Americans still aspire to own homes.

In fact, 20% are willing to trade their right to vote for a 10% down payment on a house, according to an industry survey.

The true cost of buying a home

But housing prices are only one piece of the puzzle. Buying a house comes with a number of additional costs and fees that many prospective homeowners overlook or don’t account for.

These costs can include:

- Inspection fees

- Closing costs

- Property taxes

- Time and money spent researching and visiting homes that are on the market

On top of that, it’s generally expected that a buyer will have saved up between 3.5% and 20% of the purchase price as a down payment. You’ll need some money in the bank, too, as cash reserves to make sure you can make your initial monthly payments.

America’s cheapest housing markets

The good news is that you don’t need to live in a treehouse or a shoebox to find an affordable home.

There are still places where houses sell for a relative bargain—if you know where to look.

These ten cities are home to America’s cheapest housing markets (as of January 2018), according to data from the National Association of Realtors.

| Location | Median home price |

|---|---|

| Marion, Indiana | $66,750 |

| Danville, Illinois | $69,700 |

| Pottsville, Pennsylvania | $69,900 |

| Bay City, Michigan | $88,900 |

| Weirton, West Virginia | $90,000 |

| Pine Bluff, Arkansas | $94,500 |

| Lima, Ohio | $95,000 |

| Elmira, New York | $109,000 |

| Topeka, Kansas | $109,000 |

| Cumberland, Maryland | $110,000 |

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

Budgeting for Young Adults: 19 Money Saving Tips for 2024

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning

How to Save Money: 45 Best Ways to Grow Your Savings