Jul 8, 2019

What It Means to Rent What You Can Afford

If you pay 30% or less on housing, it can really help you.

Strategies

- The general rule of thumb is to never spend more than 30% of your gross income on housing—whether you rent or own. Before renting to you, landlords often expect to see proof that you make 40 times your monthly rent annually—it’s the same calculation as 30% of your gross income. (We’ll show you.)

- To cut down on costs, consider getting a roommate, or roommates, to split rent with you.

- If you know your housing costs will exceed 30% a month, find other areas in your budget where you can cut back. For example, take public transportation rather than owning a car. Reduce dining out, or stop impulse spending.

- Look for rentals where utilities are included, as that can help you conserve cash.

Consideration: If you have a lot of debt, your monthly rent plus your other loan payments shouldn’t exceed 43% of your monthly income. You may have to seek cheaper alternatives if it does.

Let’s break it down:

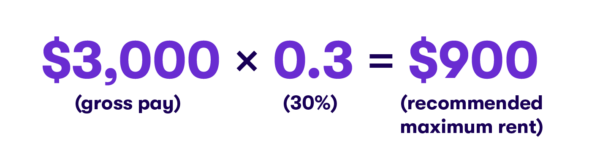

If your gross pay is $3,000 a month, you should pay no more than $900 a month.

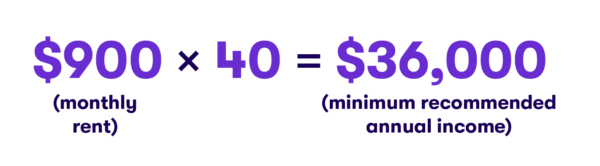

To put another way, if your rent is $900 a month, your annual income should be at least $36,000.

Jargon Hack.

What is gross pay?

Gross Pay

Gross pay is the amount you get paid prior to taxes being taken out of your paycheck.

Jargon Hack.

What is a security deposit?

Security Deposit

A security deposit is money you need to put down prior to moving in to a rental, usually in addition to your first month’s rent. It’s protection for your landlord against your not paying rent, and property damage. You typically get your security deposit back with a small amount of interest when you move out.

While the 30% rule should be your goal, remember there is a well-documented shortage of affordable housing in the U.S., and nearly 40% of renters in the U.S. spend more than 30% of their income on rent, according to research. But doing what you can to get your rent costs down will only help you in the long run.

Find out more

How Renters Insurance Can Save the Day From Disaster

Learn why it’s important to get renter’s insurance, once you’ve snagged your dream home or apartment. But don’t take it from us: Hear the scary stories of people who went without it.

How to Build Credit: Why You Need It and How to Get It

Read on to find out the difference between a credit score and credit report, and if you have bad credit or no credit, learn some great ways to build it, and to improve your score.

Americans are Paying More Than Ever For Their Cars

Find out why U.S. consumers are paying more and more for their cars each year. It’s not only our love affair with big cars that’s driving prices up. International trade has something to do with it, too.

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

Budgeting for Young Adults: 19 Money Saving Tips for 2024

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning

How to Save Money: 45 Best Ways to Grow Your Savings