Dec 7, 2018

Why is Everyone Talking About Inverted Yield Curves?

Some experts worry that it can signal a recession. But what is it?

You may have heard talk recently about something called an “inverted yield curve” affecting U.S. Treasuries, and how that may be a signal a recession is coming.

If you don’t know what a yield curve is, and how it can affect the economy, we’ll explain it to you.

What’s a Treasury?

The U.S. government issues notes and bonds called Treasuries, which have varying lengths of time to maturity, ranging from months to 30 years.

The 10-year Treasury is considered the benchmark bond issued by the U.S. government, and its rate tends to be reflected in other interest rates. The federal government has issued trillions of dollars worth of 10-year Treasuries, which it uses to finance its operations. Treasuries are considered among the safest bond investments because they are backed by U.S. government.

But there are others, such as the 5-Year Treasury, and the 2-Year Treasury.

Bonds, a quick explainer

Treasuries are bonds.

Bonds are different from stocks. Bonds are debt issued by companies or governments, that are essentially IOUs to investors. That IOU is the yield.

Bonds have three key components—a maturity date, a price, and an interest rate, sometimes called a coupon rate. The interest rate stays the same, while the price of a bond typically fluctuates.

Together the price and the interest rate combine to give you the yield of the bond, which is the actual money you earn on the investment. While the interest rate of the bond is fixed, the yield will fluctuate, based on market conditions.

A bond’s price moves in the opposite direction of its yield. As the price of a bond increases, perhaps due to investor demand, its yield will fall. If its price falls, its yield will go up.

Learn more >> Find out more about bonds

What’s a yield curve?

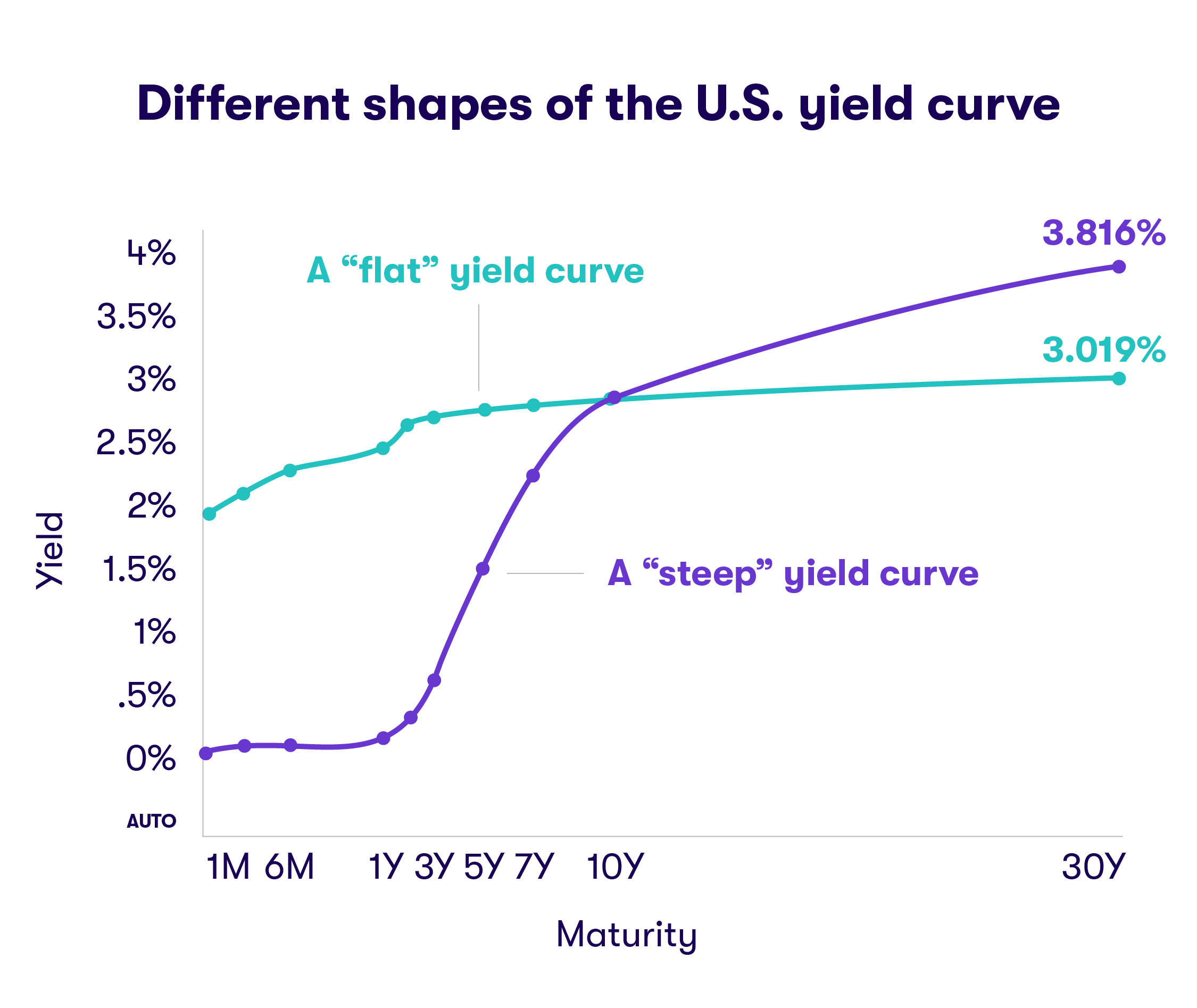

Treasuries have something called a yield curve, which is essentially a graph depicting the yields of the various bonds, from the shortest maturities to 30 years.

In normal economic conditions, the bond yield curve arcs upward.

Longer-term debt, such as the 10-year Treasury, typically has a higher yield than shorter-term debt, because there is more risk associated with it.

Think about it: The longer you hold a bond, the more can happen. We’re talking about economic risks, primarily, such as increasing inflation and the possibility of recessions. The bond market tends to compensate investors with a higher yield if they tie up their money for years at a time.

What’s an inverted yield curve?

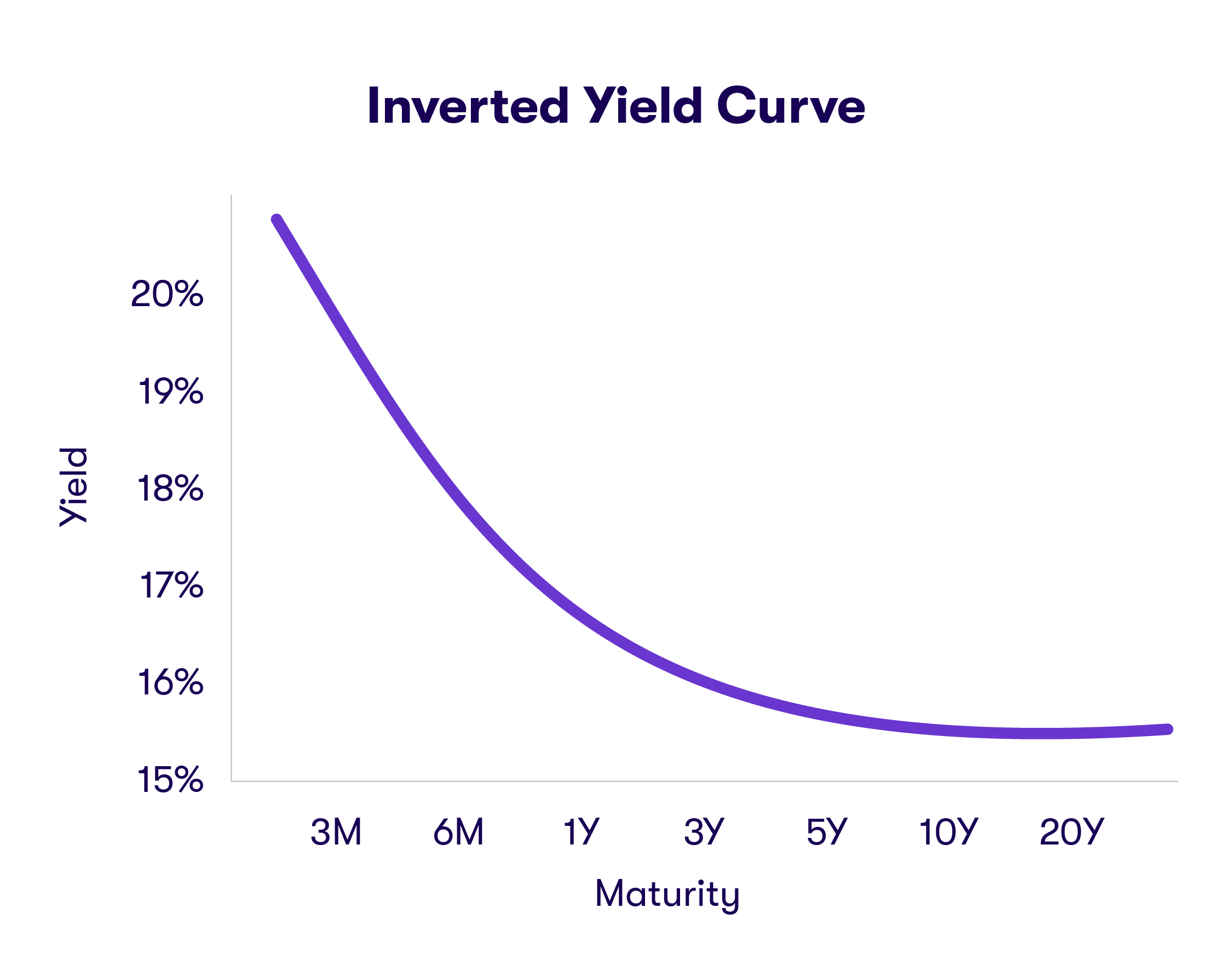

An inverted yield curve is when the yield for longer-term bonds falls below the yield for shorter-term debt.

That happened this week for the first time in a decade as the yield for the 5-year Treasury fell below that of the 2-year Treasury.

Market conditions can cause the yield of certain bonds to go down from time to time. That’s been happening with longer term Treasuries. Their yields have dropped as investors have snatched them up, driving up their current price. The yield on the 10-year Treasury, for example, has decreased to 2.9% from 3.23% in November 2018.

At the same time, yields on shorter-term debt have also been increasing as the Federal Reserve has gradually increased the Federal Funds Rate since early 2016. Interest rates, and hence the yields, for all bonds, are benchmarked to the Federal Funds Rate, and they tend to rise and fall together.

The yields of shorter term bonds are particularly sensitive to the Fed’s moves.

Why does an inverted yield curve matter?

The Federal Reserve tends to lower interest rates when the economy weakens, and that drives down the coupon rate, or interest rate, of new bonds when they’re issued.

Investors are currently buying up bonds with longer maturities—such as the 10-year Treasury—at their current coupon rates because they fear that the economy will weaken and interest rates will drop going forward. Lower interest rates will result in lower coupon rates for these bonds in the future.

So what could this all mean?

An inverted yield curve has happened prior to each of the major recessions since the 1960s according to experts. The last time it inverted was before the 2008 financial crisis. While the economy is due for a recession, an inverted yield curve can’t predict when one will happen. It could be a year or two years, or not at all.

Learn more >> How to prepare for a recession

Think long-term

Yield curves bend and flatten and they can drive volatility in the short-term, it’s part of how the market works. You can’t predict it, but you can have a smart strategy by investing for the long-term to help you weather storms.

Thinking long-term is part of the Stash Way.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement